All Eyes on October

In a week of mostly lower prices for the major asset classes, a broad measure of commodities bucked the trend with a solid gain, based on a set of ETFs for the trading week ended Friday, Sep. 24. The equal-weighted WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 1.3% last week. Despite the latest gain, GCC […]

NFP Surprise

Friday’s Non-Farm Payrolls dished out a huge surprise, rolling out a gigantic miss to the downside as the US economy added only 235,000 jobs. Despite a sizeable upward revision of 133,000 to the previous month, nothing was going to offset the shock of the miss in the headline data. Household employment performed strongly, helping to […]

The Final Quarter

Can ongoing record breaking rallies for the S&P 500 and NASDAQ Composite as well as near record highs for the Dow Jones and Russell 2000 continue as September begins? Historically, since 1945, that’s the month that’s consistently been the worst period of the year for equities. Without a doubt, it’s also the question traders are […]

Eyes on Jackson Hole

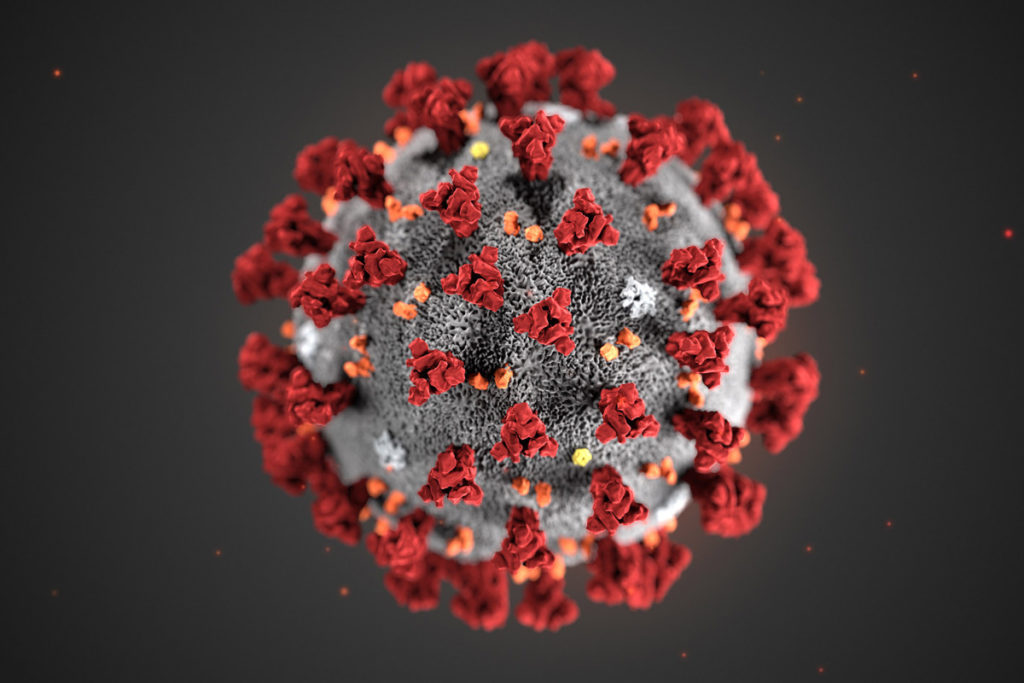

While investors will continue monitoring upcoming economic data, including home sales and personal spending, what they’re really looking forward to is the Fed’s annual symposium at Jackson Hole which usually takes place in person, but because of rising COVID cases in the US and worldwide, will this year take place online. It begins at the […]

US Dollar in Command

The dollar edged higher in early European trading Monday, but remained near a one-week low as rising Covid-19 cases and slumping U.S. consumer confidence could pressure the Federal Reserve to delay tapering its bond-buying program. At 2:55 AM ET (0755 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, […]

All Eyes on NFP

As the busiest week of the current earnings season came to a close on Friday, stocks ended lower, pressured by signs of weakness from the very mega cap companies that, over the past year, boosted the market to new highs. Here are the key market moving factors for the week: The US The […]

Chinese Shares Slump

The virus is once again raising the prospects of slowing the economic recovery that was unevenly unfolding. The preliminary July PMI for Australia, UK, France, and the US was disappointed. Expectations for the trajectory of monetary policy are being impacted. Consider that the implied yield of the December 2022 Eurodollar futures fell to 40 bp […]

UK Re-opens

Inflationary pressures are showing no signs of easing just yet and the market will soon look to test the Fed’s patience. The dollar has been stuck in a tight trading range since the middle of June, but that could soon change if the rest of the world shifts to a tightening mode more quickly than […]

A Week of Rate Decisions

Global stocks are all over the place as some indexes fall into correction while others continue to extend higher into record territory. The bond market volatility surprised many investors as the growth outlook took a massive hit with the spread of the Delta coronavirus variant showing many countries are still struggling to return to normal. […]

China’s Inflation Figure Unravel

Previously, the US nonfarm payrolls beat market expectations on the upside, with hiring accelerating in June as labor market supply constraints eased. 850k new jobs added,marking the highest reading in 10 months. Average hourly earnings rose 0.3% MoM and 3.6% YoY, reflecting strong demand for labor. This week, Wednesday’s Federal Reserve meeting minutes may give […]

Gold Prices Vulnerable

Asian stocks dropped on Monday as investors mulled the implications of a surprise hawkish shift last week by the U.S. Federal Reserve, while the Treasury yield curve flattened further with 30-year yields dropping below 2%. Though investors have been spoiled by the most generous stimulus ever, both from the Fed and the Biden Administration, a […]

G7 Probes China Over Virus

The Federal Reserve’s Open Market Committee meeting is the most important event in the week ahead. It is not that it will take fresh policy action. Rather, its observations about the economy and its forward guidance are the focus. Since the Fed last met in April, job growth has slowed, and prices have accelerated. While […]

How to Trade XAUUSD Spot GOLD on US CPI Data Day with 100% Accuracy in Net Average

US CPI DATA: Possible Impact on GOLD | TAPERING to guide the further direction If the US CPI print comes in hotter than the consensus of a 0.4% rise in May, it will ramp up the Fed’s tapering expectation, which will render negative for the non-yielding gold. The ECB could also hint towards dialling back […]

LOOK OUT FOR THE ECB MEETING & NFP

The media has played up the upcoming ECB with all the Sturm und Drang that can be mustered. However, investors and other market participants seem considerably less anxious. And for a good reason: at the end of the day, it does not really matter that much. Despite oil prices rising more than a third this […]

Dollar Correction or Month End Oppression

The dollar inched down, but traded near a two-month high against the yen, on Monday morning in Asia. Investors digested mixed economic data from China and strong inflation data from the U.S., while also expecting the U.S. Federal Reserve to start tapering its asset purchases eventually. Both the U.S. and the U.K. markets are closed […]

ALL EYES ON FED

The upcoming week is filled with another round of Fed speak and a plethora of economic releases, with many traders focusing on consumer data points. On Tuesday, the Conference Board’s Consumer Confidence reading is expected to soften from 121.7 to 119.3. The Friday release of personal income and spending will show dramatic drops as the […]

Oil Overcomes $66, Hits New Yearly High

The taperless tantrum could continue across financial markets now that it seems clear Fed Chair Jerome Powell won’t react until he sees disorderly market conditions or if financial conditions tighten further. Positive economic, such as this past employment report, might continue to fuel optimism about the economic outlook and that could raise expectations that the […]

How to Trade on Non Farm Payrolls Data Day

What Are Nonfarm Payrolls? Nonfarm payrolls is the measure of the number of workers in the U.S. excluding farm workers and workers in a handful of other job classifications. This is measured by the Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls. The BLS reports the [...]

Oil Rises Amidst Middle East Tensions

Stocks extended the late-week rebound to hit a fresh record on Friday, boosted by strong earnings growth. All four major US indices—the Dow Jones, S&P 500, NASDAQ and Russell 2000—finished higher ahead of the weekend. Helping buoy investor optimism: the logistics for vaccine distribution in the US improved, after President Joseph Biden announced his administration […]

Dollar Plummets, Again

Notwithstanding Friday’s weaker than expected nonfarm payrolls report, US equity indices for the Dow Jones, S&P 500, NASDAQ and Russell 2000 all finished higher on the final day of trade as well as for the week. The small-cap Russell saw its steepest boost since June; the SPX saw its best weekly performance since November. The […]

Gold Down, US Stimulus Hopes Cap Losses

With the chances of political drama weighing on markets now less likely, after the peaceful transfer of power to newly inaugurated US President Joseph R. Biden, Wall Street wavered on Friday, turning in a mixed performance on the final day of last week's trade. US indices retreated from all-time highs on a bleaker COVID-19 outlook [...]

Can Joe Biden Make America Illustrious Again?

The dollar strengthened on the back of a dismal market mood. Poor US employment and retail sales data spurred the sour sentiment, which extended into the weekly close. The greenback posted substantial gains against most of its major rivals. Concerns were triggered by a delay in the Pfizer’s vaccine distribution in Europe, which revived concerns [...]

US Strengthens Amidst US Yields Rise

Markets are opening with a small wobble on the risk axis this morning as perhaps investors reaching a near term inflexion point. However, it's too early to say as investors have their feet firmly planted and continue to roar like lions supported by a lengthy vaccine runway paved with US stimulus. Dramatic moves over the [...]

It’s A Wrap

This year was very interesting for foreign exchange market traders, and the next year will likely bring more volatility. The market’s attention will be focused on the fate of the U.S. dollar which may find itself under more pressure if the Fed continues to print money while the world economy recovers from the blow dealt [...]

Close Calls For 2020

We are now heading into what would typically be a quiet time of year when everyone spends time with their loved ones and market activity is more muted. This isn’t a normal year, though, and while volumes may be low, activity will be anything but. There are key deadlines on both sides of the pond […]

Gold Pulls Back From Highs

Time is running out for passage of additional US fiscal stimulus in 2020 as the year winds down and the holidays rapidly approach. Congressional parties hit a brick wall yet again, even with the scaled-down $900 billion plan, this time on conflict over employer virus liability. Each time the negotiations appear to be about to […]

No Normal December

December may normally be associated with everything slowing down as we ease our way into the festive period, but as with everything else in 2020, this is no normal December. Donald Trump is continuing to fight the election result and is going out swinging, Brexit talks are somehow still ongoing, the EU budget and rescue […]

Lockdown Woe Vs Vaccine Relief

COVID-19 is likely to remain the dominant market theme in the coming, holiday-shortened week. The rising trajectory of the pandemic versus ongoing progress toward a vaccine will cause investors to whipsaw wildly between pessimism and optimism, driving markets lower or higher depending on prevailing sentiment. Last week played out much as we predicted, when positive […]

Times Ahead of Election

On Saturday, the media called the US presidential election for Joe Biden, but President Donald Trump rejected the outcome and won’t concede. Additionally, he will continue with legal challenges, claiming fraud. So far, his demand made no progress in courts, as he failed to add prove to his accusations, except for those asking for observers […]

Expect the unexpected!

Expect the unexpected! Covid-19 infections are surging. Will the price of gold surge too?How will the Covid-19 cases surge affect the gold market? The record spread has brought the national total to about 8.78 million infections and nearly 227,000 deaths. What’s more frightening, with the recent spike, these numbers are only going to rise higher. [...]

All Eyes On Elections

A two-week period is about to begin that could usher in a new phase for the global capital markets. Most of the major central banks hold policy meetings, and the US and Europe report the preliminary estimates of Q3 GDP. The US holds its national elections. A clearer sense of UK-EU trade talks ahead of [...]

Are We Due For A Hold?

Markets are cautiously optimistic and the US dollar is edging lower amid fresh hopes that the US agrees on a stimulus deal before the elections. Chinese Q3 GDP missed estimates but includes several positives. Concerns about eurozone coronavirus cases and Brexit talks is weighing on sentiment. Fiscal stimulus: US President Donald Trump has said that […]

High Volatility Ahead

With the US presidential election coming closer, up for November 05, global banks come forward with their analysis concerning the most likely outcome if the market favorite Democrats win. Asian shares remain bid, led by China, while heading into the European open on Monday. Although weekend headlines challenged Friday’s optimism, mainly due to the chatters […]

Big Stimulus Moves

Brexit talks and rising coronavirus cases in Europe are also a consideration for general market mood. The EU and UK resume negotiations this week and the risk of a no-deal Brexit is another shroud of uncertainty for the global economy. The focus will shift to the latest US non-farm payrolls report on Friday. Rosy data […]

Gold: $1866.00 TP Achieved!

Another Victory in Gold Analysis: As per analysis dated 12.08.2020 #Gold crashed from 1966.00, target price of 1866.00 was achieved successfully on 23.09.2020 Gold’s (XAU/USD) correction from record highs of $2075 has regained traction this week, with the August low of $1863 taken out, thanks to the relentless surge in the US dollar’s safe-haven demand. [...]

Adding To Woes

The major central banks have met, and not one felt it incumbent upon them to take fresh policy action. Despite some dramatic intraday swings and close scrutiny, the euro-dollar exchange rate continues to be mainly in a $1.17-$1.19 trading range that has dominated since the end of July. All the commotion about the rapid rise […]

Exacerbated downturn amid the Pandemic

AstraZeneca’s renewal of its coronavirus vaccine test is contributing to a better market mood, favorable for stocks and weighing on the dollar. Japan will have a new prime minister and the UK parliament will debate the controversial internal market bill today, aggravating relations with the EU. Below are thumbnail sketches of the events and data […]

Fx Co-Relations

Co-Relation Based Trading By Automated Robots | RvR Ventures Understanding price relationships between various currency pairs allows you to get a more in-depth look at how to develop high-probability Forex trading strategies. Awareness of currency correlation can help to reduce risk, improve hedging, and diversify trading instruments. In this article, we will introduce you to [...]

Another amazing victory!

Another amazing victory! As per our analysis posted on 12.08.2020: Buy at 1866/88. As per our analysis posted on 18.08.2020: Buy zone was at 1926. Today Gold is back in 1990 zone. Total pips: 130/70*100= 13000/7000. Check our Analysis based Performance posted on 30 July, 12 August and 18 August with PROOF by clicking here [...]

The Final Quarter of 2020

Investors are cheering fresh hopes for an upcoming coronavirus vaccine and upbeat Chinese PMIs. Eurozone CPI figures and end-of-month flows are set to move markets. Stephen Hahn, head of the US Food and Drug Administration, said he is willing to fast-track vaccine approval if benefits outweigh the risks. China has approved the Sinovac COVID-19 vaccine […]

Fatal Levels of Recession

The dollar fell to new lows against the euro, sterling, the Australian dollar, and the Swedish krona last week. However, it was a head fake and the greenback quickly returned to its previous ranges. The combination of the July FOMC minutes that dampened expectations for new initiatives, such as yield curve control or an increase […]

The Plunge of 2020

Amid thin trading and signs the economic recovery is losing momentum, most stocks closed lower on Friday. Adding to the gloom: Congressional negotiations over additional pandemic relief have gone nowhere and likely won’t start again for weeks, now that US legislators have gone on holiday through the end of August. We expect this conviction to […]

Crippling Economy and Turtle Recovery

Friday’s sharp corrective pullback in Gold (XAU/USD) was mainly driven by the broad-based US dollar rebound, as the US-China tech war escalation and US fiscal wrangling reinforced the haven demand for the greenback. Better US payrolls report, further, aided the dollar recovery from two-year lows. The bright metal dropped nearly 1.50% and settled at $2035 […]

Welcome, August

While stocks ended slightly higher for the day, week and month on Friday, on strong Technology earnings and US GDP that was less negative than expected, signs the economic rebound is stalling will likely make any further equity gains an uphill battle during the coming month. Friday's late session rally was sparked by a report [...]

Double – Dip Recession

The market mood is mixed as a new week begins as coronavirus cases continue rising in the US while hopes for a COVID-19 vaccine remain high. Hopes for a breakthrough in the EU Summit are keeping the euro bid. Below are thumbnail sketches of the events and data that shape the macro picture. Country US […]

Pause, Think, Act

Asian shares cheer the hopes of further corporate debt, increasing odds of the pandemic’s cure. Global virus numbers rise beyond 13.00 million with the US, Brazil and India on the top. Gilead’s Remdesivir, trials in the UK and Australia are all suggesting that the vaccine is nearer. Below are thumbnail sketches of the events and […]

Second-half and Second-wave

Asian stocks kicked off the week on a strong positive note; hopes for more policy support being pretty much the only explanation to the early week optimism. The economic calendar is modest, and many market participants will probably extend their long weekends. The ISM Non-Manufacturing Index and jobless claims data will be the most important. […]

Economic Stability In Doubts

The economic calendar is a big one, compressed into a holiday-shortened week. Market participants will be checking out shortly after the Thursday morning jobs report for an extended weekend – somewhere! Employment data is the focus, but ISM manufacturing, consumer confidence, industrial production, factory orders, pending home sales, and auto sales are also all on […]

The Debts Continue To Rise

FX markets have been joggled into action, as risk sentiment has not precisely fallen off a cliff, just as the bears always seem to expect on a Monday. Although if pressed for a view, this morning’s price action seems more related to position-squaring on new USD longs rather than anything else. Overall, the FX market […]

The Big Week

There is a definite risk-off tone to Asia’s financial markets this morning as the week gets underway. Weekend headlines were dominated by fears of secondary outbreaks of COVID-19, especially in Beijing; where part of the city has been locked down to contain a localized outbreak. South Korea and Japan are ready to play whack-a-mole controlling […]

The Recovery Momentum

The Federal Reserve moves to centre stage this week. Outside of the US and Chinese inflation measures, it looks to be a relatively light week in terms of high-frequency economic data. Investors are still ruminating over the surprising jobs report (gain of 2.5 mln jobs vs. forecasts for 7.5 mln loss). Yes, there were classification […]

Welcome, June

Three major central banks meet this week, the Reserve Bank of Australia, the Bank of Canada and the European Central Bank. The first two will likely assure investors and businesses that they are prepared to do more if necessary, but are probably not going to take fresh initiatives. On the other hand, the ECB is […]

Rising trade wars amidst a Pandemic

Brewing geopolitical risks helped investors take some risk off the table heading into the long weekend. The dollar rallied against most of its peers as tensions remain front and center for the world’s two largest economies. Renewed unrest in Hong Kong will continue to weigh on the overall outlook as Western nations contemplate how to [...]

Emerging from the Havoc?

It’s been another interesting week in financial markets. This week is going to be no less eventful as investors come to grips with the reality of the situation we’re all facing while factoring in the seemingly endless supply of monetary support. Add to all of this the renewed tensions between the world’s two largest economies. [...]

Economy v/s Covid-19

With many countries in the West attempting to reopen their economies, attention has turned to whether new infection rates will remain low as mobility picks up. The week ahead will have a tremendous amount of focus with the Chinese recovery, as critical April economic data will show how fast their economy is bouncing back. China’s […]

May May be the Panacea

What we are witnessing everyday due to a pandemic is often so crazy that it becomes extremely difficult to gauge the market and its trends. We’re into the second week of May and so far, things have not quite improved in terms of the pandemic. However, this week is equally crazy and twisted in terms [...]

Will we see a better May?

Peak virus seemed to be the overriding theme of the week, with the rate of new cases and deaths falling in Europe and the United States, the COVID-19 epicentres. Plans appear to be accelerating also for partial reopening around the world. New Zealand returns to work tomorrow, Australia plans a partial effort this week, New [...]

The Pandemic. The Shrink.

While dozens of earnings reports are expected in the coming week and economic data will bring more insights into the impact of the coronavirus the main focus will still be on developments relating to the virus and how soon the economy can reopen. Authorities around the world are between a rock and a hard place: they [...]

The Clock Is Ticking!

It is no doubt that we’re battling the greatest ever economic devastation due to COVID19 pandemic. Last week, on Thursday, the weekly U.S. Jobless Claims remained the most important parameter to follow through the economic depression claim. The number of Americans seeking unemployment benefits in the last three weeks has topped 15 million. IMF Managing [...]

The Quarrel of Barrels!

The Wrecking of the Virus U.S. stocks are set to open higher Monday, as investors take comfort from tentative signs the spread of coronavirus is slowing. The coronavirus outbreak has already caused severe disruption across the globe and economies, and it is likely that the effect will not die down for a considerably significant time [...]

The World Braces For More Pain!

Latest Highlights: TrumpExtends Shutdown Past Easter Stocks Brace For More Volatility Oil Hits Lowest Since 2002 Bond Yields Sink China PMIData Ahead Last week ended with a lot of changes in the global markets. As the fear of the pandemic seems to rise and only rise, with the number of cases growing constantly, the unpredictability [...]

COVID_19 v/s Bazookas

In an effort to get a handle on the economic and financial consequences of the Covid-19 pandemic, many have pointed to the 2008 global financial crisis as the most relevant example, especially in the aftermath of the extraordinary monetary policy actions announced by the US Federal Reserve on March 15. That would be an unfortunate mistake. What [...]

The Cautious Realm!

If you’re expecting the volatility to end anytime soon in the realm of forex, you’re highly-mistaken. After last week’s twists and turns in order to accelerate the economies, some measures seem to have worked, some backfired. The last week began with the biggest shock with the drop in the prices of oil, as the Saudi-Russia [...]

Let’s March in March 2020

Coronavirus fears continue, crashing markets at close of trading week The week opened with a very hideous start, with Asian stocks and global share futures tumbling down drastically, as following the inability of the OPEC+ group to agree on new production cuts, Saudi Arabia decided to hike its crude production and to cut its [...]

February 2020 Wrap Up

Worst Weekly Losses Since October 2008 In fact, the major indices last week suffered their severest weekly losses since October 2008, when markets were in the throes of the worst financial crisis this century. February's overall performance was the worst showing for the month since February 2009, right before the stock market bottomed. Plus, after [...]

Plan Your Trade. Trade Your Plan.

Generally speaking, there are two main groups of people in the market, long-term investors and short-term traders. One person buys stocks at attractive prices, holds for multiple years and profits when the rest of the world finally figures out what they knew a long time ago. The other person takes advantage of daily price swings [...]

Most Accurate GOLD XAUUSD Forex Traders

Check the trading performance of one of The Most Accurate GOLD XAUUSD Forex Traders. No, we are not asking you to invest with us! No, we are not asking you to trust us! No, we are not showing you any dream! Because after verifying facts you will believe in us! Because, you are sharp & [...]

Market Overview 02 May, 2019

On this first trading day of May the Federal Reserve reignited the US dollar’s rally. The greenback recovered all of its earlier losses and traded sharply higher after Fed Chairman Jerome Powell dismissed talk of easing. He said the Fed’s policy stance is “appropriate right now” and “we don’t see a strong case for moving in either [...]

Market Overview | 26 March 2019

EUR/USD Yesterday, EUR rose steadily against USD, retreating from lows since March 12, renewed late last week. EUR was supported by an unexpectedly strong IFO Germany business sentiment data. The March German Business Expectations rose from 93.8 to 95.6 points while the forecast was 94.0 points. German IFO Business Climate Index jumped from 98.7 to [...]

Dollar steady, but for how long?

The US Dollar held steady near a one-week high against a basket of major currencies this morning as bulls remained inspired by last Friday’s strong U.S. payroll figures. While the Greenback is seen extending gains in the near term as renewed trade optimism supports risk sentiment and elevates U.S. Treasury yields, the medium- to longer-term [...]

Forex Trading Strategy for 2019

Financial services must tie these three factors together – customer experience, best practices and reliability/responsiveness – to have an effective web presence. They can’t go hard into one particular area and ignore the others. They have to understand what’s available versus their competitors, what consumers think of their sites versus competitors’ and how their sites are performing.

XAUUSD: Trade Wisely!

Some say that Gold | XAUUSD is one of the most difficult markets to trade and there is some truth to that – gold doesn’t move like other markets and if investors want to be successful in trading it (and it can be very rewarding), they have to keep several things in mind. Over the [...]

RvR Forex Trading Robots

Wouldn't it be great to have a robot trade on your behalf and earn guaranteed profits? It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits! RvR Forex Trading Robot is your trading partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, [...]