Emerging from the Havoc?

It’s been another interesting week in financial markets. This week is going to be no less eventful as investors come to grips with the reality of the situation we’re all facing while factoring in the seemingly endless supply of monetary support.

Add to all of this the renewed tensions between the world’s two largest economies. Given that a trade war between the two was once viewed as a major risk to the global economy, it’s extremely unwelcomed now.

Lastly, we have oil. Last month’s plunge to minus $40 on the May contract is not expected to see a repeat performance. A lot has changed since then. But with the June expiry on Tuesday, who knows what chaos could ensue. Prices are inflated after an impressive rebound in recent weeks, maybe even vulnerable. The week started off on a very interesting note.

Here are the key-pointers for major economies and markets:

Country

US expected to show improvement in economic data

- The US economy’s staggered reopening is expecting to show incremental improvements in economic data this week.

- US business activity is expected to bounce from record lows as some states start to reopen. Housing data is expected to be persistently bad, while weekly Initial Jobless Claims is expected to continue to decline alongside continuing claims.

- The primary driver for global equities remains improving economic data as global economic activity picks up and whether renewed outbreaks will disrupt the reopening of economies.

UK’s harsh realities

- The first week of lockdown easing has brought confusion, debate and worrying images of packed tubes. It’s also been accompanied by news that the worst monthly economic contraction on record and 2% as a whole in the first quarter. When you consider that the lockdown only started a week before the end of the quarter, you can imagine what the Q2 data will look like.

- This week, Andrew Bailey will be joined by three of his colleagues from the MPC to answer questions from the Treasury Select Committee on the economic impact of the coronavirus, as the country passes the peak of the first phase.

- In Europe, the United Kingdom has the highest number of deaths at around 34, 546 and a case-fatality rate of 14.3 percent. Furthermore, renewed fear about the prospect of a disorderly Brexit has been weighing on the British Pound since last Friday, adding a spice of political uncertainty to the situation.

- Renewed fear about a disorderly Brexit is amplifying selling pressure in the virus-hit GBP as the Bank of England hints at the use of negative rates.

Europe’s decline in cases looks promising

- Germany is officially in recession after its fourth quarter was revised lower to -0.1%. Naturally, it received the good old “who cares” in the markets.

- Mild technical recessions are something to aim for when you’re in the midst of a severe recession with a hugely uncertain outlook.

- The euro area as a whole just avoided a similar fate.

- Germany is loosening quarantine restrictions for travellers arriving from EU, Schengen Area and UK. The Baltics launched a travel bubble that would allow citizens and residents of Lithuania, Latvia and Estonia to travel freely within the region. Investors see all of these steps as a move in the right direction for the Eurozone and drove the euro higher in response. Eurozone GDP numbers were also in line and not worse than expected with GDP contracting 3.8% in the first quarter

- The number of cases and deaths continues to decline which is promising. With lockdown measures easing, this will be the key over the next few weeks to further easing and economies returning to something resembling normal.

Australian markets under pressure

- Australia employment fell by 574K in April. ABS said the real figure is actually much higher. However, lockdowns are being eased across the country which should see a sharp rebound.

- AUD has fallen on global economic fears. High beta to China and world trade leaves Australia markets vulnerable to downward pressure. No data of significance next week.

China attracting a lot of attention about its handling of the coronavirus

- The economic recovery is expected to continue in China with the PBOC this week signalling more powerful and broad reaching stimulus measures are on the way to support growth and employment.

- The trade situation with the US is in danger of deteriorating. US administration members from the President down, labeling COVID-19 the “Chinese plague” and threatening new sanctions if China does not meet its trade agreement obligations. The Presidential election is going to be fought on who is toughest on China.

Japan’s economy fell into recession, braces for worst slump

- Japan’s economy slipped into recession for the first time in 4-1/2 years in the last quarter, putting the nation on course for its deepest post-war slump as the coronavirus crisis ravages businesses and consumers.

- Monday’s first-quarter GDP data underlined the broadening impact of the outbreak, with exports plunging the most since the devastating March 2011 earthquake as global lockdowns and supply chain disruptions hit shipments of Japanese goods.

- Japan has extended the nationwide state of emergency to the end of May with 34 prefectures reopening next week – not Tokyo or Osaka.

- 2nd extra budget being formulated. BoJ says willing to increase easing if needed.

- USD/JPY continues to range. Risk aversion return could see USD/JPY fall sharply.

Market

Oil’s rally continue

- Oil continued to power higher on Friday as global production curbs, and global recovery expectations continued to underpin the impressive rally.

- Oil surged on Friday, jumping 6.8% as analysts began noting glimmers of light at the end of the economic dark tunnel created by the COVID-19 pandemic and related lockdowns.

- Oil prices are heading higher once again as WTI closes in on $30 a barrel, almost $70 above the level it plummeted to almost a month ago.

- There’s clearly a different feel to the oil market heading into this contract expiry, with production cuts having been enforced globally, either through deals or unilaterally.

Gold motorized by record U.S. spur

- In lockdown, it can be easy to lose track of what day it is but take one look at a gold chart and that Friday feeling is shining through. Consolidation over the last month has made this running daily commentary quite painful at times. You’d swear we’re living in relatively mundane times.

- Finally, it seems gold is catching up with reality. On the precious metals front, gold has had a break out too, with the spot contract which tracks live trades in bullion, hitting 7-½ year highs Friday to finally shatter the $1,750 ceiling.

- The breakout came during some weakness in risk markets and while they have bounced back, whatever the reason, a break of $1,750 could kick it into a higher gear.

Here’s a look at all the important market-moving factors for the week:

Week Ahead

All times listed is EDT

Monday

21:30: Australia – RBA Meeting Minutes

Tuesday

2:00: UK – Claimant Count Change: seen to surge to 150.0K from 12.1K.

5:00: Germany – ZEW Economic Sentiment: expected to jump to 33.5 from 28.2.

8:30: US – Building Permits: anticipated to fall to 1.000M from 1.350M.

21:30: China – PBoC Loan Prime Rate: currently at 3.85%

Wednesday

2:00: UK – CPI: expected to have plunged to 0.8% in April from 1.5% previously.

5:00: Eurozone – CPI: forecast to decline to 0.4% from 0.7% YoY.

8:30: Canada – CPI: anticipated to have moved to 0.5% in April, from 0.6%.

10:30: US – Crude Oil Inventories: forecast to soar to 4.147M from a drawdown of -0.745M last week.

14:00: US – FOMC Meeting Minutes

Thursday

4:30: UK – Manufacturing PMI: expected to rise to 33.5 from 32.6.

4:30: UK – Services PMI: anticipated to have jumped to 22.1 from 13.4.

8:30: US – Initial Jobless Claims: last week’s heart-stopping reading was 2,981K, a total of more than 36-million since mid-March.

8:30: US – Philadelphia Fed Manufacturing Index: seen to rise to -45.0 from -56.6.

10:00: US – Existing Home Sales: seen to drop to 4.30M from 5.27M.

Friday

2:00: UK – Retail Sales: likely plummet to -16.5% from -5.1%.

3:30: Germany – Manufacturing PMI: expected to rise to 40.0 from 34.5.

8:30: Canada – Core Retail Sales: anticipated to pop to -5.0% from -15.6%

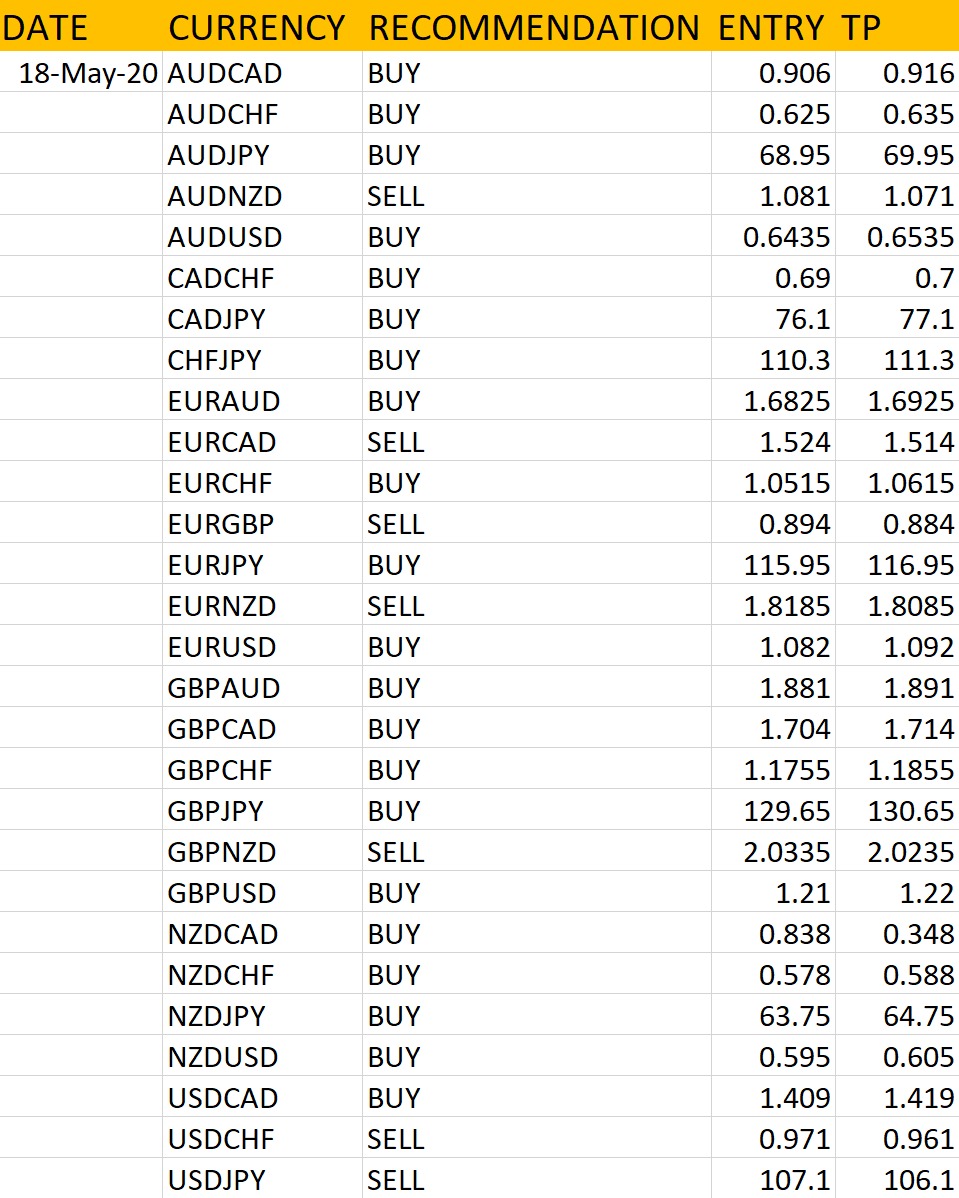

Based on the above factors and the events lined up for the week, the analyst at RvR Ventures has penned down his predictions for the week.

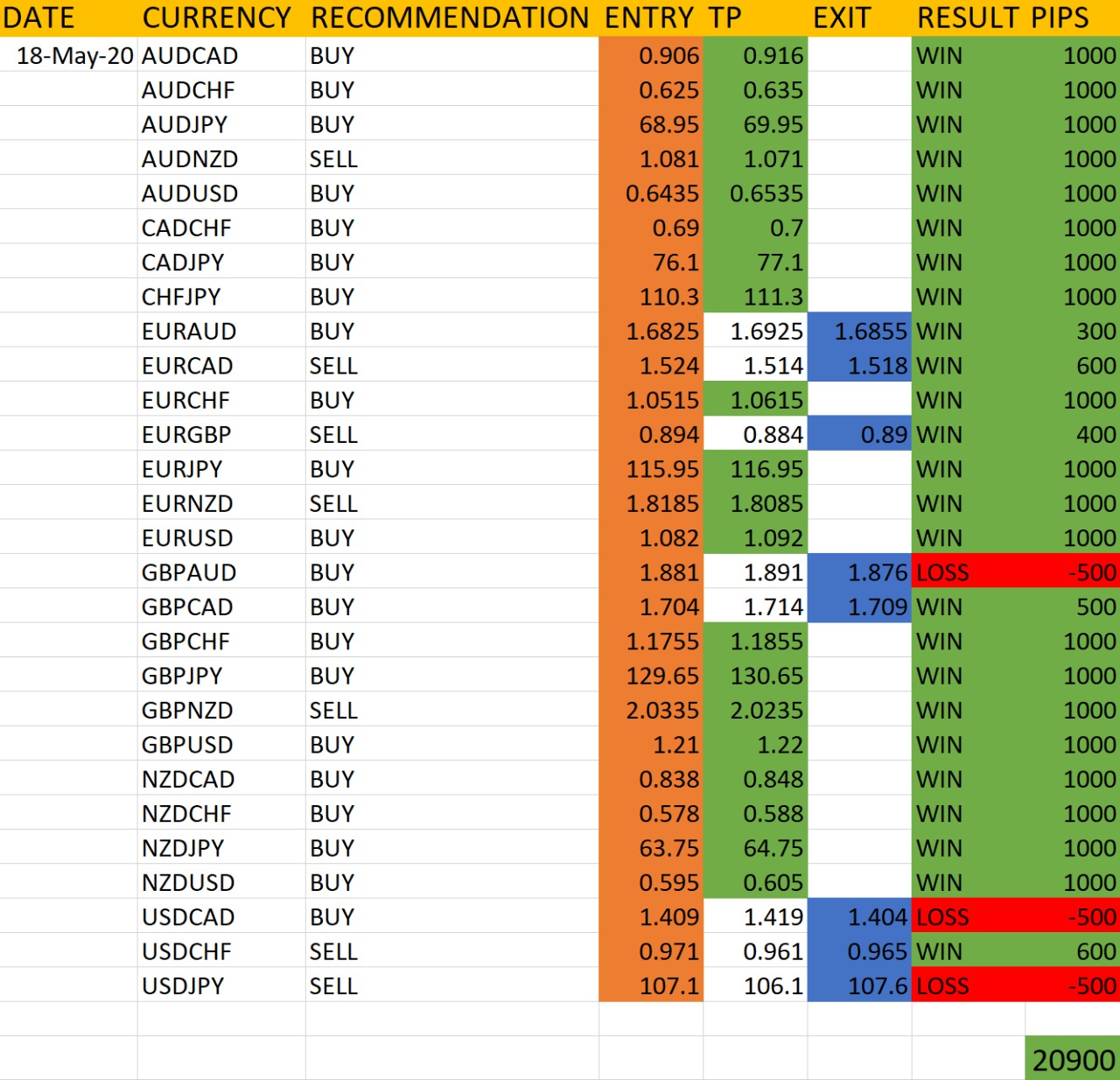

The accuracy report of the above market analysis will be published on 22nd May, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading. Small Account holders can exit in 40/80 pips.

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe to Our YouTube Channel: https://youtu.be/AnTlQd-FQxc