Hire Professional Forex Traders | Fund Managers

Hire Professional Forex Traders | Verified Track Record

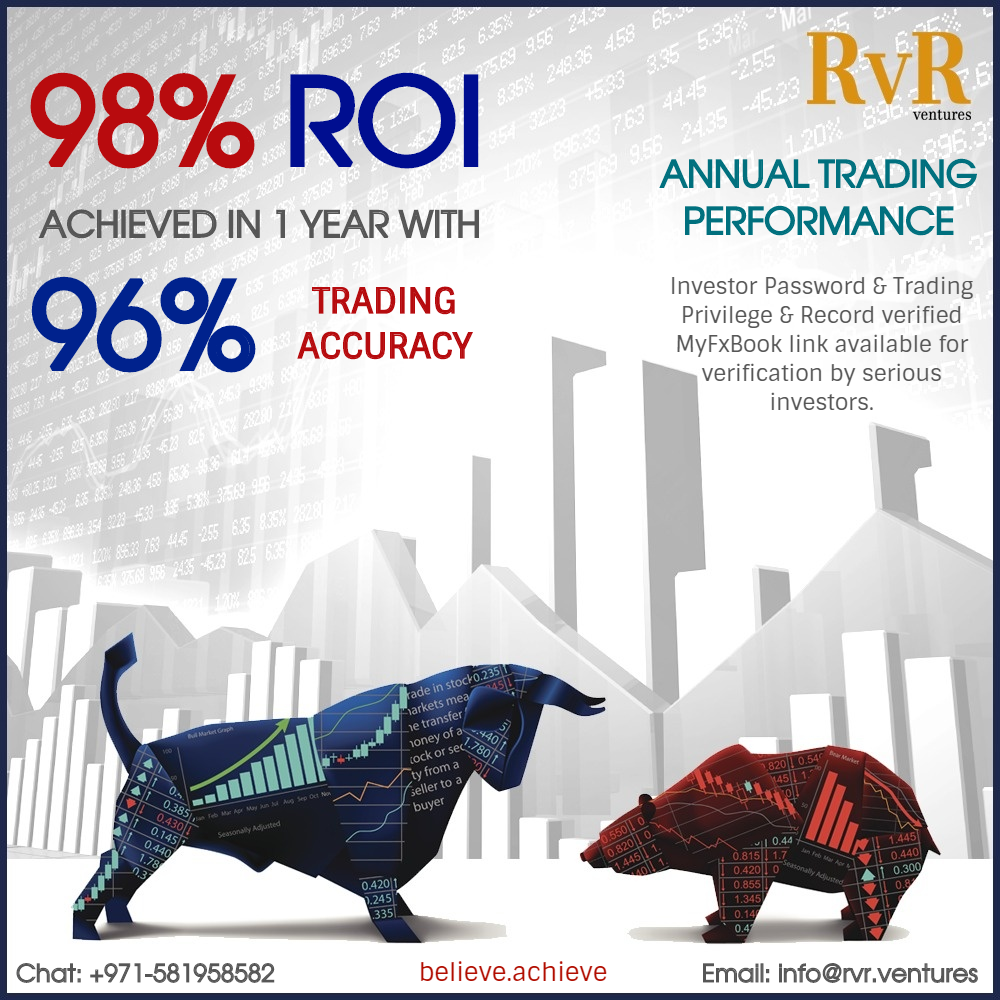

RvR Ventures | Fund 627 | Annual Trading Performance

Duration: 11 October 2018 – 30 October 2019

Net Profit Booked: 98.13% in 280 Trading Days

Total Drawdown: 48.43% | Trading Accuracy: 96%

Total Trades in : 7975 in 280 Trading Days

Avg. Monthly ROI: 6.0% | Deviation: 10.26$

Investor Password & Trading Privilege & Record verified MyFxBook link available for serious investors.

Check our verified performance here: https://www.myfxbook.com/members/RVRventures

For more details, email: info@rvr.ventures | Chat: +971-581958582

#Forex #ForexTraders #ForexTrader #PortfolioManagers #FundManagers

#RvRventures Performance Report

Duration: July – October 2019

Net profit Booked: 72% | Net Drawdown: 12%

Average Trade Length: 3 Hr. 48 Min.

Net Trading Accuracy: 80%

Total no. of trades: 2010 | Account type: Real – ECN

Monthly ROI: August: 10.29% | September: 9.45% | October: 42.50%

Investor Password & Trading Privilege & Record verified MyFxBook link available for serious investors.

For more details, email: info@rvr.ventures | Chat: +971-581958582

Follow us on telegram: https://t.me/ForexFundManagers

#Forex #ForexTraders #ForexTrade #PortfolioManagers #FundManagers

How to become a successful Forex Trader?

The Forex market is very unique in many ways including its 24 hour schedule and its rapid growth. However, one characteristic really sets it apart from the rest of the world’s financial markets. It is by far the largest market in the world with close to four trillion dollars traded daily.

Though often touted as a way to get rich quickly and effortlessly, Forex Trading will have most of its traders lose. You do not have to be one of the losers though. Just heed the tips we’ve rolled out below and you’ll be on your way to Forex trading success.

1. Know your trading goals

The first thing you have to set straight about your trading effort concerns your goals. Do you want to dabble in trading just a little bit to see what it is all about? Do you want to take it one step further maybe, or even get to the point where you make a living off it?

These goals determine your overall risk tolerance, as well as the amount of money you’re willing to push into the venture. Both are extremely important variables of the trading success equation and it is relatively easy to get them both wrong, especially if your goals are vague.

- Based on your goals – draw up a battle-plan and stick to it

Once you have your goals set, and thus success and failure clearly defined, you need a plan to get there. Define how much time you’re willing to sink into the affair and also how much money you’re willing to lose during your initial trial and error stage. Yes, you will mostly lose in the beginning as there are no guarantees in forex trading.

Sticking to your plan makes sense in more ways than one: if you do your best and still end up short of your goals, you know it is time to pull the plug on the experiment.

What should your “battle-plan” look like though?

Write down the following:

- the currency pair that you will trade

- your trading/analysis time frame

- your position opening trigger (according to the strategy you use)

- your trigger for exiting a trade (again: based on the strategy you use and the signals on which your strategy is based)

- your stop-loss (the amount of money you’re willing to risk on a trade)

- money management and take-profit related variables (you define them according to your needs).

- Choosing a broker – perhaps THE most important hurdle a beginner needs to clear

The importance of picking the right forex broker cannot be stressed enough. Unfortunately, while this exercise should be a simple one, due to the peculiarities of the industry, it is everything but.

First off: there are scores of crooked brokers out there, whose only reason for being in the game is to fleece unsuspecting depositors.

As a matter of fact, if one were to judge based on the user feedback available out there, the conclusion would be that the majority of brokers are indeed only out to steal money.

In this respect, your best bet is to read and read, especially the feedback left by other users/traders. Be on the lookout for unregulated brokers, for denied withdrawals and for spread manipulation, through which stop losses can be triggered.

Beyond the fraud aspect, there are still scores of other issues you need to get right with your broker. You need a proper account type (which offers you proper trading conditions and leverage-options), you need good customer service and you need a decent trading platform.

- Do not be overly ambitious when picking your account type

Make sure that the account-type you pick is indeed in-line with your above-mentioned goals and plans. You do not need a professional account if all you’re planning on is a little bit of occasional trading. The same goes vice-versa.

You need to understand that while leverage increases your profit potential, it also increases the risks you assume through your trades. The wise things to do in its regard is to go for as low leverage as possible. As a beginner, you do not need increased risks/volatility.

- Make sure your broker offers a Demo Account option

Regardless of how naturally talented you believe yourself to be at FX/CFD trading, you will go through a period of trial and error initially, and that’s going to cost you money if you’re in the real money game. The Demo Account gives you an opportunity to save that “tuition”. Take it!

- Start out small

FX trading success won’t happen overnight, so you need to be in the game for the long-run. Start out with a small account and set it as your immediate objective to increase the size of your balance through profitable trading. Do not fall for the lure of the big leagues and attempt to shortcut your way there through ever more generous deposits.

Remember: if you cannot increase your balance through trading, there is no point really in adding more money. You’ll only increase your losses that way.

- Keep it simple

Focus on just one tradable asset in the beginning. Learn technical analysis on this one asset and try to figure out the fundamentals. A popular currency pair like the EUR/USD is perfect for this purpose, since you’ll get much better spreads and liquidity on it than on some exotic pair.

Once you have that one asset mastered, expand carefully.

- Stick to what you have a thorough grasp of

This tip stems from the above one: stick to markets the movements of which make sense to you. It is very important that you understand what you are doing. Trading based on gut feelings and rumors is the recipe to disaster, as has been proven countless times by traders much more knowledgeable than you are. Wandering outside your comfort zone may be recommended in life, but it definitely does not translate to trading.

- Keep your emotions in check

Remember: this is not gambling. If trading elicits the same euphoria, panic and greed in you as gambling does, you are doing it wrong. Emotional trading is the shortest path to a busted balance.

This is why it is important to start out with smaller sums: your emotional response will be limited on amounts you deem more or less insignificant. As you get used to the whole emotional process of trading, you can also increase the amount of your trades, provided your balance-size allows you to do that.

- Let losing positions be

Since we’re talking about gambling, we need to bring up the “stuffing” of losing positions some gamblers like to do.

Adding to a losing position does not make sense in any way, unless you are after gambling thrills. Do not do it. Let your losing position be and fight it out on its own, according to your original plan.

- Whip your fundamental and technical analysis skills into shape

Make sure you understand the importance of both. You are free to develop an affinity towards one or the other too, there’s no problem with that. Just make sure though that you do not ignore either side.

If the technical side tells you one thing and the fundamentals contradict it, be mindful of them too. If you decide to follow an expert trader, make sure he/she takes both technical analysis and fundamental analysis into account.

- Keep things simple as far as your trading setup is concerned

Do you really need 4-6 displays set up for your trading? Not by a long-shot. As a matter of fact, sticking to your current laptop/PC is the way to go in this regard.

Why would you need such an intricate setup to begin with?

The reason professional/advanced traders’ resort to such fancy display solutions is that they trade several assets. Since you will only trade a single one, you’ll be fine with a single display.

Also, proper trading platforms offer split-screen solutions for the tracking of multiple assets, so if you graduate to 2-3 traded assets, you will still be just fine with your current computer.

- Keep track of your past performance

Your goal as a beginner trader is to find a strategy/trading setup that works. This quest is a trial and error-based one, during which you will commit mistakes, but hopefully, you will get some things right too.

A successful trader keeps a diary of his/her mistakes and successful moves and learns from them. Remember: he who forgets the mistakes of the past is doomed to repeat them. In trading, that translates to direct financial losses.

- Always aim to simplify everything about your trading

There seems to be a misconception that to be a successful trader, one needs to be some sort of a math genius, running more intricate schemes and strategies than everyone else out there. This is simply not true. Keep your technical and fundamental analysis as well as your risk management, as simple as possible.

Define your goals, draw up your plans and follow through in a level-headed manner.

- Try to automate as much as possible

Automation is not only the best way to allow small edges to generate significant profits, it is also the best solution to taking the emotion factor out of the equation.

Obviously, by urging you to automate, we do not want you to purchase fancy trading robots (that never seem to work) or to buy into one of the countless auto-trading scams out there.

You can make use of legitimate auto trading solutions though, such as MT4’s Expert Advisors, which let you set the strategy that you want to push, the way you want it pushed. EAs just trade away while you’re sleeping, according to the parameters defined by you.

- Do not buy into “guaranteed” trading systems/Forex robots

If something looks too good to be true, it most certainly is and that is doubly valid in the world of online trading.

Given the peculiarities of this industry, it is a fertile ground for all sorts of scams, and there is no shortage of “smooth operators” trying to make money through such scams.

Just stick to straight-up trading, based on a strategy/approach that you fully understand and let the snake oil salesmen peddle their “solutions” to others.

- Risk management and probabilities

Profitable FX trading is indeed a game of probabilities. What this means is that you will never find the way to profit off every single one of your trades, because such a way does not exist. You will win some and you will lose some.

What expert traders do is they make sure their losses are insignificant compared to their profits. To be able to pull that off, you need to understand probabilities as well as risk allocation/management.

- The trend is your friend

Beginner traders are advised to always try to trade the trends. Going against the trends is an option only for those patient enough to wait it out in the long-run. Obviously, such an approach requires generous balances too, something which is a luxury a beginner cannot usually afford.

Going against the trend exacts an additional emotional toll on the trader too.

- Patience is of the essence

While you won’t be able to fight the trends – as said above – you will still need to be patient. Keep a cool head about the whole thing.

Recognize your failures and learn from them. Never assume that you might have some kind of “natural talent” for trading.

- Talk trading with others

Nowadays, there are social trading solutions out there by the score. Some of these platforms are communication-focused, providing traders with an excellent environment where they can discuss their experiences and make heads and tails of their mistakes with the help of other – potentially more experienced – traders.

While listening to the opinions of others is almost always productive, never forget that you are the one wholly responsible for your decisions.

- Persistence

As with any venture, persistence is key to profitable trading too. As said above, this game is one of probabilities, and if you manage to get it all right, it will still take some time for your edges to translate into actual profits.

Furthermore, your skills and trading knowledge need time to build up. Your primary mission is to make the learning process as financially and emotionally painless as possible. Make sure that the undertaking does not interfere with your life and future goals in any negative way. As long as you are able to achieve that, you should be OK in the long-run.

- Money management

As made clear above, money/risk management is an integral part of the profitable FX trading experience. At the end of the day, this is where your success is made/broken.

The objective of money management is to shrink your losses to manageable levels, while increasing your profits.

- Proper technical/fundamental analysis

Though this is the factor on which most beginners will focus from the get-go, it should be fairly down on your list of priorities.

Yes: being able to perform proper analysis is indeed important but overcoming the emotional and risk-management related aspects of the early trading experience is far more important. Only once you have these challenges covered, should you consider switching your focus to analysis.

- How much money do you need to start a successful trading venture?

This is a question most beginners will face sooner rather than later.

Brokers feature some pretty varied minimum deposit requirements and some of them will indeed settle for as little as $100. Technically, that is how much you need to get going.

Will you be able to grow your balance to tens of thousands of dollars having started off with $100-$300? Not likely. Also, you won’t really be able to make a living having started off with that much.

As long as your broker offers micro lots, you will be able to play around a little, with money you can afford to lose. Trading this way is a reasonable step up from the Demo Account trading mentioned above.

Do not believe that with such a balance, you’ll be able to use leverage to your advantage. That’s not going to happen.

Since you’re a beginner, you might not want to even know this, but as a full-time trader, you’ll need more than $10,000 in your trading balance.

- Choose your timeframe wisely

Picking the right time frame for analysis/trading is more important than one would believe at first glance.

Low time-frames like 1 minute, do not allow for much analytical thinking. There’s a lot of robot-trading going on at that time frame too.

Generally speaking, nothing below 5 minutes time-frame-wise is healthy for a beginner trader. For swing trades, even higher time frames of 1hr+ should be considered.

Obviously though, you should not look at just one time-frame. To get the proper, big picture, you will need to look at higher time frames too than the one at which you are trading.

- Limit the number of indicators you use for analysis

Modern trading platforms put scores of technical indicators at the disposal of their traders. Many beginners feel that the more indicators they use, the more accurate picture they get of the potential trading opportunities.

This is obviously not true though. Stick to just a few MAs and an oscillator, use that setup for a while and get to know it/understand it well. Play around with the parameters and see where that gets you.

Some indicators do indeed work extremely well with others, but you really need to understand how they complement each other’s capabilities to be able to effectively use them.

- Find a strategy that works

There are scores of trading strategies out there and more than enough people willing to provide you with more still.

Through trial and error, you need to determine an approach that works for your personal needs.

Do not be inflexible in this regard: no strategy works for ever. Know that you will have to adjust every now and then.

- Always be open to new information and be willing to learn

As said above, successful trading does not come with a foolproof recipe. You need to make up this recipe as you go, on the move. To make matters worse, it changes all the time. To be able to keep up, you need to be level-headed and always open to trying out new strategies/analysis methods, without getting tangled up in the intricacies.

In case you cannot / do not want to trade on your own, you should hire a professional forex trader to trade on your account or follow trading signals, simply copy the trades of an account to make profits.

Unfortunately, many people incorrectly associate forex trading with scams. The problem is that there is an increasing number of unscrupulous companies marketing false information. The number of Forex-related scams has significantly increased over the last few years, so it’s important for you to be able to identify a hoax. Hence reach us at info@rvr.ventures / +971-581958582 to check verified track record of Professional Forex Traders. You can choose your choice of Forex Trader to assign him to trade on your trading account.

Latest Trading Performance in Forex Trading by RvR Ventures:

If you are busy in your professional life/business and in case you do not have so much time learn and trade, it is always suggested to hire experienced – professional Forex Traders to generate profits by trading on your accounts under monitored and control conditions.

If you are busy in your professional life/business and in case you do not have so much time learn and trade, it is always suggested to hire experienced – professional Forex Traders to generate profits by trading on your accounts under monitored and control conditions.

For more details, you can email us at info@rvr.ventures | Chat with us at +971-581958582 | Telegram Channel: https://t.me/ForexFundManagers

Follow us:

Twitter.com/VenturesRvR

YouTube.com/RvrVentures

Facebook.com/RvRventures