May May be the Panacea

What we are witnessing everyday due to a pandemic is often so crazy that it becomes extremely difficult to gauge the market and its trends. We’re into the second week of May and so far, things have not quite improved in terms of the pandemic.

However, this week is equally crazy and twisted in terms of important data. The US jobs report (and jobless claims figures with April’s total above 30, yes thirty million), Bank of England and Reserve Bank of Australia decisions and another busy earnings week and the oil crisis are some of the key factors to look out for this week.

Though the number of new cases of COVID-19 have slowed in some regions, with more than 3,441,000 cases reported around the world and more than 67,000 fatalities in the US alone, the pandemic’s impact is far from over.

Countries:

US

- Wall Street is paying close attention to the slow reopening of the economy across 20 states. Economic activity will need to see a successful reopening of the economy before investors feel confident that we are on the other side of the virus.

- The risk at opening now for some states is that a new wave of new cases could happen. Not every state is adhering to the guidelines set for reopening, so investors will closely watch to see if any spikes occur with new cases over the next couple of weeks.

Fed Minutes:

- The Fed has been very active in delivering stimulus and now they need to unveil the details to the rest of the emergency programs. A more calculated approach seems to be working for the Fed, case in point with the details with the Main Street Lending Program. The Fed will remain accommodative for the foreseeable future and will be quick to intensify their efforts if the recovery is threatened.

Dollar Index:

- The dollar fell on Friday, along with yields, including for the benchmark 10-year Treasury. It was the sixth straight day declines for the Dollar Index.

- The US dollar is broadly stronger this morning against both developed and developing market currencies, the Dollar Index rising 0.25% to 99.33 in early trading.

UK

- Boris Johnson announced on Thursday that the country is finally past the peak of coronavirus which, in theory, means it can start preparing for lockdown measures to be lifted. This won’t be done quickly or without certain conditions being met, the five tests laid out by the PM. But it does provide hope that some businesses can reopen their doors and people return to work.

- The Bank of England meets next week and has already eased monetary policy considerably in line with others around the globe. No significant measures are currently expected, although as we’ve seen, central banks are continually tweaking programs to respond to the evolving needs of their countries.

- The BoE has changed the time of the release to 7am next Thursday from the usual midday. While there haven’t been expectations of a change, the last time they announced measures on budget day, they also released this at 7am. More speculation likely over the coming days.

ECB

- On the day when Italy and France officially fell into recession, with sharp contractions in the first quarter, the ECB expanded its easing programs in an attempt to further alleviate pressure on the region in these tough times. The central bank reduced interest rates on its TLTRO III program and introduced new non-targeted pandemic emergency LTROs (PELTROs) in a bid to further support liquidity conditions.

- There was no increase in the PEPP or the addition of “fallen angels” in the purchases yet but that must just be a matter of time. It could be a few months before the latter becomes compulsory so there was no urgency today, with Italy holding onto its investment-grade earlier this week.

China

- The economic data this week from China has been encouraging for the rest of the world as it emerges from lockdown. What is less encouraging is what’s coming from the White House with Donald Trump insistent on ensuring that the finger of blame for the coronavirus toll in the US is not pointed his way.

- Trump has threatened tariffs on China once again and the trade deal which took so long to thrash out may already be at risk.

- The coronavirus has already likely meant that the terms are not being met and Trump may feel the need to make China a key feature of his re-election campaign. Expect more hostility in the weeks and months ahead.

Australia

- RBA meeting on Tuesday, no change in interest rates expected.

- Traders are likely to look for more insight on bond buying, with the central bank expected to continue to taper having achieved its goal of managing the yield curve through this extraordinary time.

- It wanted to keep the 3 year rate around 0.25% which it has successfully managed to do.

Japan

- BoJ removed the ¥80 trillion ceiling on annual purchases at its meeting earlier this week, making the announcement a day earlier than planned, and joined the QEinfinity club.

- The central bank no longer expects to hit its inflation target in the next three years and pledged to do more when needed.

Market

Oil Rebounds

- Oil prices have staged an impressive rebound this week after a rocky start, as the USO (NYSE:USO) – America’s largest oil ETF – opted to avoid another May contract scenario and shed its June holdings. This represented around 20% of its $3.6 billion portfolio so traders were naturally keen to get out the way and compress prices to very generous levels, if you’re a buyer. The price rebounded shortly after but still trades below $20.

- The production cuts are finally kicking in with Saudi Arabia reportedly implementing agreed reductions ahead of schedule, the OPEC+ deal officially underway as of today, Norway announcing a reduction of 250,000 barrels per day and ConocoPhillips (NYSE:COP) culling 265,000 this month, rising to 460,000 next. Others will likely follow, at which point we may see downside pressures ease on oil prices and near contracts. Prices are still extremely low though and the next two weeks will likely see extreme volatility return.

A strange week for Gold

- Gold remains broadly aligned with risk assets but not necessarily reliably so at this point and even its relationship with the dollar has become a little sketchy.

- It seems after a period of turbo-charged volatility, the yellow metal has settled into a consolidation phase, with $1,660 providing the floor and $1,750 the ceiling. Quite a broad range, granted, but given the environment, something has to give.

Here are the important market-moving factors for the week:

The Week Ahead

All times listed is EDT

Monday

3:55: Germany – Manufacturing PMI: anticipated to plunge to 34.4 from 45.4.

Tuesday

4:30: UK – Construction PMI: seen to rise to 44.0 from 39.3.

4:30: UK – Services PMI: likely to have plummeted to 12.3 from 34.5.

10:00: US – ISM Non-Manufacturing PMI: forecast to fall to 44.0 from 52.5.

Wednesday

5:00: Eurozone – Retail Sales: expected to have tumbled to -10.5% in March from 0.9% previously.

8:15: US – ADP Nonfarm Employment Change: seen to decline to -20,000K from 27,000K.

10:30: US – Crude Oil Inventories: likely to soar to 10.619M from 8.991M.

Thursday

7:00: UK – BoE Inflation Report, MPC Meeting Minutes

8:30: US – Initial Jobless Claims: last week, an additional 3,839K people lost their jobs, bringing the current US total up to 30 million…and counting.

Friday

8:30: US – Nonfarm Payrolls: one of the most closely watched releases of the month is forecast to surge to -21,000 from -701,000.

8:30: US – Unemployment Rate: anticipated to jump to 16.0% from 4.4%

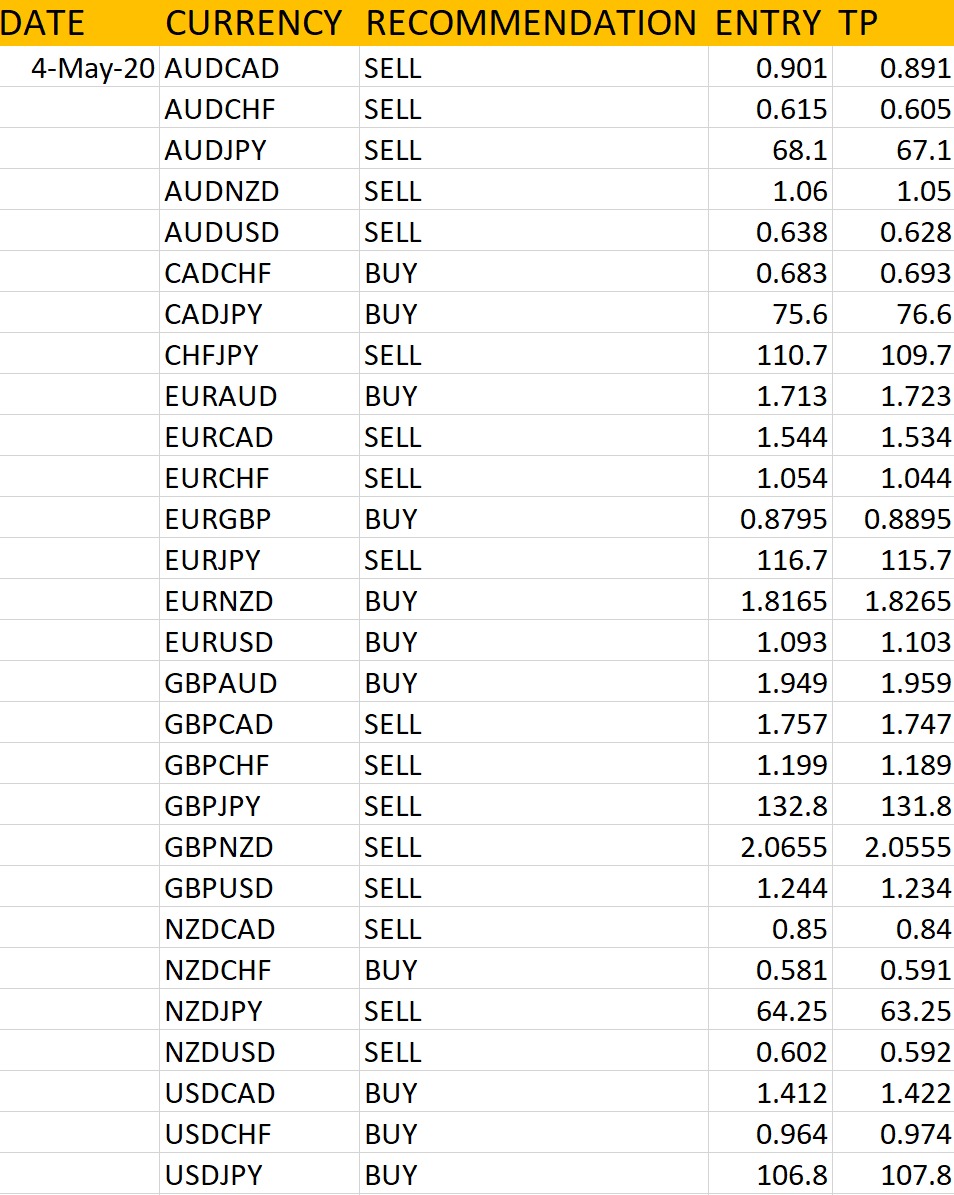

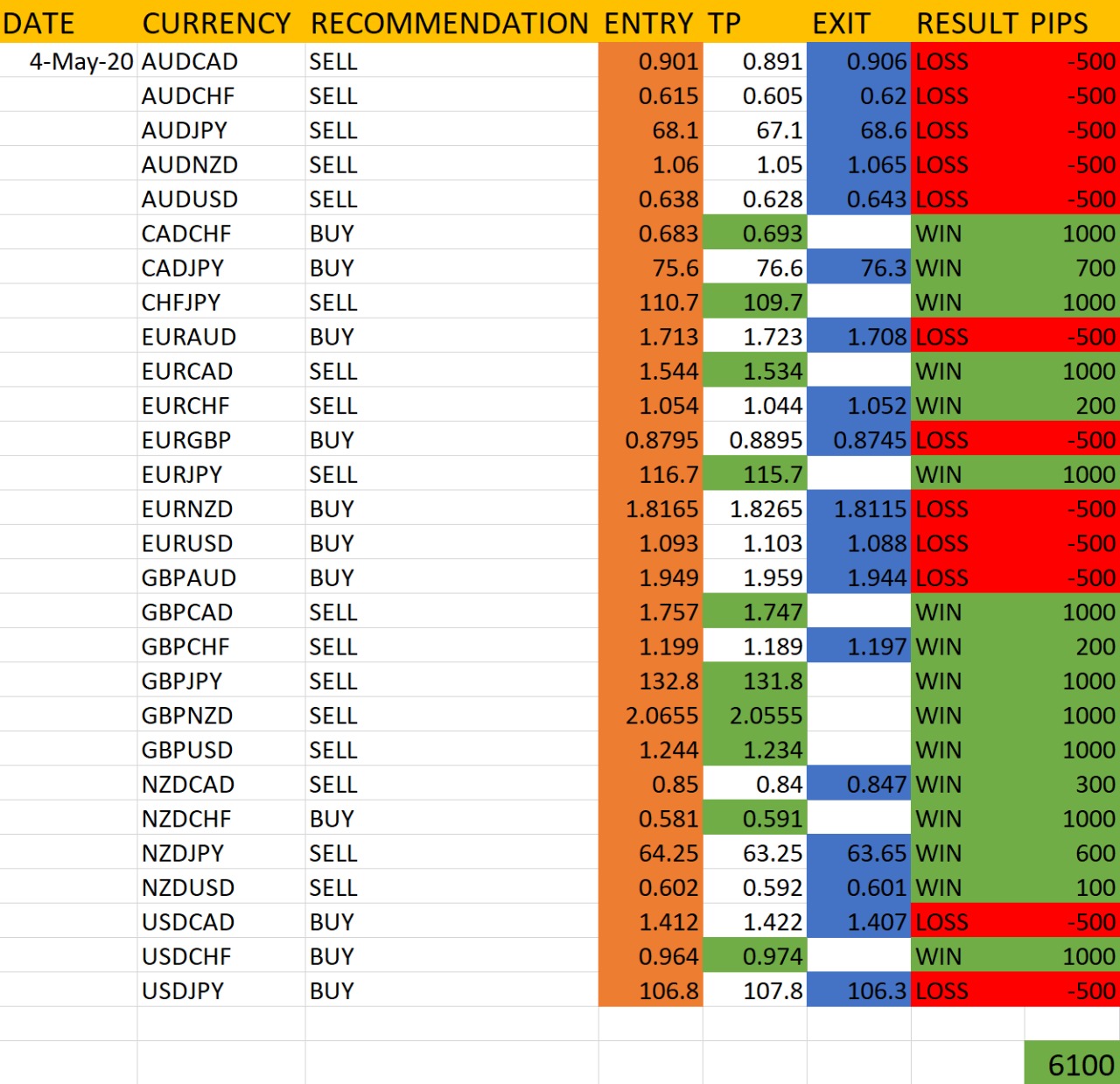

Based on the above factors and the market conditions, here is the analysis –provided by the analyst at RvR Ventures. It is solely based on the current momentum and the situation lying around, out of which the analyst was able to come to the following conclusion.

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

The accuracy report of the above market analysis will be published on 8th May, 2020.

Small account holders can exit in 40/80 pips.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading.

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc