February 2020 Wrap Up

Worst Weekly Losses Since October 2008

In fact, the major indices last week suffered their severest weekly losses since October 2008, when markets were in the throes of the worst financial crisis this century. February’s overall performance was the worst showing for the month since February 2009, right before the stock market bottomed. Plus, after mid-February of this year, all three major averages saw decent gains for the young 2020 completely disappear.

Companies, including Apple and Microsoft, that are betting China will be the source of future growth, are already warning of profits and sales in the first quarter likely missing earlier targets.

Week Ahead: U.S. Stocks Enter Correction Territory; NFP (+) | Room For A Bounce Next?

Week Ahead: Fed, PBoC Policy And OPEC Meeting

Wall Street recorded its biggest weekly decline since the 2008 financial crisis on Friday amid rampant fears of a recession resulting from the epidemic, which has now infected around 86,000 people and killed more than 3,000.

Latest data from China showed factory activity in February contracted at its sharpest pace on record, underlining the impact on the world’s second biggest economy from drastic travel curbs and other public health measures.

This week will be filled with essential data releases, such as the manufacturing ISM and Friday’s February employment report. However, given the collapse in risk assets and a sharp repricing of Fed rate cut expectations last week, market attention will likely focus on this week’s rollout of Fed speakers.

Depending on the severity of the economic impacts of the spread of the coronavirus, there is certainly scope for more stimulus. So, Chair Powell’s unusual statement last Friday afternoon likely marked a turning point in the Fed’s tone concerning the potential for near-term policy action—probably as soon as the March 18 meeting or even before although now that might produce more panic than not is in the works.

Oil Markets: All Eyes On OPEC

With oil heading for its most significant weekly loss in almost nine years, the pressure is growing on OPEC+ to deliver a response to halt the decline. Saudi Arabia is reportedly pushing for an additional 1mb/d production cut, more aggressive than the 600kb/d cut recommended by OPEC’s Joint Technical Committee, and OPEC’s secretary-general said there is “renewed commitment” within the group to take action to stabilize the oil price.

While the OPEC+ meeting next week (March 5-6) will be relevant, we continue to believe that any optimism that follows a positive outcome will be short-lived and that oil will not begin to recover until

Covid-19 is no longer seen as a risk. Keeping in mind, we are dealing with the April delivery contract, so there’s not a great deal of material wiggle room address an oversupplied market.

There is no denying gold’s “haven” credentials are getting questioned in light of gold’s tepid performance with nary a bounce in sight. It should be particularly worrying for gold bulls with Treasury yields collapsing, which should have been extremely positive for gold.

Risk-free sovereign assets, not gold, is the preference of choice as cross-asset investors grow concerned about the considerable drop in physical demand since the virus hit. So, the bearish aspect of reduced consumer demand amid the economic slowdown could be depressing prices as physical does remain a significant demand channel.

In a reminder of how vital month-end can be for precious metals, what started small – moves driven by losses in equities or elsewhere – seems to have turned into a complete position unwind.

Indeed Month-end rebalancing and people possibly selling their winners (gold) to cover margin calls and raise cash could be the straw that broke $ 1600 back, however a reversal from 1568/00/1555.00 looks certain with a target range of $1666.00 – $1675.00 price range. Sell Limits at 1690-1680 price range TP: 1568.00/1555.00, buy limits at 1568.00/1555 range TP: 1666.00/1675.00 are suggested for this week.

KEY MARKET MOVEMENTS:

- S. futures fall in choppy trade as stimulus measures in focus

- European Open – Market Bounce, Fed, Gold, Oil

- Dollar takes a back seat as markets bet on Fed rate cuts

- EUR/USD now looks to 1.1096 and above – UOB

- EUR/USD: Well-supported for more gains

- EUR/GBP climbs to 4-1/2 month tops, eyeing 0.8700 mark

EUR/GBP boosted by a combination of factors

The buying interest around the shared currency picked up some additional pace in the last hour following the news that Germany is mulling a way to loosen its rigid limits on spending and stimulate the economy.

- Pound US Dollar Exchange Rate Sinks as UK Coronavirus Cases Boost BoE Rate Cut Odds

- 4-Month-Worst for Pound to Euro Exchange Rate as Bank of England Rate Cut Bets Hit Outlook

- USD/JPY slides back closer to 5-month lows, around mid-107.00s amid a turnaround in risk sentiment

- Fed rate cut speculations continued weighing on the USD and did little to support.

- The global death toll from the coronavirus outbreak surged past 3,000. New York City, Brussels and Berlin reported their first infections, while cases surged in South Korea. India reported two new cases, including one in the capital New Delhi.

- Euro Surges, Sterling Sinks as Central Banks Ease Panic

- Yuan Rises Despite Downbeat PMI Data

- British poundremained on the defensive amid persistent uncertainty about the future UK-EU trade relationship and concerns that Britain might crash out of the EU later this year.

- GBP/USD capped at critical resistance amid coronavirus and Brexit news

- GBP/USD: Bearish ahead of Brexit negotiations

Like so much that is unknown about this virus, the answers may come slowly and require hard work to clarify.

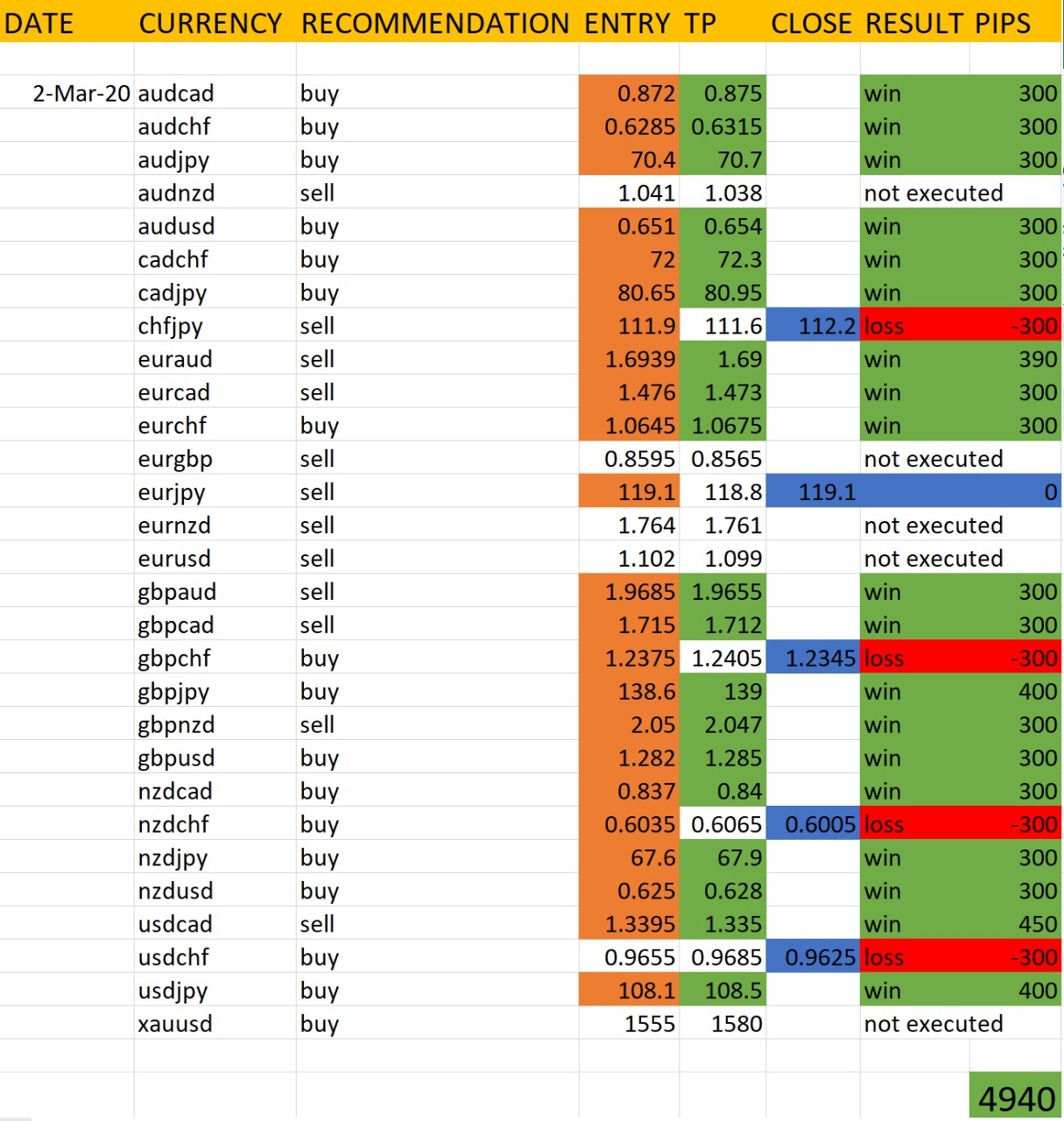

Based on the assessment provided by the analysts at RVR Ventures at the start of the week on 30 currencies, we stand corrected with how the week turned out for the world. Out of the 30 currencies that were analysed, the trades were executed on 23 pairs, out of which 19 closed in profit, providing the analyst an accuracy of 82.6%.

The key market factors included Fed Interest Rate Decision, PBoC Policy and OPEC Meeting on the basis of which the analyst was able to assess the market scenario, further identify the key buying and selling points, also advising you the profit points.

Here’s a recap from the week and our analysis at the end: