Will we see a better May?

Peak virus seemed to be the overriding theme of the week, with the rate of new cases and deaths falling in Europe and the United States, the COVID-19 epicentres.

Plans appear to be accelerating also for partial reopening around the world. New Zealand returns to work tomorrow, Australia plans a partial effort this week, New York has announced protocols for a mid-May reopening with some US states already tentatively opening. European hotspots such as Italy, Spain, Germany and the UK are also planning partial reopening or will be doing so this week.

As we head towards May, next week’s focus will turn to central banks again, with the Fed, ECB, and BoJ all announcing their latest decisions on rates.

Dollar eases against majors and regionals on risk-seeking sentiment

- The US dollar saw profit-taking in New York on Friday as traders booked profits on longs. It sparked modest recoveries on the JPY, EUR, GBP and also petro-currencies as oil prices rallied slightly.

- Peak-virus and better than anticipated China data has maintained that modest momentum this morning.

A game of two halves in oil markets today

- Brent and WTI have diverged sharply this morning in Asia with Brent easing by 20-cents to $21.60 a barrel from its Friday closed. WTI, by contrast, has fallen by nearly 10% to $15.60 a barrel, from its New York close at $17.30 a barrel.

Oil Market

- There has been a massive drop in open interest in the June 20 NYMEX. This is very much a result of the USO ETF (NYSE:USO) being told by the CME to reduce the front-month delivery risk.

- This policy shift is to avoid another technical break down. And it makes sense as June contract might be un-deliverable with Cushing storage probably full.

Gold eases as Asia goes peak-virus and the BOJ set to ease further

- Gold eased slightly on Wall Street Friday, falling 0.15% to $1727.50 an ounce. It has dropped another 0.30% in Asia this morning, falling to $1722.00 an ounce.

- Much of the fall is likely to be weekend risk hedges being taken off the table by Asian investors this morning. The positive risk sentiment sweeping Asian equities and currencies has also added gentle downward pressure to gold.

- Gold now has resistance at $1750.00 and a double top at $1740.00 an ounce, substantial obstacles to further advances, especially in a peak-virus environment. Support ay $1707.00 an ounce is probably the weaker side as the new week begins.

The European Central Bank

- The ECB has turned on the taps, similar to the Fed, albeit with a more lukewarm reception to its €750bn Pandemic Emergency Purchase Programme, but there have also been temporary collateral easing measures and moves to mitigate the impact of rating downgrades on collateral availability.

- However, the landscape remains extremely thorny, as evidenced by last week’s dispiriting EU composite PMI for April falling to a record low of 13.5, while sovereign bond spreads have continued to widen.

UK

- The UK may be heading for its sharpest contraction in more than a century, with the lockdown still having at least a couple of weeks to go and easing measures likely to be very gradual thereafter.

- The PMI data this week was horrific but the same is true everywhere. The all-important services sector unsurprisingly shrank at a phenomenal pace, leaving the 35% contraction estimates last week looking perfectly feasible.

Australia

- Inflation Wednesday and New Home Sales on Friday. Closed for ANZAC Day Monday.

- The AUD has risen 8.0% this month, and the ASX 200 by 5% this month. Currency consolidated gains but equities have faded along with US ones. Acutely vulnerable to resource price fears, lower oil and poor China data next week.

New Zealand

- Balance of Trade due Wednesday with ANZAC Day holiday this Monday. Level 4 lockdown finishes nationally on Tuesday after acceptable COVID-19 progress.

- NZD has rallied 3.50% this month, and the stock market by a huge 12.50% on “peak-virus” and a potential China recovery. Disappointments on either front leave the NZD vulnerable to an aggressive downward reversal although level 4 exit is supportive as the country goes back to work.

China’s market favour:

- China has done markets a favour this morning, reinforcing the peak-virus risk-on sentiment.

- Industrial Profits for March YoY fell by 36.70%, an improvement on the previous -38.3% number and much better than the forecast -48.7% fall.

- Less bad news is good news in a COVID-19 world, and today’s data should give hope that China has weathered the storm, and a return to business will lift the economies globally.

Japan announcements:

- The BOJ may well announce a significant extension to its bond-buying program today to support the Government’s fiscal plan announced last week.

- The monetary policy meeting lasts typically for two days, but the BOJ appears set to bring forward its decisions to today.

- It may well also suspend yield curve control and move to allow unlimited purchases of JGB’s and corporate bonds.

Important economic data and events due out this week are as follows:

Week Ahead

All times listed are EDT

Monday

23:00: Japan – BoJ Monetary Policy Statement and Outlook Report

Tuesday

10:00: U.S. – CB Consumer Confidence: expected to contract to 88.0 in April from 120.0 in February.

10:19: Japan – BoJ Interest Rate Decision| Japan Interest Rate Decision

Upcoming Release:

Apr 28, 2020: Forecast:-0.10% |Previous: -0.10%: the central bank is anticipated to hold steady at -0.10%.

18:45: New Zealand – Employment Change

New Zealand Employment Change QoQ: Upcoming Release:

Apr 28, 2020: Forecast: 0.3% Previous: 0.2%: anticipated to have increased to 0.3% QoQ from 0.2% previously.

21:30: Australia – CPI: seen to have fallen to 0.2% from 0.7%.

Wednesday

8:30: U.S. – GDP: expected to plunge to -4.0% from 2.1%.

10:00: U.S. – Pending Home Sales: seen to plummet to -10.00% from 2.4%.

10:30: U.S. – Crude Oil Inventories: presumed to jump to 15.150M from 15.022M.

14:00: U.S. – Fed Interest Rate Decision: rates are expected to remain steady at 0.25%

21:00: China – Manufacturing PMI: estimated to have declined to 51.0 from 52.0, still within growth territory.

Thursday

3:55: Germany – Unemployment Change: seen to surge to 75K from 1K.

5:00: Eurozone – CPI (YoY): probably declined to 0.1% from 0.7%.

7:45: Eurozone – ECB Interest Rate Decision: anticipated to remain flat at 0.00%.

8:30: U.S. – Initial Jobless Claims: markets remain riveted by this metric; the sum of four previous weekly releases has hit 26 million.

8:30: Canada – GDP (MoM): probably remained at 0.1%

8:30: Eurozone – ECB Press Conference

Friday

4:30: UK – Manufacturing PMI: expected to edge to 32.8 from 32.9.

10:00: U.S. – ISM Manufacturing PMI: seen to have fallen to 36.7 from 49.1.

The focus this week will remain on COVID-19, big tech earnings and rate decisions by BoJ, Fed and ECB. A plethora of data will also show the economic conditions in the first quarter and how China’s recovery is unfolding.

Based on the above factors and the data uncovering, here’s our analysis for the week. As we are slowly venturing into May soon with heaps of important economic data, right decision at the right time will help you trade well and trade profitably.

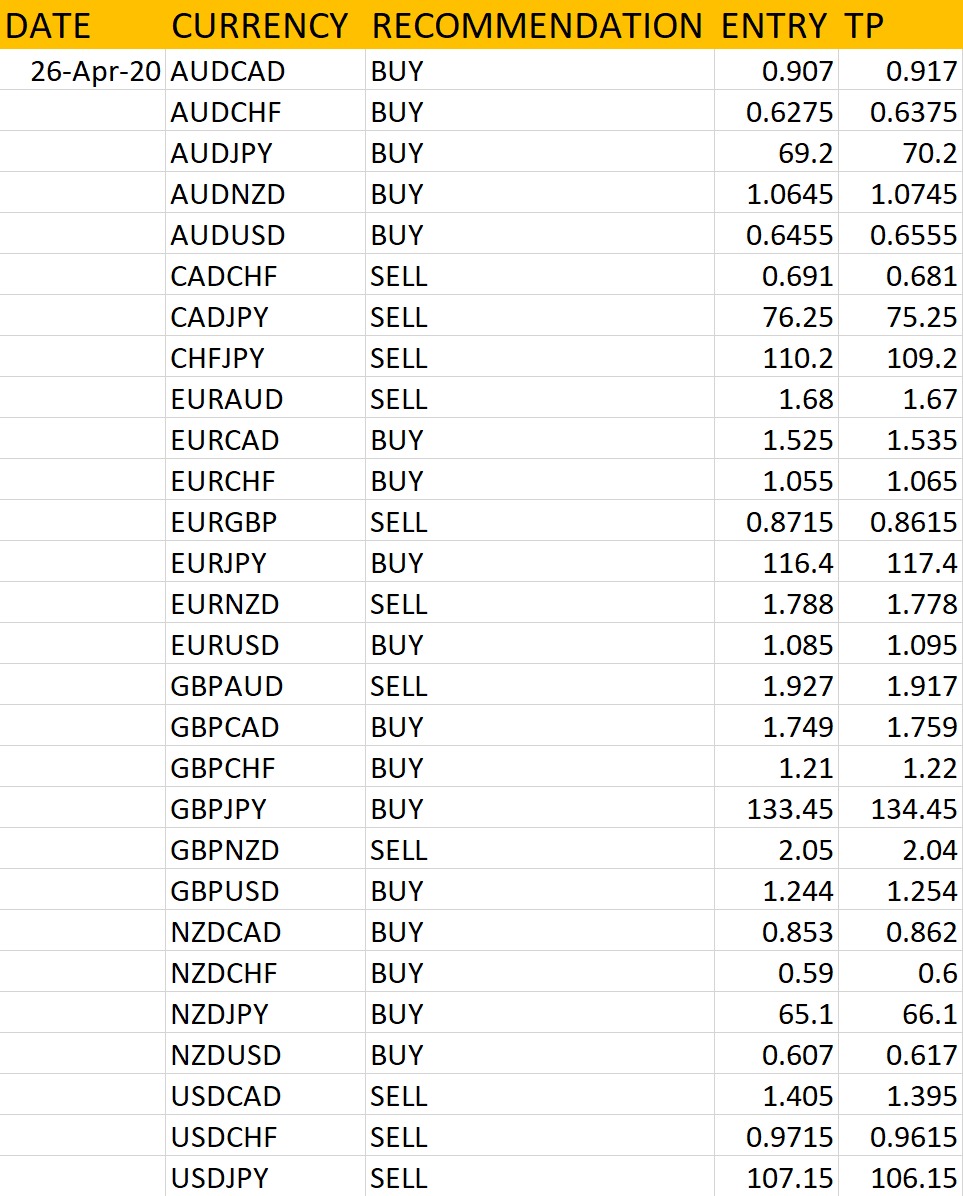

Here’s the analysis by the analyst at RvR Ventures.

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

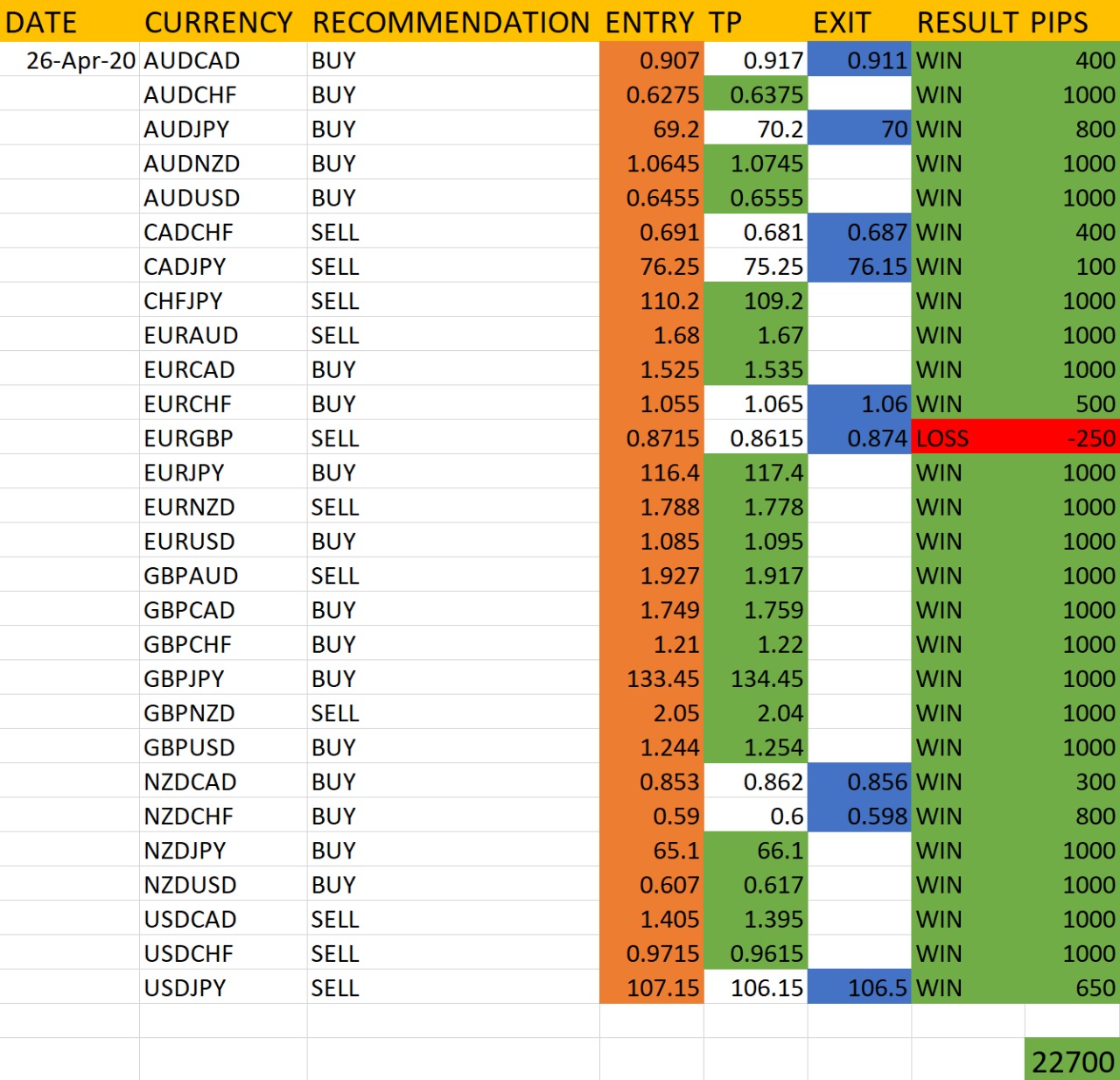

The accuracy report of the above market analysis will be published on 1st May, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading.

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc