The Cautious Realm!

If you’re expecting the volatility to end anytime soon in the realm of forex, you’re highly-mistaken. After last week’s twists and turns in order to accelerate the economies, some measures seem to have worked, some backfired.

The last week began with the biggest shock with the drop in the prices of oil, as the Saudi-Russia price war surged and continued. By the end of the week, the dollar had reached a flight to safety as gold fell drastically. The dollar soared last week as a collapse of equity markets and disruption even to sovereign bond markets unveiled a large shortage of dollars. As equities collapsed and volatility jumped, and financial stress soared, the price of gold fell by 8.6% last week, which appears to be the largest fall in at least 30 years.

China data on Monday will be watched closely to see how the coronavirus has impacted the Chinese economy.

Below are some of the more important releases for this week:

Monday:

China: Fixed Asset Investment (YTD) Jan-Feb

China: Industrial Production Jan-Feb

China: Retail Sales Jan-Feb

Tuesday:

Australia: RBA Meeting Minutes

UK: Claimant Count Change (Feb)

Germany: ZEW Economic Sentiment Index (Mar)

US: Retail Sales (Feb)

US: Industrial Production (Feb)

US: Capacity Utilization

Wednesday:

Germany: 30-Year Bund Auction

Canada: Inflation Rate (Feb)

US: FOMC Interest Rate Decision and Economic Projections

Thursday:

Australia: Employment Change (Feb)

Japan: BoJ Interest Rate Decision

US: Philly Fed Manufacturing Index (Mar)

Friday:

Canada: Retail Sales

Dollar:

The U.S. Federal Reserve and its global counterparts moved aggressively with sweeping emergency rate cuts and offers of cheap dollars in a bid to combat the coronavirus pandemic that has roiled markets and paralyzed large parts of the world economy.

- Stock markets were routed and the dollar stumbled on Monday after the Federal Reserve slashed U.S. interest rates in an emergency move and its major peers offered cheap U.S. dollars in a bid to prevent global lending markets seizing up.

- Markets see Fed replay of 2007-8-9 and are assuming a repeat of the financial crisis is at hand

- A massive rollout of easing measures by the Federal Reserve served to deepen some investors’ anxiety over how effectively policymakers will be able to mitigate the economic damage from a spreading coronavirus pandemic.

- Fed’s dramatic actions brought home the severity of the situation the U.S. finds itself in as it is confronted by an accelerating epidemic that threatens to tip the world’s biggest economy into recession.

- This is an indication that the central bank is very scared about the environment we’re in.

The U.S. economy will also suffer a great deal amidst the Oil Price war. The bulk of U.S. production is coming from shale producers, many of whom are overleveraged and struggling. Low oil prices should permanently clear out the weakest players and semi-permanently reduce the supply of U.S. shale.

CLICK TO WATCH LIVE Forex Trading by Robots & Forex Traders

CLICK TO WATCH LIVE Forex Trading by Robots & Forex Traders

Euro:

European stock markets are set to open sharply lower Monday, with moves by the U.S. Federal Reserve overnight to cushion the economic impact of the spread of the coronavirus having little success in calming panicking investors. The real crisis has started in Europe, as the number of cases and deaths arose, making the continent on a lockdown. While COVID-19 may have been the catalyst for the breakdown of capital markets across the continent, capital markets were simply waiting for that spark to occur.

France and Spain joined Italy in imposing lockdowns on tens of millions of people, while the United States saw school closings, runs on grocery stores, shuttered restaurants and retailers, and ends to sports events.

Coronavirus is also beginning to spread much faster in the Scandinavian countries and in Switzerland. In the week ahead, look for land transport across Europe to become affected as countries start bringing in more Italy-type restrictions that make any non-essential travel very difficult.

Australian Dollar:

Australian Prime Minister Scott Morrison is considering further economic measures and support to buttress the economy, just days after announcing a A$17.6 billion ($10.8 billion) stimulus package.

Australia has recorded almost 300 cases of the coronavirus, with five deaths.

Oil:

Oil sold off in a single day at the start of the past week, the biggest drop for the commodity in nearly three decades, which was the beginning of the volatility in the market. Saudi Arabia announced that it will increase oil production from 9.7 million barrels a day to 10 million and then to 12 million if needed. This news alone sent the oil price down 20% – and the whole stock market with it.

For oil, that could mean Goldman’s $20 call for a barrel becomes a more distinct possibility. While both WTI and Brent remain above $30 now, it’s not too hard to see them losing another third of their value.

Gold:

Up until a week ago, perhaps the only question we had was, “Why isn’t Gold going up?”

The key factors for the decline in gold’s progress are:

- The dollar strength: Of course gold plays no currency favourites, but there is a gold old sayin’ that goes, “the dollar went way up and Gold went way down.” For the third successive week, Gold was unable to move materially above our call for 1675 as this year’s high, price peaking at 1704 this past Monday. Simply stated, Gold just cannot (as yet) muster the puff to bust up through that overhead pricing mass.

- The spot price of gold got a bump of less than 2% after the historic rate cut — not quite living up to its safe-haven tag, which has been on the decline anyway, especially after last week’s loss of 9%, its most for a week since 2011.

- In gold’s case, expect any rebound to be limited with players likely to sell quickly to cover margins and other losses on stocks and elsewhere.

- If equities drop further, liquidation of gold longs seem inevitable; if equities rise again toward $1,600, or even reprise the $1,700 highs of last week, it will get sold in double quick time.

- In all likelihood, patience will reward XAUUSD sells with TP at 1450.00 target for today, but deep pockets will be required in case of a reversal. Buy Entry: 1450.00 TP: 1490.00

Central Banks Getting Serious About Coronavirus Economic Measures:

The volatility has exploded and forcing margin calls, distressed liquidation, illiquid conditions in the biggest and deepest markets, like U.S. Treasuries. Corporations are drawing down credit lines, which impacts banks’ liquidity. Central Banks around the world are taking necessary steps to control the economy and limit the destruction that’s come in the way due to the global halt.

The Fed’s rate cut combined with the promise of more bond-buying pushed U.S. 10-year Treasury yields down sharply, to 0.68% from 0.95% late on Friday.

- The Fed’s emergency 100 basis point rate cut on Sunday was followed on Monday by further policy easing from the Bank of Japan in the form of a pledge to ramp up purchases of exchange-traded funds and other risky assets.

- New Zealand‘s central bank also shocked by cutting rates 75 basis points to 0.25%, while the Reserve Bank of Australia (RBA) pumped more money into its financial system. South Korea cut rates and Russia rushed together a $4 billion anti-crisis fund.

- The Bank of Japan eased monetary policy on Monday by pledging to buy risky assets such as exchange-traded funds (ETF) at double the current pace, joining global central banks in combating the widening economic fallout from the coronavirus epidemic. Japanese Prime Minister Shinzo Abe said G7 leaders would hold a teleconference at 1400 GMT to discuss the crisis. At the meeting, the BOJ decided to buy ETFs at an annual pace of around 12 trillion yen ($112.55 billion), double the previous amount, until markets stabilize from the recent rout.

- Southern (NYSE:SO) European bond yields jumped to multi-month highs as investors continued to worry about the rapid spread of the virus there.

- Spanish and Portuguese 10-year bond yields rose to 9-1/2 month highs at 0.74% and 0.93% respectively, up as much as 13 basis points on the day.

- French 10-year yields also soared as much as 14 basis points to 3-1/2 month highs at 0.14%, while Italian 10-year yields were up 17 basis points at 1.98%.

Even so, markets were expecting extraordinary action, so it remains to be seen whether the announcement will meaningfully shift market sentiment. On this note, in this highly volatile market, invest only as much as you can afford to lose. Do not risk more than 2% of your total Principle amount, trade less but trade well.

The accuracy report of the above analysis will be published on Friday evening for cross verification. All The Best!

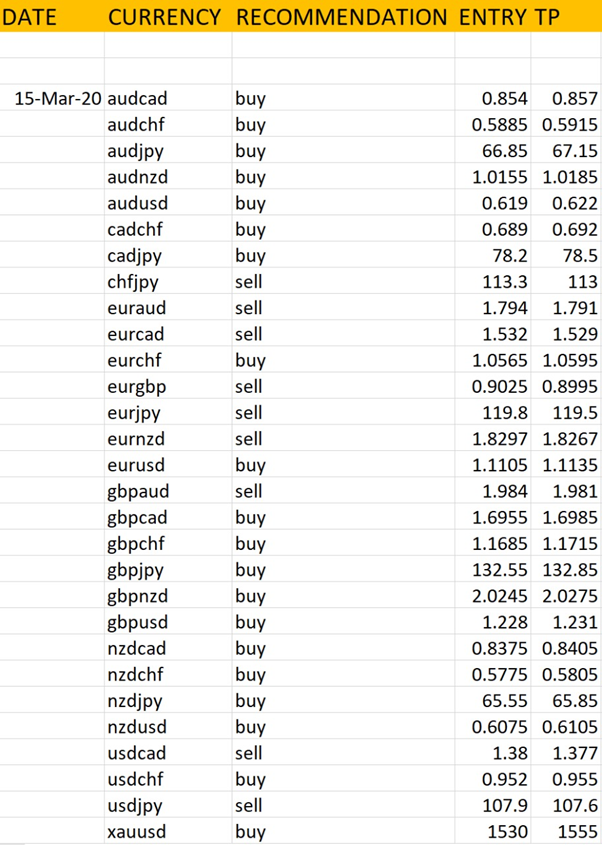

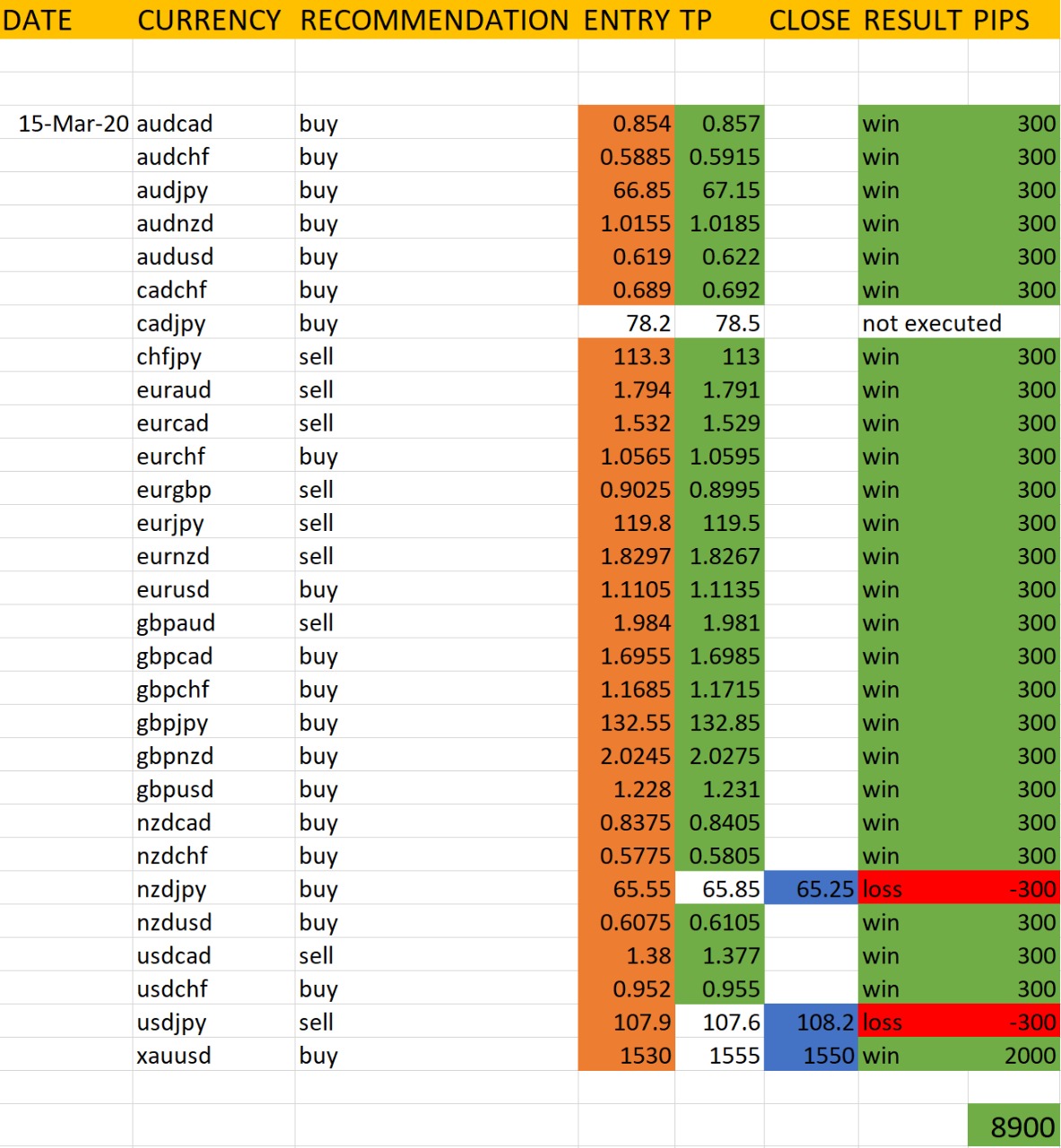

As per the analysis published on 16 March, 2020, here is the performance report: