The World Braces For More Pain!

Latest Highlights:

- TrumpExtends Shutdown Past Easter

- Stocks Brace For More Volatility

- Oil Hits Lowest Since 2002

- Bond Yields Sink

- China PMIData Ahead

Last week ended with a lot of changes in the global markets. As the fear of the pandemic seems to rise and only rise, with the number of cases growing constantly, the unpredictability and the volatility seems to be at the edge of everything. COVID19 has gotten a hold of the world and the growth graph is only ever depleting. The weekend brought more bad news on the virus front. Total deaths are nearly 34,000. The United States has emerged as the latest epicentre, with more than 137,000 cases and 2,400 deaths and lockdowns are toughening worldwide.

World central banks continue to pump liquidity in the financial system to lessen the negative impact on business from strict isolation measures across the globe. The latest example was the People’s Bank of China, which on Monday announced a 20 basis point cut, while RBNZ said it would accept corporate bonds as collateral for loans.

The actions of the world’s central banks are holding back the rollback of financial markets, which have moved uncertainly into the green zone since the opening of trading on Monday. As in the past, we believe we should be cautious about spikes in market optimism as long as the coronavirus outbreak continues to accelerate.

On the positive side, there are some signs of stabilization of the daily growth of new infection cases. This allows us to make cautious predictions that current quarantine measures in Europe and the United States won’t be tightened further. But still, it is too early to talk about their removal – for this to happen, the number of new infections must shift to a steady decline.

The focus this week will remain on the spread of the virus in Europe and the US. Unfortunately, it seems that stringent mitigation measures have not helped the curve as much as many have hoped for in the US, Italy and Spain. Another major event to look forward to this week is the Chinese PMI data.

The pandemic has already driven the global economy into recession and countries must respond with “very massive” spending to avoid a cascade of bankruptcies and emerging market debt defaults, the head of the International Monetary Fund warned on Friday. U.S. House of Representatives on Friday approved a $2.2 trillion aid package – the largest in history – to help cope with the virus-inflicted economic downturn.

The US dollar sees a week of declines:

- Shorting the US dollar has been without a doubt the best play over the last week as the Fed inundated the market with a new level of liquidity/funding capacity. The signing of the $2 trillion stimulus package by Trump, while not aiding stocks in the last 24h, has nonetheless alleviated the near-term economic stresses in the US. The dollar snapped a week of declines and the safe-haven yen rose on Monday, as coronavirus lockdowns tightened across the world and investors braced for a prolonged period of uncertainty.

- The unprecedented actions by the Fed have put a tentative stop for the dollar, however, the flight to safety could return if the duration and severity of the economical and financial disruptions worsen over the next couple weeks.

U.S. 10-year Treasury:

- Yields for the U.S. 10-year Treasury fell to their lowest close since March 9, which had bounced back from the benchmark note’s lowest level ever on March 8. Friday’s plunge back below 0.7% signals the end of a return move to a rising flag, bearish after the preceding drop from 1.6% to 0.3%

- The greenback climbed against the pound, euro, kiwi and the Australian dollar. Sterling GBP= was last 0.7% softer at $1.2371, the Aussie AUD=D3 down by almost the same margin at $0.6134 while the euro EUR=EBS was 0.5% weaker at $1.1082.

Thanks to swift action worldwide by central banks, global equities avoided a disastrous place, a possible combination of the 1930s like depression and the 2008 financial crisis. In just a matter of weeks, massive monetary and fiscal stimulus was injected into the global economy, showing financial markets central banks and government leaders were not taking any chances with the shock that was about to hit consumption and production, also providing key relief to funding markets.

The United Kingdom lockdown can save the nation:

- The UK is in lockdown, unfortunately, the measures weren’t implemented in time to save the Prime Minister and his Health Secretary, both of who have tested positive. The pound fell 1% on the news but has since rebounded to trade 2% higher on the day.

- The number of cases and fatalities is rapidly rising in the UK now and the hospitals are already overwhelmed, with emergency facilities now being set up in various cities and former NHS staff coming out of retirement to assist with the crisis. This is likely to get much worse before it gets better but now that the country is in lockdown and taking it seriously, the peak may not be too far away.

Italy under stress, but shows positive signs:

- This was looking like a turnaround week for Italy until Friday when the country recorded 919 more deaths, taking the total to more than 9000. There were positive signs this week though but the fear is that the virus has taken hold in the south – with many of the cases until now in the north – which is poorer and potentially less able to deal with the spread. This could be a very worrying phase two for Italy which has already suffered considerably.

Spain threatens to become the European epicentre:

- Spain is still some way behind Italy in terms of fatalities but the numbers are rising at an alarming rate. The country reported 769 deaths on Friday, taking the total to 4,858. Spain has the fourth-highest number of cases and has threatened to become the European epicentre but recent efforts may bear fruit.

Australia taking things slow:

- Australia is in wait-and-see mode. They are preparing for several months of social distancing and anticipate further fiscal and monetary stimulus will be needed shortly. Traders may not put much weight on the upcoming retail trade and housing prices data. On Wednesday, some focus will fall on the minutes to the RBA’s emergency meeting.

New Zealandcalls for a lockdown:

- The spotlight for New Zealand will primarily remain on the spread of coronavirus cases. The country has raised its lockdown level to four and incremental updates on the escalation of cases will likely be met with calls for further action by the RBNZ.

- On Tuesday, the ANZ Bank New Zealand will release the business confidence index that will show a sharp decline in confidence and with the outlook.

Japan takes important measures to contain the spread:

- Now that the Olympics have finally been postponed, investors are going to anticipate that the upcoming economic data and surveys will be a very high baseline that are not yet reflecting the coronavirus impact and minimal boost the Olympic games were to provide the economy.

- Though the USD/JPY advanced for the week, the rise of the safe haven asset took place alongside U.S. dollar weakness, which makes it difficult to determine how much of the climb for each of the havens was due to hedging against rising equities versus simply the result of USD weakness.

- The release of the BOJ Q1 Tankan Survey and February industrial production data will probably not move the needle.

Oil prices took another tumble as fears mounted the global shutdown for the virus could last for months:

- This week has provided some welcome reprieve for oil prices, although even now they’re not trading too far off the lows. Even stabilization is welcome after an extraordinary period, with the impending global recession being compounded by the oil price war to smash prices to bits. The sell-off may have slowed but there’s still a lot of vulnerability to the downside.

Gold advanced against every major currency:

- Gold is holding onto its recent gains after rebounding strongly earlier this week as the Federal Reserve announced its unlimited, open-ended, quantitative easing program. That, combined with other measures, eased the upside pressure on the dollar and saw it pull back around 4%, aiding the rally in gold back to levels you would expect to see in times like this. It’s still seeing resistance around $1,640 but as long as we don’t see any more sharp shocks in equity markets, this will likely come under pressure.

- The yellow metal advanced against every major currency, including the traditional safe haven yen and Swiss franc, reclaiming its precious metal designation.

- Spot gold XAU= was down 0.2% to $1,614.46 per ounce by 0346 GMT after Friday’s 0.7% drop. U.S. gold futures GCv1 fell 0.4% to $1,646.60 per ounce.

Here are the key market-moving factors this week to watch out for:

(All times listed are EDT)

Monday

10:00: U.S. – Pending Home Sales: expected to plunge to -1.0 % from 5.2%

21:00: China – Manufacturing PMI: anticipated to have risen to 45.0 from 37.5 the month previous.

Tuesday

2:00: UK – GDP: Seen to remain flat at 1.1% YoY, while declining to 0.0% growth from 0.5%.

3:55: Germany – Unemployment Change: predicted to surge to 28K from -10K previously.

5:00: Eurozone – CPI: probably fell to 0.8% YoY in March, from 1.2%.

8:30: Canada – GDP: expected to have declined to 0.1% in January, from 0.3% at the end of 2019.

10:00: U.S. – CB Consumer Confidence: seen to drop to 112.0 in March from 130.7.

19:50: Japan – Tankan Large Manufacturers Index: to plunge to -10 from 5.

21:45: China – Caixin Manufacturing PMI: anticipated to rise to 45.8 from 40.3

Wednesday

3:55: Germany – Manufacturing PMI: expected to edge down to 45.4 from 45.7.

4:30: UK – Manufacturing PMI: seen to slightly slow to 47.0 from 48.0.

8:15: U.S. – ADP Nonfarm Employment Change: forecast to plummet to -154K from 183K.

10:00: U.S. – ISM Manufacturing PMI: likely to have contracted to 45.0 from 50.1.

10:40: U.S. – Crude Oil Inventories: previous print was 1.623M barrels.

Thursday

4:30: UK – Construction PMI: February’s reading of this key measure was 52.6.

8:30: U.S. – Initial Jobless Claims: expected to continue freefalling to 3,000K from last week’s record 3,283K.

Friday

8:30: U.S. – Nonfarm Payrolls: seen to plunge to -100K from 273K.

8:30: U.S. – Unemployment Rate: expected to rise to 3.9% from 3.5%.

10:00: U.S. – ISM Non-Manufacturing PMI: probably tumbled to 44.0 from 57.3.

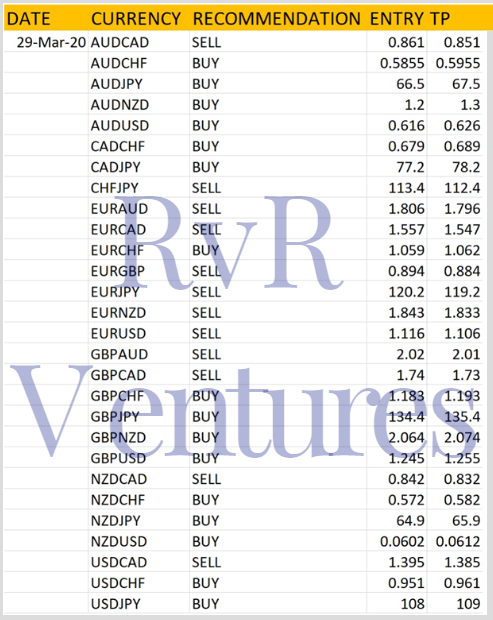

On the basis of the above mentioned factors and the technical trends, here is the analysis provided by the analyst at RvR Ventures on 28 currency pairs. There is a lot to watch out for this week and the factors don’t seem to show any fall any time soon. The virus has taken a toll and impacted every currency, for that matter even the commodities show significant change. Trade responsibly; Invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility.

Trade responsibly; Invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility.

Watch LIVE #ForexTrading by Neural network based #Robots & Professional Traders at: https://youtu.be/QbE2i46JsfM

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc

Report: Market Analysis Published on 30 March 2020: Date of report: 05 April, 2020

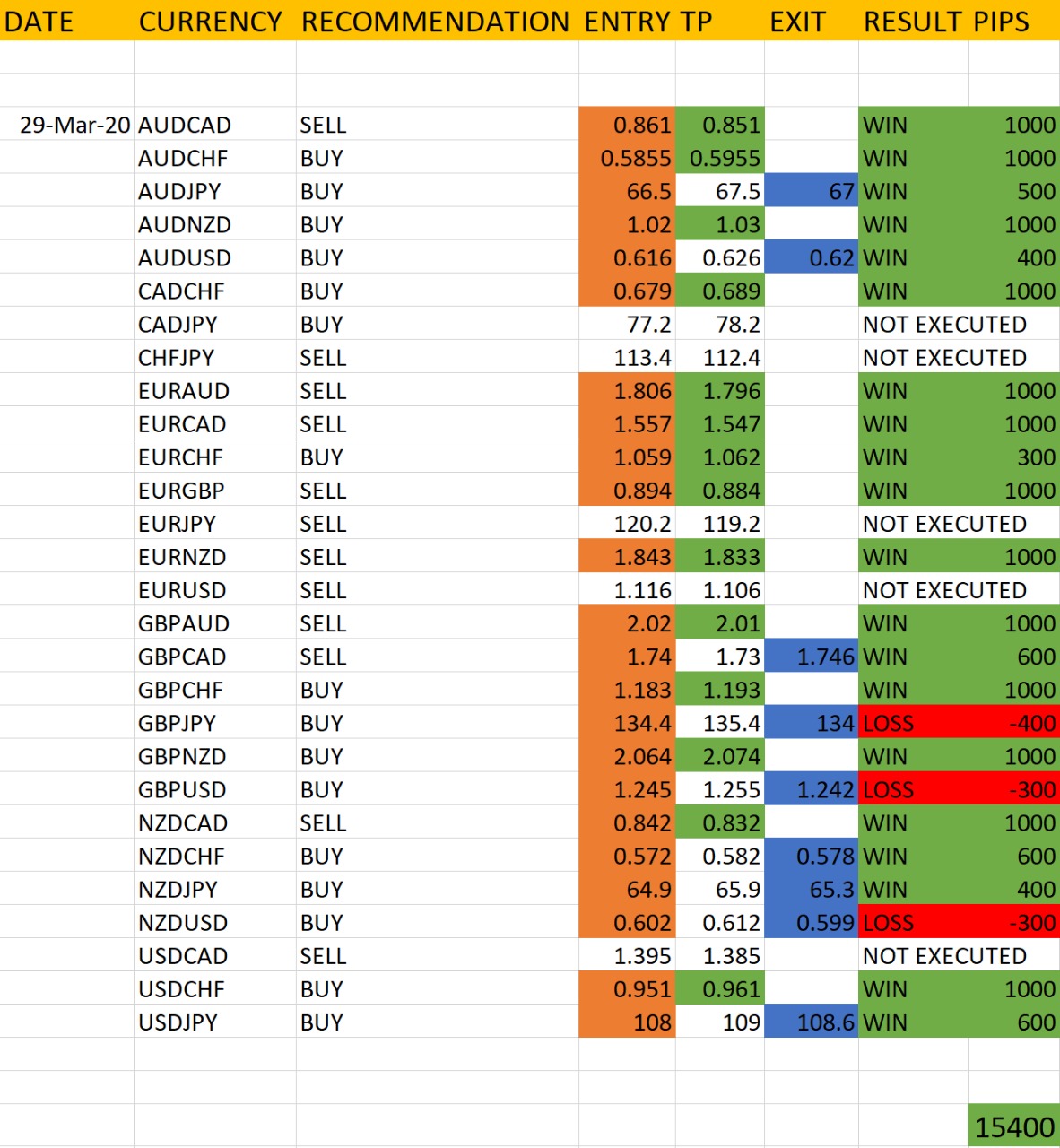

On Monday, 30 March 2020 we had published our analysis based on the market conditions and the technical signals on 28 currency pairs. This week, the market saw a lot of twists and turns with some of the most important data revelation in the time of this pandemic. Some of the major market turning events that happened included the Chinese PMI which turned out to be better than expected, the German Manufacturing Index and the US Initial Jobless Claims data, NFP, US Unemployment Rate to name a few.

Following the analysis, the traders at RvR Ventures encashed a profit of 15,400 pips, even in this extremely unpredictable market. At a point where any moment could change the ball game in the market, our analyst still managed to achieve profits on 20 currency pairs out of 23 currency pairs on which the trades were executed on, providing an accuracy of 82%, even in the unpredictable market waters.

During this time of pandemic, it has become difficult to analyse the market trends and entry and exit points. Hence, trade carefully and stay safe. Also, invest ONLY as much as you can lose. Implement strict money management formats to save your principle amount invested.