Let’s March in March 2020

Coronavirus fears continue, crashing markets at close of trading week

The week opened with a very hideous start, with Asian stocks and global share futures tumbling down drastically, as following the inability of the OPEC+ group to agree on new production cuts, Saudi Arabia decided to hike its crude production and to cut its official selling price.

This week, the underlying fear of the epidemic surges again. The highly infectious disease that nearly shut down most parts of China is spreading rapidly in the other parts of the world, especially in Europe and in the United States, disrupting many corners of life. The number of cases rise all across the world, an many nations are on a lockout.

Major market moving factors to look out for this week include:

- Wednesday’s and Thursday’s U.S. Consumer Price Index and Producer Price Index will likely be the most important economic news this week.

- On Thursday we will get a very important economic data release from the Eurozone: Main Refinancing Rate, Monetary Policy Statement, ECB Press Conference

- Wednesday’s U.K.’s GDP along with Manufacturing Production releases will be important for the British Pound currency pairs.

- We will also get the Reserve Bank of Australia Deputy Governor Debelle Speech on Tuesday.

- President Donald Trump imposed a 30-day ban on arrivals of people from most of Europe in an effort to stop the spread of what he called a “foreign virus” through the U.S. For reasons he didn’t explain, the measures exempt the U.K. and Ireland, both of which are already reporting sharp increases in confirmed cases.

- The Italian government now projects a budget deficit of 2.7% of GDP this year. It remains to be seen how the euro zone will accommodate what represents a clear, if inevitable and necessary, breach of its fiscal rules. The yield on Italy’s 10-year benchmark bond rose 17 basis points to 1.36%.

- The European Central Bank is expected to announce a package of monetary and prudential policy measures to support the economy at 8:45 AM ET (1245 GMT) after its governing council meeting.

- Expectations for ECB easing have ramped up dramatically in recent days, even though it has little room to cut interest rates further and many at the bank are opposed to further quantitative easing. The market now expects not only a cut of another 10 basis points to its deposit rate, but also measures to ensure bank liquidity and the availability of credit to businesses struggling with cash flow problems. Many expect an increase in the bank’s asset purchases program too.

Other than the above mentioned, here’s what happened this week for the figures below:

Crude Collapse:

Crude crashed at the open with WTI opening down 27% lower as traders frantically attempt to re-price the curve.

Oil prices crashed and US equity futures plunged at the open Monday in Asia after crude producers launched a price war, an additional disruption to a global economy already struggling thanks to the coronavirus. As economies are already in a lockdown, this further adds to the volatility of market. Saudi Arabia’s pricing move over the weekend signalled they are going after market share and all signs suggest they will ramp up production quickly to over 10 million barrels a day in April and possibly another 2 million in the short-term.

The Dollar:

Investors remain worried, even after the last Tuesday’s emergency rate cut by the Federal Reserve, a move predicted by some analysts. Unfortunately, it only aggravated investor concerns, by signalling to many that the U.S. central bank was spooking, and led to an immediate sell-off that continued through the week.

The dollar weakens this week as US yields fall and America’s domestic coronavirus outbreak expands.

Gold:

Gold shot higher out of the gates as haven demand soars with investors buckling in, as oil plummets compounded by the fact, we’re on the event horizon of a massive credit risk vortex due to the COVID-19 negative economic effect.

GBP/EUR

The Bank of England cut rates, which caused a short-term depreciation of the GBP. Short-term only, as now, the GBP is back on track, shrugging off the cut. It does not change our long-term view on the EUR/GBP, where we continue to be bullish.

One of the major event to look forward to this week is the ECB interest rate decision, where the market is expected to experience high volatility.

Safe Haven:

Above all other countries, people trust Japanese yen. When the whole world is falling, the yen is rising, maintaining its safe-haven credentials.

In summary, investors woke up to risk markets buckling that are already stressed to an extent. But compounding the COVID-19, no endgame in sight narrative with probable value-at-risk implosion triggered by the fall in oil prices should give global investors a case of the cold sweats while keeping them awake at night for the foreseeable future.

CLICK to read the analysis for February 2020 by our analysts.

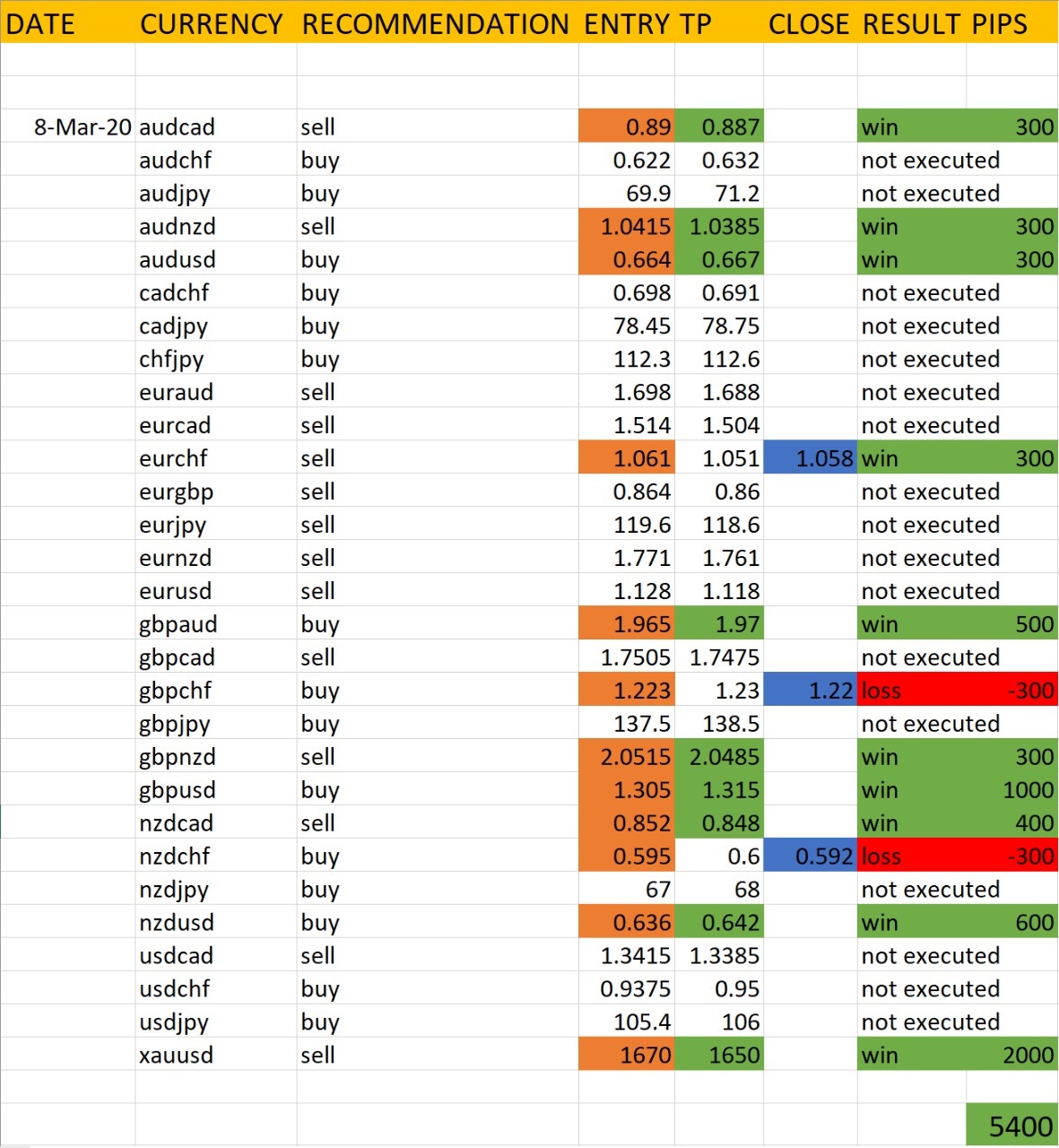

Here’s the analysis by the analyst at RVR Ventures, which was executed by our trades for the second week of March | 09 March 2020: