The Clock Is Ticking!

It is no doubt that we’re battling the greatest ever economic devastation due to COVID19 pandemic.

Last week, on Thursday, the weekly U.S. Jobless Claims remained the most important parameter to follow through the economic depression claim. The number of Americans seeking unemployment benefits in the last three weeks has topped 15 million.

IMF Managing Director Kristalina Georgieva warned last Thursday that the pandemic will turn global economic growth “sharply negative” in 2020, triggering the worst fallout since the 1930s Great Depression, with only a partial recovery seen in 2021.

The week is jam packed with important data release to look forward to:

IMF forecasts:

- The IMF will release its detailed World Economic Outlook forecasts on Tuesday after the IMF and World Bank Spring Meetings, which will be held by video conference as a result of the pandemic.

- IMF MD’s speech also underlined the need for the meeting to offer debt relief and to agree an increase in the IMF’s financial firepower so it could help the world’s poorest countries through the crisis.

Economic data to show depth of fallout

- Investors will once again be focusing on Thursday’s report on weekly jobless claims, which are expected to be in the millions again.

- “In its first month alone, the coronavirus crisis is poised to exceed any comparison to the Great Recession,” said Daniel Zhao, senior economist at Glassdoor. “The new normal for unemployment insurance claims will be the canary in the coal mine for how long effects of the crisis will linger for the millions of newly unemployed Americans.”

Fed speakers

- Chicago Fed President Charles Evans, St. Louis Fed President James Bullard and Atlanta Fed President Raphael Bostic are all scheduled to make appearances this week, with investors keen to hear how policymakers view the scale of the economic downturn.

- The Fed has slashed rates to zero, launched open-ended bond purchases and introduced a suite of emergency lending tools in response to the economic shockwaves unleashed by the virus.

The Fed is also to publish its Beige Book on Wednesday.

Earnings season

- First quarter earnings season kicks off with the six largest banks in the U.S., including JPMorgan Chase, Bank of America and Goldman Sachs set to report.

- Investors will be watching for any indications that banks are scaling back on lending, which could be a sign of a prolonged recession. Also, the Federal Reserve said Thursday it will be working directly with banks to deliver much of its financial support to businesses.

Oil output cut deal hangs in the balance

- The biggest supply cut ever contemplated by the world’s top oil producers is hanging in the balance with Mexico resisting pressure from Saudi Arabia to sign up to global cuts worth nearly a quarter of output for participating countries.

- The refusal by Mexican President Andres Manuel Lopez Obrador to compromise his plan to revive state oil company Pemex by agreeing to the cuts has shown the global spotlight on Mexico and angered Saudi Arabia.

- In a compromise hammered out with U.S. President Donald Trump, Lopez Obrador said on Friday the United States had offered to cut an additional 250,000 bpd on Mexico’s behalf, bringing them close to the target.

- However, Saudi Arabia – the heavyweight of global oil diplomacy – has balked at that and dug in its heels, despite some other producers from the group of OPEC nations and their allies – known as OPEC+ – calling for the cuts to go ahead regardless.

OPEC+ made its commitment to cut a record 10 million barrels a day conditional on Mexico’s agreement.

Global oil demand is estimated to have fallen by around 30 million bpd as more than 3 billion people are locked down in their homes due to the outbreak.

Apart from the above important factors, here’s what’s happening in the global markets and economies:

The Gold Threshold:

- Even although risk sentiment is still turning “green,” the real economy is still shaky enough to attracts safe-haven demand.

- Gold prices are rising fuelled by massive stimulus from the Fed and increases in joblessness. which is the reason triggering the Fed to pre paper over all the data cracks now with money.

- And what should translate into a positive view for gold this week is we will likely have a veritable smorgasbord of nasty real-time data do digest.

U.S. Week Ahead

- This week’s data will start to echo at great length the economic devastation from the onset of COVID-19 and the associated containment measures. Using the best real-time data available, analysts believe we’re on the verge of topping the four-week total of 25 million, which is over ten times the prior worst four-week period in the last 50-plus years.

- Monetary policymakers continue to deploy their broadened toolkit aggressively. Late last week, in Federal Reserve Boards finest hour, they detailed steps to provide $2.3tn to support the economy. They are delivering on three critical fronts: corporate credit facilities to support lending for large businesses, the Main Street Business Lending Program (MSBLP) to boost liquidity for loans to small-and-medium-sized industries, and further support for the municipal bond market.

Asian week ahead:

- This week, China’s GDP report will attract much attention, as it should also provide an advantageous reference point for benchmarking the probable effects of COVID-19 on economic activity in other economies.

- The recent run of high-frequency data points to a very sharp downturn in China’s GDP growth where current estimates are coming in around -7.5%yoy in Q1 from +6% in Q4. High-frequency data will likely remain downcast for March, even though better than in February; despite economic activities partially resuming, the outlook for exports remains depressed as the critical markets are not consuming and due to lockdown.

The Week Ahead

All times listed are EDT

Monday

Numerous global markets, inlcuding the UK, Germany, Italy, Singapore and Australia will be closed for the Easter Monday holiday.

Tuesday

17:32: China – Trade Balance: expected to soar to 19.10B from -7.09B.

Wednesday

8:30: U.S. – Core Retail Sales: seen to plunge to -3.0% in March from -0.4%; Retail Sales: likely plummeted to -7.0% from -0.5%.

10:00: Canada – BoC Interest Rate Decision: currently holding steady at 0.25%.

10:30: U.S. – Crude Oil Inventories: forecast to drop to 9.271M from 15.177M.

21:30: Australia – Employment Change: anticipated to have undergone a severe slump in March, to -40.0K jobs lost from +26.7K in February.

Thursday

4:00: Germany – Ifo Business Climate Index: previous reading was 86.1.

8:30: U.S. – Building Permits: expected to fall to 1.300M from 1.452M.

8:30: U.S. – Initial Jobless Claims: after last week’s staggering print, markets await this week’s results to see if claims have levelled off at all.

8:30: U.S. – Philadelphia Fed Manufacturing Index: expected to have gone into freefall and slid to -30.0 from -12.7.

22:00: China – GDP: forecast to have dived to -6.0% from 6.0%.

22:00: China – Industrial Production; Forecast: -7.0%, Previous: -13.5%: seen to have expanded to -7.0% from -13.5%.

Friday

5:00: Eurozone – CPI: expected to climb to 0.5% from 0.2% MoM, while keeping steady at 0.7% YoY.

Energy Calendar Ahead

Monday, April 13: Private Genscape data on Cushing oil inventory estimates

Tuesday, April 14: American Petroleum Institute weekly report on oil stockpiles.

Wednesday, April 15: EIA weekly report on oil stockpiles

Thursday, April 16: EIA weekly natural gas report

Friday, April 17: Baker Hughes weekly rig count.

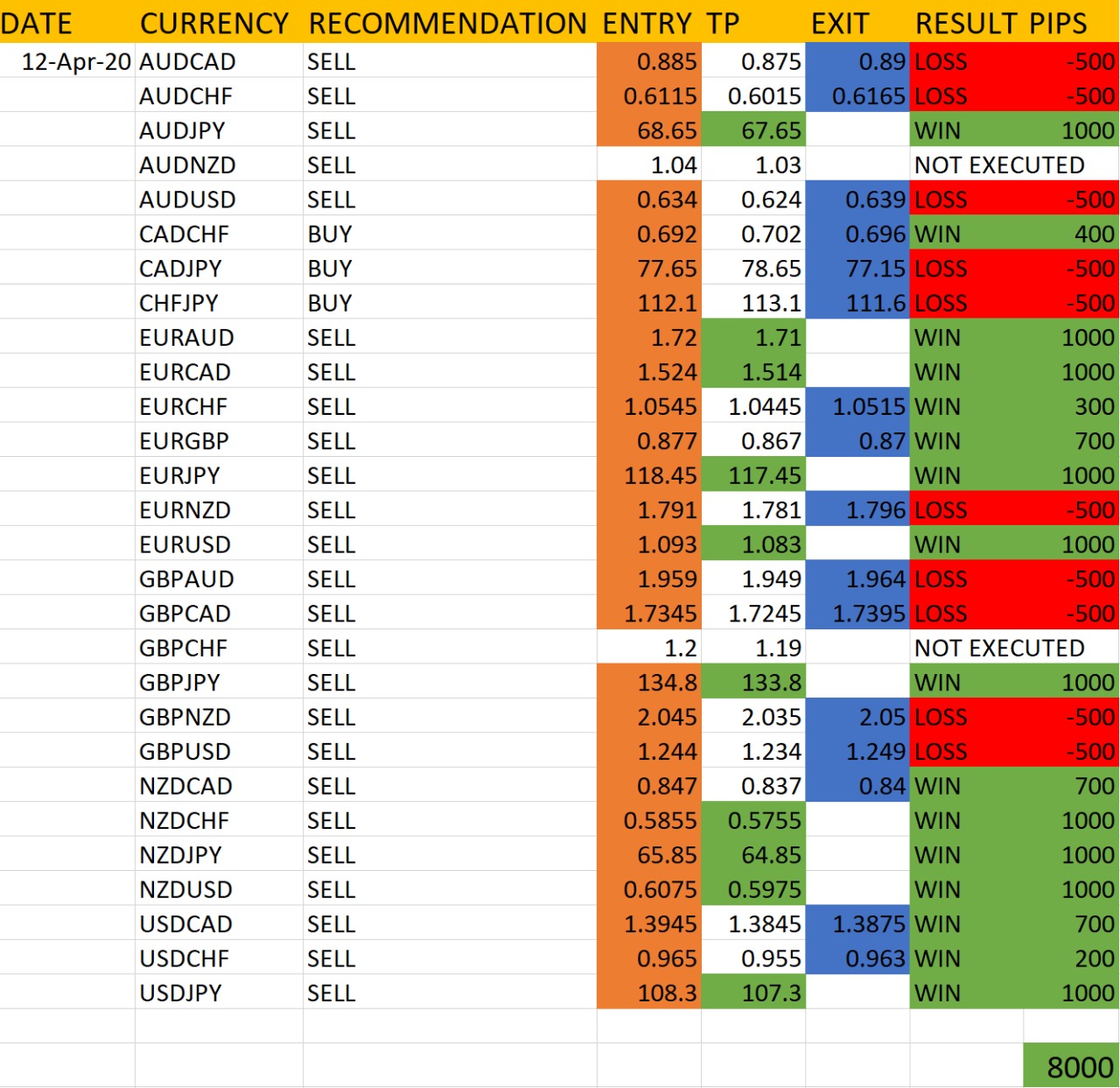

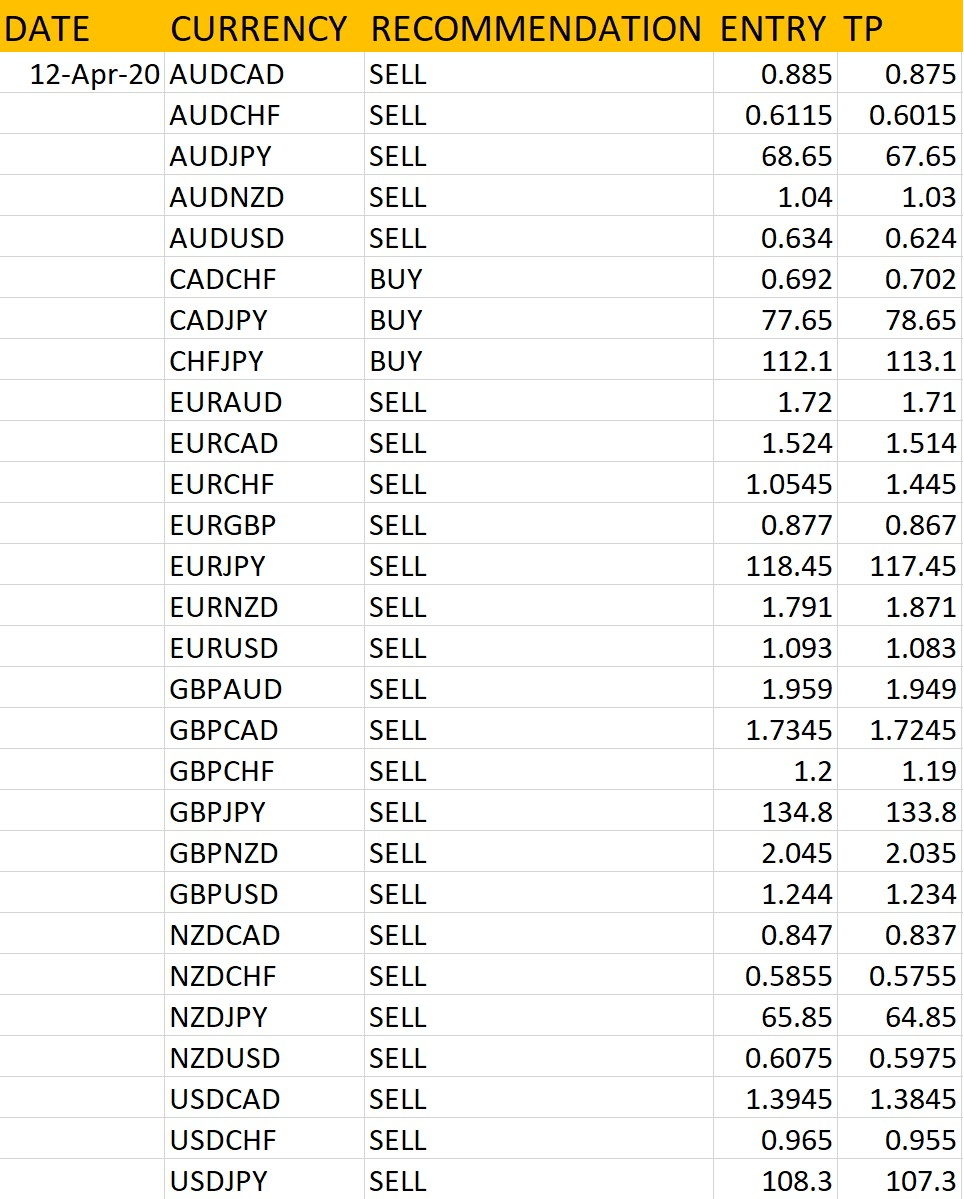

Based on the market indices and metrics, and observing the patterns being followed even in this highly volatile and uncertain market, here’s the weekly analysis provided by the analyst at RvR Ventures on 28 currency pairs.

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

The accuracy report of the above market analysis will be published on 17th April, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading.

- Chat with us to know more: https://wa.me/971581958582

- Register to open your account: http://bit.ly/OpenFxAccount

- Join Our Telegram Channel: https://t.me/ForexFundManagers

- Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc