All Eyes On Elections

A two-week period is about to begin that could usher in a new phase for the global capital markets.

Most of the major central banks hold policy meetings, and the US and Europe report the preliminary estimates of Q3 GDP. The US holds its national elections. A clearer sense of UK-EU trade talks ahead of the mid-November summit is likely. China holds a plenary session for the central committee of the Communist Party to hammer out the new five-year plan (2021-2025).

In terms of high-frequency data, the eurozone estimates October CPI amid deflationary worries. The US will report its October employment data a couple of days after the election. There is some concern that seasonal factors and the winding of census workers could see a weak report, and some warn of the risk of an outright

Here are the key market moving factors for the week:

The US

- That’s Bob Prince, co-chief investment officer of the world’s largest hedge fund at Bridgewater Associates, explaining to Bloomberg in a recent interview why the U.S. is looking at “severely” limited economic growth even after the pandemic.

- Going forward, he said, fiscal policy will continue to be the main source of stimulus, which will only serve to fuel the mounting pile of debt and put pressure on exchange rates. This is a problem around the world, too, but it’s more acute outside of Asia, according to Prince.

- “Global investors tend to be very Western-centric,” he said. “A number of countries have done a much better job of dealing with the virus without inflating their budget deficits and printing money.“

- Meanwhile, the U.S. is in the midst of a relatively quiet stretch, in terms of the stock market and economy, according to Scott Minerd of Guggenheim Partners, who warned that could change in a big way heading in to the home stretch of the 2020 presidential election.

EUROPE

- The day after the ECB meets, the first look at Q3 GDP and the preliminary estimate for October CPI will be announced. After contracting by nearly 12% in Q2 (11.8% quarter-over-quarter), the eurozone is expected to have grown by around 9%.

- Growth is believed to be slowing markedly in the current quarter, maybe 2%, according to the Bloomberg survey, which may be optimistic given the contagion.

- Economists surveyed by Bloomberg expect the eurozone to expand by 5.5% in 2021, while the IMF’s new forecast was shaved to 5.2% from 6.0% in June. While the IMF’s forecasts for external balances seem not to have taken onboard the US and China’s diverging trajectories, the GDP forecast for the eurozone and Japan next year is lower than the market, judging from the Bloomberg surveys.

- Estimates for October CPI are essentially unchanged from September’s -0.3% year-over-year headline and 0.2% core rate.

- European countries are reporting record numbers of new coronavirus cases as the continent prepares for the pandemic to intensify through winter.

- Europe’s second wave of the coronavirus pandemic is accelerating, forcing countries to impose ever-more social-distancing rules in a bid to avoid a return to full-blown lockdowns.

The UK

- Ivan Rogers, who was the UK’s permanent representative in Brussels from 2013 to 2017, told the Observer “several very senior sources in capitals have told him they believe Johnson will await clarity on the presidential election result before finally deciding whether to jump to ‘no deal’ with the EU.

- Rogers said that if Trump won he and others in Europe believed Johnson would think “history was going his way” with his rightwing ally still in the White House.

JAPAN

- Although the Bank of Japan may soften its economic assessment as it updates its forecasts, it will not prompt the central bank to act. Governor Kurdo and the BOJ will look through the deflationary readings (core -0.3% year-over-year in September) as they partly reflect the government’s efforts to promote tourism with discounts.

- There had been some speculation that the BOJ’s emergency measures could be extended. Still, there is no rush as there is plenty of time to monitor developments as the facilities do not expire until the end of the fiscal year (31 March 2021).

- Note that Japan’s composite PMI remains below 50 (as do both the manufacturing and service components).

- The IMF forecasts the world’s third-largest economy to grow by 2.3% next year, while the Bloomberg survey’s median projection sees a 2.5% expansion. It would be the strongest in a decade.

AUSTRALIA

- A significant easing of restrictions in Victoria looks likely in the coming days and may underpin the Australian Dollar against its major counterparts, as the nation’s second most populous state recorded zero new infections of coronavirus for the first time since June 9.

- In fact, with the 14-day average of coronavirus cases across Melbourne falling to 3.6, and below the mandated threshold of 5, Premier Dan Andrews is expected to announce that retail and hospitality businesses can resume operations and reopen to customers from November 2.

CHINA

- It is often not top of mind, but some meetings of the Chinese Communist Party may be increasingly important for international businesses and investors to follow and understand. The fifth plenary session of the Central Committee of the Communist Party is important. It begins Monday and runs for most of the week, and is the last in the cycle, marking a new period. Plans for the next (15th) Five-Year Plan (2021-2025) will be drafted and approved by the National People’s Congress next March.

- It will present a series of aspirational goals and social priorities, which will likely include more market-opening measures.

- Foreign interest is not only in tariff barriers, but China has, arguably, stronger non-tariff barriers to imports.

- There is also a keen interest in the growth target, partly because there is a deep-seated conviction among many that the target becomes what is said to have been achieved regardless. The target in the five-year plan ending this year was 6.5%. In the first four years of the plan, it reported year-over-year growth averaged about 6.6%. The growth target of the next five-year plan is likely to be around one percentage point less.

Market Overview:

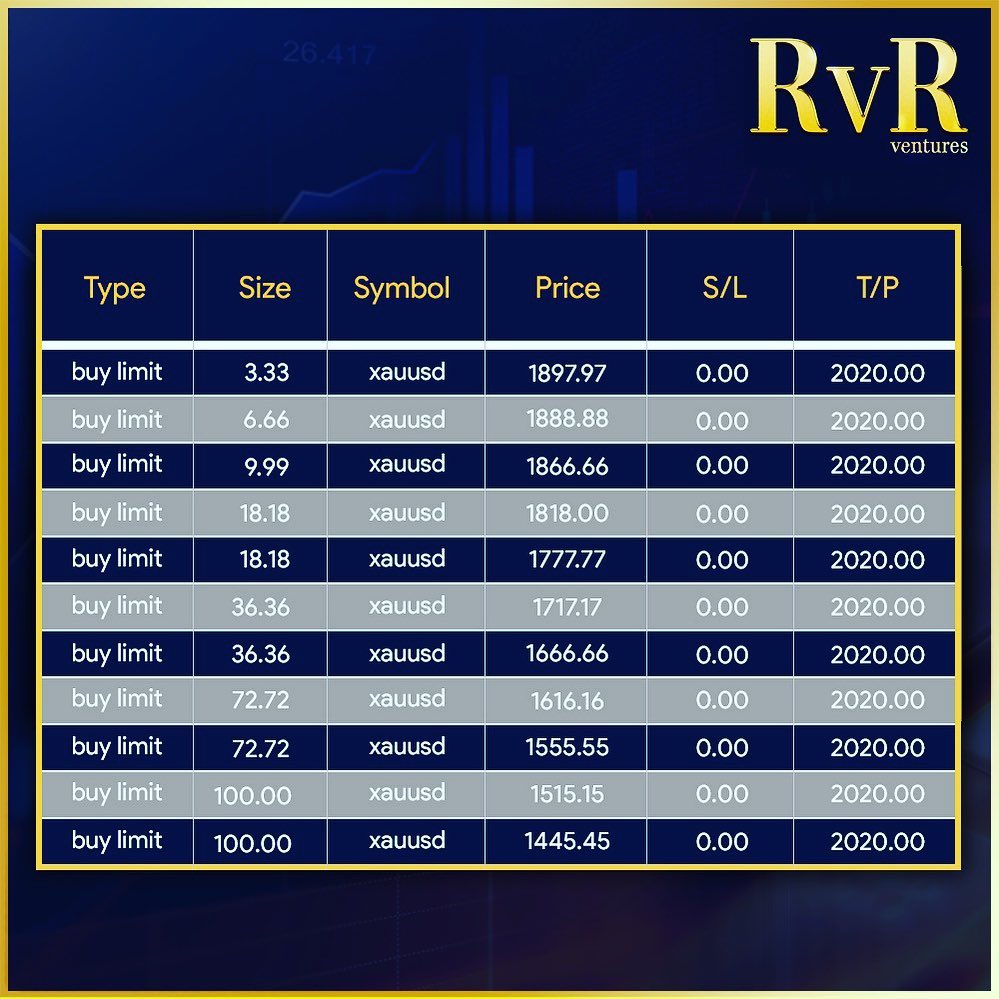

Gold

- Gold has retreated from the highs above $1,900 and trades just below that round number.

Oil

- As an aside, higher oil prices provide more market incentives to shift to renewables, and countries with large reserves and low population density like Saudi Arabia traditionally recognized this.

Below are the major market moving events for the week:

All times listed are EDT

| Monday, October 26, 2020 | |||||||

| All Day | Holiday | Hong Kong – Chung Yeung Day | |||||

| All Day | Holiday | New Zealand – Labour Day | |||||

| 05:00 | EUR | German Ifo Business Climate Index (Oct) | 93.0 | 93.4 | |||

| 10:00 | USD | New Home Sales (Sep) | 1,025K | 1,011K | |||

| Tuesday, October 27, 2020 | |||||||

| 08:30 | USD | Core Durable Goods Orders (MoM) (Sep) | 0.4% | 0.6% | |||

| 10:00 | USD | CB Consumer Confidence (Oct) | 102.5 | 101.8 | |||

| 20:30 | AUD | CPI (QoQ) (Q3) | 1.5% | -1.9% | |||

| Wednesday, October 28, 2020 | |||||||

| 10:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | |||

| 10:30 | USD | Crude Oil Inventories | -1.001M | ||||

| 11:15 | CAD | BOC Press Conference | |||||

| Tentative | JPY | BoJ Monetary Policy Statement | |||||

| Tentative | JPY | BoJ Outlook Report (YoY) | |||||

| Thursday, October 29, 2020 | |||||||

| Tentative | JPY | BoJ Press Conference | |||||

| 04:55 | EUR | German Unemployment Change (Oct) | -5K | -8K | |||

| 08:30 | USD | GDP (QoQ) (Q3) | 31.9% | -31.4% | |||

| 08:30 | USD | Initial Jobless Claims | 780K | 787K | |||

| 08:45 | EUR | Deposit Facility Rate (Oct) | -0.50% | -0.50% | |||

| 08:45 | EUR | ECB Marginal Lending Facility | 0.25% | ||||

| 08:45 | EUR | ECB Monetary Policy Statement | |||||

| 08:45 | EUR | ECB Interest Rate Decision (Oct) | 0.00% | ||||

| 09:30 | EUR | ECB Press Conference | |||||

| 10:00 | USD | Pending Home Sales (MoM) (Sep) | 4.5% | 8.8% | |||

| Friday, October 30, 2020 | |||||||

| 03:00 | EUR | German GDP (QoQ) (Q3) | 7.2% | -9.7% | |||

| 06:00 | EUR | CPI (YoY) (Oct) | -0.3% | -0.3% | |||

| Tentative | GBP | Autumn Budget | |||||

| 08:30 | CAD | GDP (MoM) (Aug) | 0.9% | 3.0% | |||

| 19:30 | JPY | Tankan Large Manufacturers Index | -27 | ||||

| 19:30 | JPY | Tankan Large Non-Manufacturers Index | -12 | ||||

| 21:00 | CNY | Manufacturing PMI (Oct) | 51.2 | 51.5 | |||

| 21:45 | CNY | Caixin Manufacturing PMI | 53.0 | ||||

Based on the above factors and the events lined up for the week, the analyst at RvR Ventures suggests you to Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above data are your own personal responsibility. Kindly practice money management & risk mitigation while trading.

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe to Our YouTube Channel: https://youtu.be/AnTlQd-FQxc