Economy v/s Covid-19

With many countries in the West attempting to reopen their economies, attention has turned to whether new infection rates will remain low as mobility picks up.

The week ahead will have a tremendous amount of focus with the Chinese recovery, as critical April economic data will show how fast their economy is bouncing back. China’s pickup in economic activity will be the template many will use for outlining what will happen in Europe and the US.

Countries

US: Despite record US jobs lost, and unprecedented unemployment rate, equities rally

- Financial markets remain primarily focused on the spread of COVID-19 and as US states reopen economies and ease coronavirus lockdowns.

- The economic data devastation is mostly priced in and risk appetite seems like it will remain healthy as long the Fed and US government continue to signal more monetary and fiscal stimulus is in the pipeline.

- US-Chinese relations are also providing some uncertainty for the global economic rebound story. Tensions between the world’s two largest economies could derail much of the reopening optimism that has eased demand for safe-havens.

- President Trump appears focused with the November election and will likely keep up the verbal pressure on China but fail to deliver any harsh action that will threaten the second half economic recovery.

UK and the lockdown

- British Prime Minister Boris Johnson on Sunday announced a phased plan to ease a nationwide coronavirus lockdown, with schools and shops to begin opening from June 1 — as long as infection rates stay low.

- “This is not the time simply to end the lockdown this week,” the 55-year-old said, but unveiled a “conditional plan” to ease the measures in England in the months ahead.

- The Bank of England opted against easing monetary policy on Thursday, despite moving the announcement to earlier in the day, which led to speculation that more easing was coming. The BoE stands ready to do more and will meet multiple times before June, when the additional bond purchases announced in March are completed.

Europe’s ongoing restrictions

- Europe continues to see restrictions being gradually lifted in various countries and all eyes will be on the experience here in the coming weeks to see what can be expected elsewhere.

- But the data is heading in the right direction and governments are acting with strong caution which will give people hope that further restrictions won’t be needed in the future.

Australia and job loss

- Australia is expected to have lost over a half-a-million jobs in April. The coronavirus pandemic has crippled the Australian economy, but hopes are growing that they will reopen by July.

Japan’s extended lockdown

- Japan has extended the nationwide state of emergency to the end of May but will reassess the situation on May 14th.

- Japan seems poised to lift some measures in some areas that are showing no new cases. PPI data from Japan will likely confirm the deflationary pressures that have persisted this year.

Market

Oil sees first back-to-back weekly gain in 11 weeks

- Oil prices have staged quite the rebound as more countries signal further curtailment of crude production and as crude demand begins to comeback after several states and countries begin to reopen.

- Oil prices seem to finally be settling on a range after a constructive two weeks of steady gains.

- Energy markets are becoming confident the market will return to balance this summer and that we won’t have a repeat of last month’s contract expiry volatility.

Gold market

- The US jobs report it tarnished gold luster, as focus shifted from the headline data to the positive rebound in hourly earnings. Before NFP, gold traded up, building on substantial gains made the previous day.

- Firm prices in Europe and Asia lasted into early US trading.

- Gold rallied despite the broader financial markets adopting a mild “risk-on” tone, which is usually unfavorable for gold.

- But that correlation has broken down of late as equity market “risk-on “appetite is primarily driven by central bank largesse, which is equally supportive for gold.

Currencies

The Chinese Yuan

- Despite the improved tone on trade via a planned US-China trade, chiefs call this week. Most Yuan watchers believe the latest trade calming comments will fall well short of settling the bilateral and what could soon emerge as multi-pronged disputes more generally.

- Particularly in light of the upcoming US presidential election, which will see both parties charging the election stage with trade war playbooks in hand? Notwithstanding the difficulty, China

The Euro

- On a narrow reading, the German Constitutional Court’s request for the ECB to show that its first sovereign QE program (PSPP) was “proportional” doesn’t look like a bridge too far to cross.

- But the broader implications for markets are more worrisome, in part because it reinforces the view that ECB is operating under certain limitations and remain bridled to antiquated policy constraints ill-suited for this current crisis.

- So, it may mean market pressure, equity market rout, or the EUR/USD trading considerably lower to be the compelling mechanism for any further steps toward fiscal risk-sharing.

- So, amid the Eurozone legal squabbling, there could remain downside pressure on the EUR/USD at least until the debt. mutualisation issues are resolved

The Japanese Yen’s favourable chances

- The yen has a favorable balance between a currency that is cheap on most metrics but does not have a cost of carry as a disadvantage and acting as an anvil on its back.

- And although there have been numerous stops and starts in Japan’s attempt to exit from the virus its certainly one of the more advanced North Asia countries and leaps and bounds ahead of the Euro area and North America.

- With the Eurozone trials and tribulation over providing a unified policy response to the crisis, it is tending to highlight the yen as a significant currency alternative. It is reflected in downward pressure on EUR/JPY.

Listed below are the important market-moving indices for the week:

The Week Ahead

All times listed is EDT

Monday

21:30: China – CPI: expected to rise to -0.5% from -1.2% on a monthly basis, while retreating to 4.3% from 3.7% YoY.

Tuesday

8:30: US – Core CPI: seen to have edged down to -0.2% from -0.1%.

22:00: New Zealand – RBNZ Interest Rate Decision, Rate Statement: rates forecast to remain flat, at 0.25%.

Wednesday

2:00: UK – GDP: probably fell to -2.1% from 1.1% YoY, while plunging to -2.5% from 0.0% QoQ.

2:00: UK – Manufacturing Production: presumed to have plummeted to -5.7% from 0.5%.

8:30: US – PPI: expected to have fallen to -0.5% in April, from -0.2% previously.

10:30: US – Crude Oil Inventories: last week’s reading showed an addition of 4.590M barrels to stockpiles.

Thursday

8:30: US – Initial Jobless Claims: the previous week’s 3,169K new job losses brought the seven week tally to over 33 million US jobless.

22:00: China – Industrial Production: seen to jump to 1.5% from -1.1% YoY.

Friday

2:00: Germany – GDP: estimated to plunge to -2.1% from 0.0% QoQ and to -1.6% from 0.3% YoY.

8:30: US – Core Retail Sales: seen to have fallen further, to -8.6% from -4.2%.

9:15: US – Industrial Production: the contraction is anticipated to have worsened in April, to -11.5% from -5.4%.

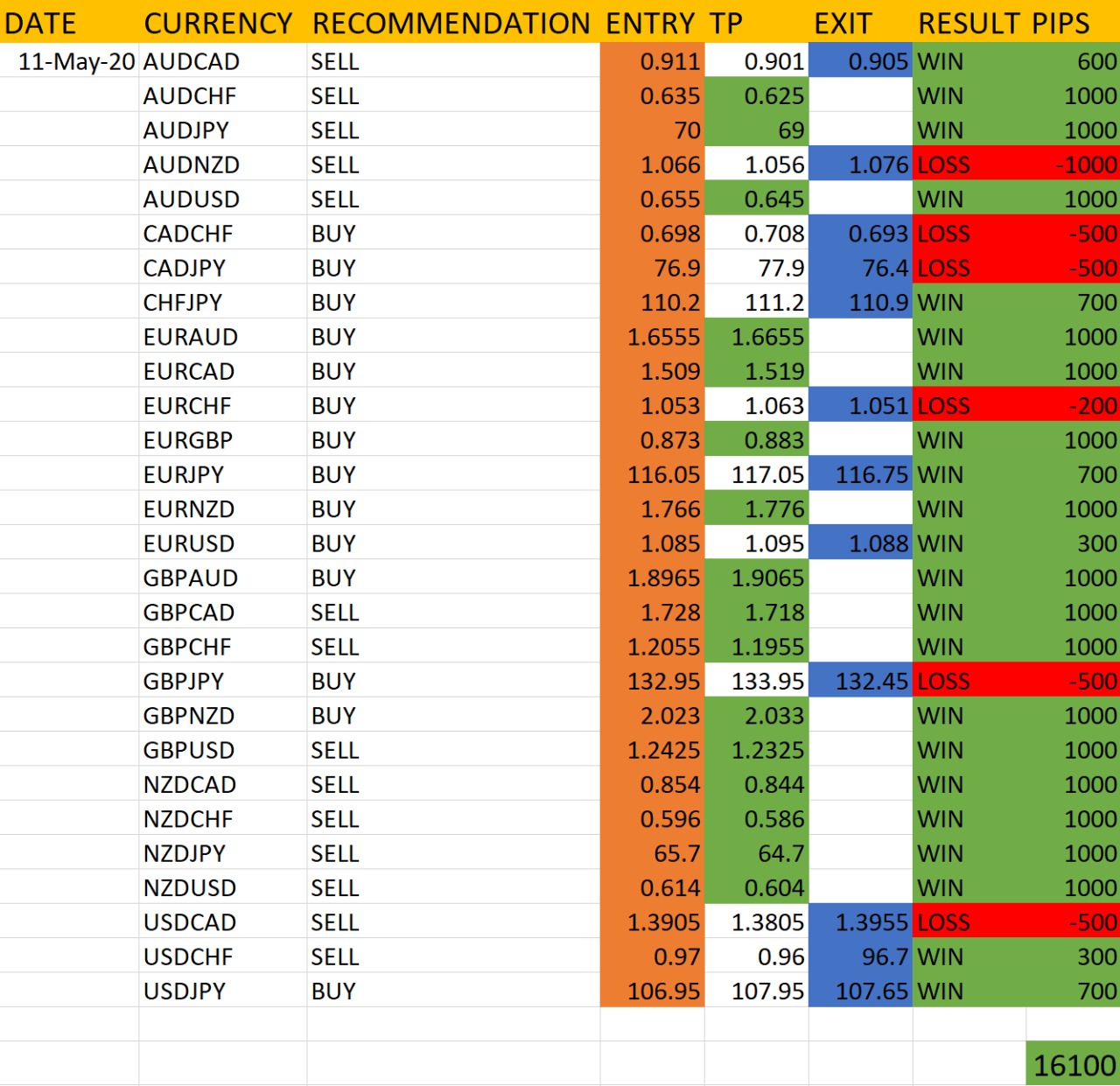

Based on the above analysis and market observations, here’s the analysis provided by the analyst at RvR Ventures for the week.

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

The accuracy report of the above market analysis will be published on 15th May, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading. Small Account holders can exit in 40/80 pips.

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe to Our YouTube Channel: https://youtu.be/AnTlQd-FQxc