The Pandemic. The Shrink.

While dozens of earnings reports are expected in the coming week and economic data will bring more insights into the impact of the coronavirus the main focus will still be on developments relating to the virus and how soon the economy can reopen.

Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to “open for business.” The two demands are inherently incompatible, and so neither one can be fulfilled.

Here is an overview of the market for the week ahead:

The U.S data and the lockdown:

The U.S. has by far the world’s largest number of confirmed coronavirus cases, with more than 720,000 infections and over 37,000 deaths. Several states, including Ohio, Michigan, Texas and Florida, have said they aim to reopen parts of their economies, perhaps by May 1 or even sooner, but appeared to be staying cautious.

- U.S. President Donald Trump said on Saturday that Texas and Vermont will allow certain businesses to reopen on Monday while still observing coronavirus-related precautions.

- The coming week is likely to see some governors making use of the blueprint to allow a gradual return to work and a tentative restart of businesses.

- Initial jobless claims could slow again this week as the initial reaction to shutdowns starts to ease. More than 22 million Americans have filed for unemployment benefits in the past month as closures of businesses and schools and severe travel restrictions have hammered the economy.

- The calendar also features updates on new and existing home sales and PMI data, which is expected to drop further.

Earnings deluge

- Around one hundred S&P 500 companies are expected to report results this week, as investors digest a market surge that has lifted the S&P index 25% from its March lows as of Thursday.

- Those include major industrial, tech and consumer products companies, as well as streaming company Netflix (NASDAQ:NFLX), whose shares rose to a record high in the past week as widespread stay-at-home orders drove demand for online streaming services.

- Some of the companies also reporting are among those worst hit by the pandemic’s fallout, including airlines such as Delta Air Lines and Southwest Airlines.

Euro zone data and the week ahead:

- The euro zone is to release PMI data for April along with reports from Germany’s ZEW and Ifo

- Thursday’s advance readings of euro zone PMIs for April are likely to make for painful reading.

- Composite euro zone PMIs, comprising. Services and manufacturing, dropped to a record low of 29.7 last month, the biggest monthly drop since the survey began in July 1998.

- In addition to the PMI data reports from Germany’s ZEW and Ifo Institutes will shed more light on the health of the bloc’s largest economy as it prepares to ease virus lockdown measures.

- Euro zone finance ministers are to meet on Thursday to continue discussions about an EU fund to boost the recovery. The issue of joint European debt, or corona bonds, is likely to come up again, but the chance they will ever see the light of day remains slim.

UK data to give first real look at economic hit

The U.K. is set to publish figures on unemployment, inflation, and retail sales.

- The scale of the economic fallout from coronavirus pandemic in the UK is likely to be both larger, and much more rapid, than that of the Global Financial Crisis.

- With that in mind, some economists expect Thursday’s retail sales figures to show a decline of around 10%, but this number could be much larger based on other spending indicators already released.

- PMI data is also expected to point to a steep slowdown in activity.

The week will also bring what will be closely watched updates on unemployment and inflation.

China’s economic and financial response to the crisis has been underwhelming:

- The government and the central bank’s response appear mild compared with the actions in 2008-2009 and relative to the reaction of other major countries.

- By first cutting the seven-day repo rate at the end of March and then the medium-term funding rate last week, the PBOC signalled that the new benchmark 1-year Loan Prime Rate will fall 20 bp (to 3.85%) when it is set in the banks’ submissions.

Japan’s fallen exports:

- Japan reported its exports fell almost 12% in March from a year earlier, with shipments to the United States down over 16%.

- Readings on April manufacturing globally are due on Thursday and are expected to hit recession-era lows.

Good news for NZ:

Better news came from New Zealand where success in containing the virus allowed the government to announce an easing in the country’s strict lockdown from next week.

Oil overview:

- As oil was readying to end another tumultuous week, Riyadh and Moscow signalled readiness for more cuts, with WTI finding itself back in a spot the U.S. crude benchmark had gotten quite familiar with lately: the under $20-per-barrel level.

- Saudi Arabia and Russia will “continue to closely monitor the oil market and are prepared to take further measures jointly with OPEC+ and other producers if these are deemed necessary,” Abdulaziz bin Salman and Alexander Novak, energy ministers for the two countries, said in a statement after phone call between them.

- Just a week ago, oil producers within the G-20 and OPEC – an alliance now known as GLOPEC – overcame a stubborn Mexico to piece together a near 10-million-barrel-per-day cut deal that they hastily announced hours before Asian markets opened. In similar manner, crude markets held up for a few hours in Monday’s trade before turning south.

Crude Oil’s 20 year low:

- Oil prices remained under pressure as the global lockdown saw fuel demand evaporate; leaving so much extra supply countries were finding it hard to find space to store it.

- So great was the near-term glut that the May futures contract for U.S. crude was trading down over 18% at $14.81 a barrel, while June shed 6.19% to $23.48 .

Gold

- The bullish mood on Wall Street on Friday saw goldretreat in a disorderly fashion, falling 2.0%, or around $34 to $1683.40 an ounce.

- The size of the fall probably reflects the amount of retail positioning that has flocked to gold ETFs recently and into spot goldlast week. A break of the $1708.00 an ounce support level, seems to have spurred an intense bout of stop-loss selling.

The Week Ahead

All times listed are EDT

Sunday

21:30: China – PboC Loan Prime Rate: a rate cut is widely anticipated after Friday’s GDP release signalled the dire effects of the coronavirus outbreak.

Monday

2:00: Germany – PPI: a contraction to -0.7% is forecast.

Tuesday

5:00: Germany – ZEW Economic Sentiment: likely ticked up to -41.0 in April from -49.5 in March.

8:30: Canada – Core Retail Sales: expected to jump to 0.3% from -0.1%.

10:00: U.S. – Existing Home Sales: seen to continue to decline to 5.30M from 5.77M.

Wednesday

2:00: UK – CPI: probably edged lower to 1.5% from 1.7% YoY.

8:30: Canada – CPI: likely slipped to -0.4% in March, from 0.4% previously.

10:30: U.S. – Crude Oil Inventories: forecast to plunge to 11.676M from 19.248M.

Thursday

2:00: UK – Retail Sales: expected to have plummeted to -3.8% from -0.3%.

3:30: Germany – Manufacturing PMI: anticipated to fall deeper into contraction territory, to 39.0 from 45.4

8:30: U.S. – Initial Jobless Claims: after the past few weeks’ dreadful numbers, this release will be closely watched.

10:00: U.S. – New Home Sales: seen to decline to 645K from 765K.

Friday

2:00: UK – Retail Sales: expected to contract further, to -4% from -0.3%.

4:00: Germany – Ifo Business Climate Index: likely to fall to 80.0 from 86.1.

6:30: Russia – Interest Rate Decision: anticipated to remain at 6.00%.

8:30: U.S. – Core Durable Goods Orders: likely to have plunged to -6.0% from -0.6%.

Energy Calendar Ahead

Monday, April 20: Private Genscape data on Cushing oil inventory estimates

Tuesday, April 21: American Petroleum Institute weekly report on oil stockpiles.

Wednesday, April 22: EIA weekly report on oil stockpiles

Thursday, April 23: EIA weekly natural gas report

Friday, April 24: U. S Baker Hughes weekly rig count.

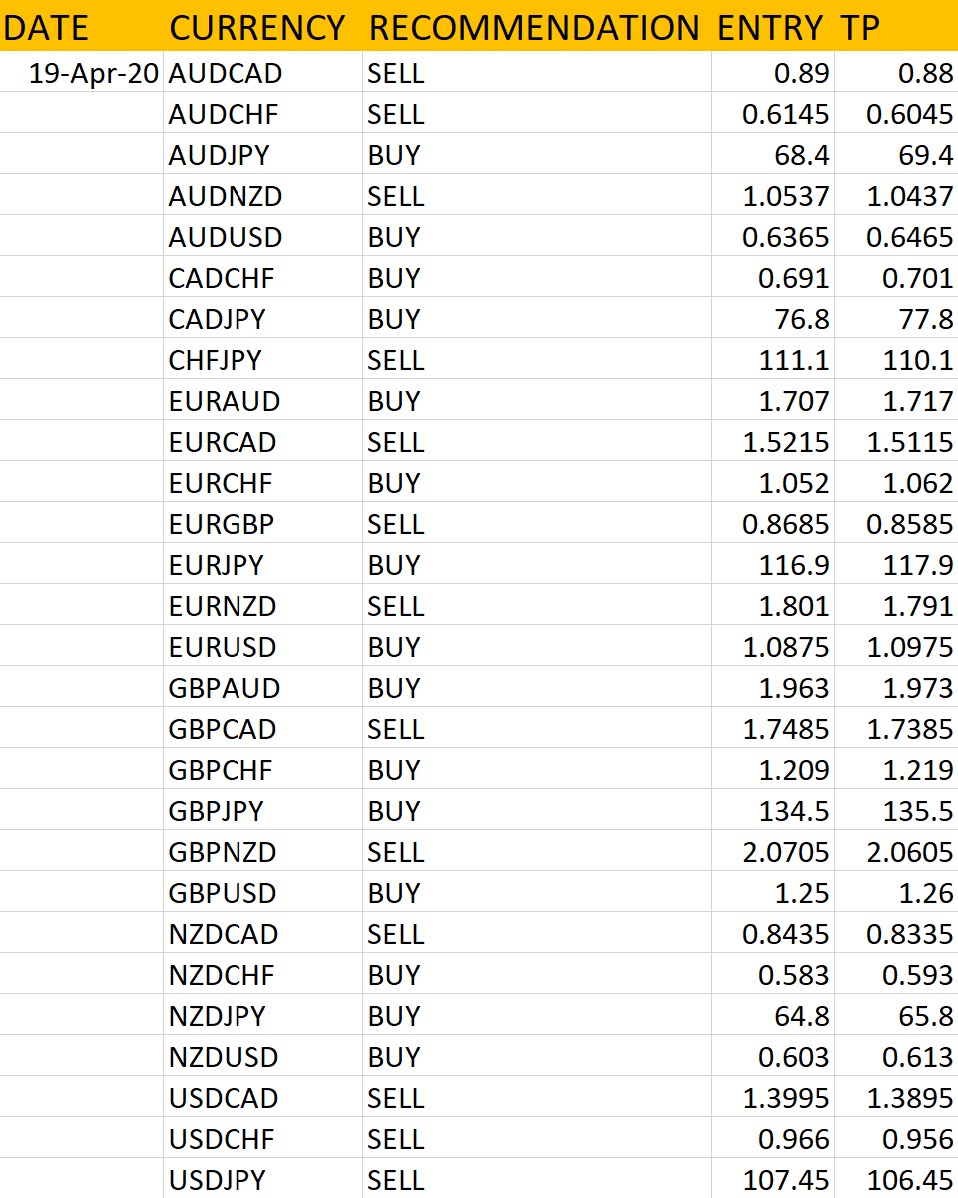

Based on the above important market moving factors this week and the current mainstream trend, the analyst at RvR Ventures has predicted the future for 28b currency pairs to trade on. This analysis is solely based on market indices and momentum, followed by an intricate experience in the trading field.

Here’s what the analyst has to say about the currency pairs this week:

The analysis is solely based on market knowledge and key moving factors, and the technical trends furthermore. According the important weekly events mentioned above, these currency pairs have been judged.

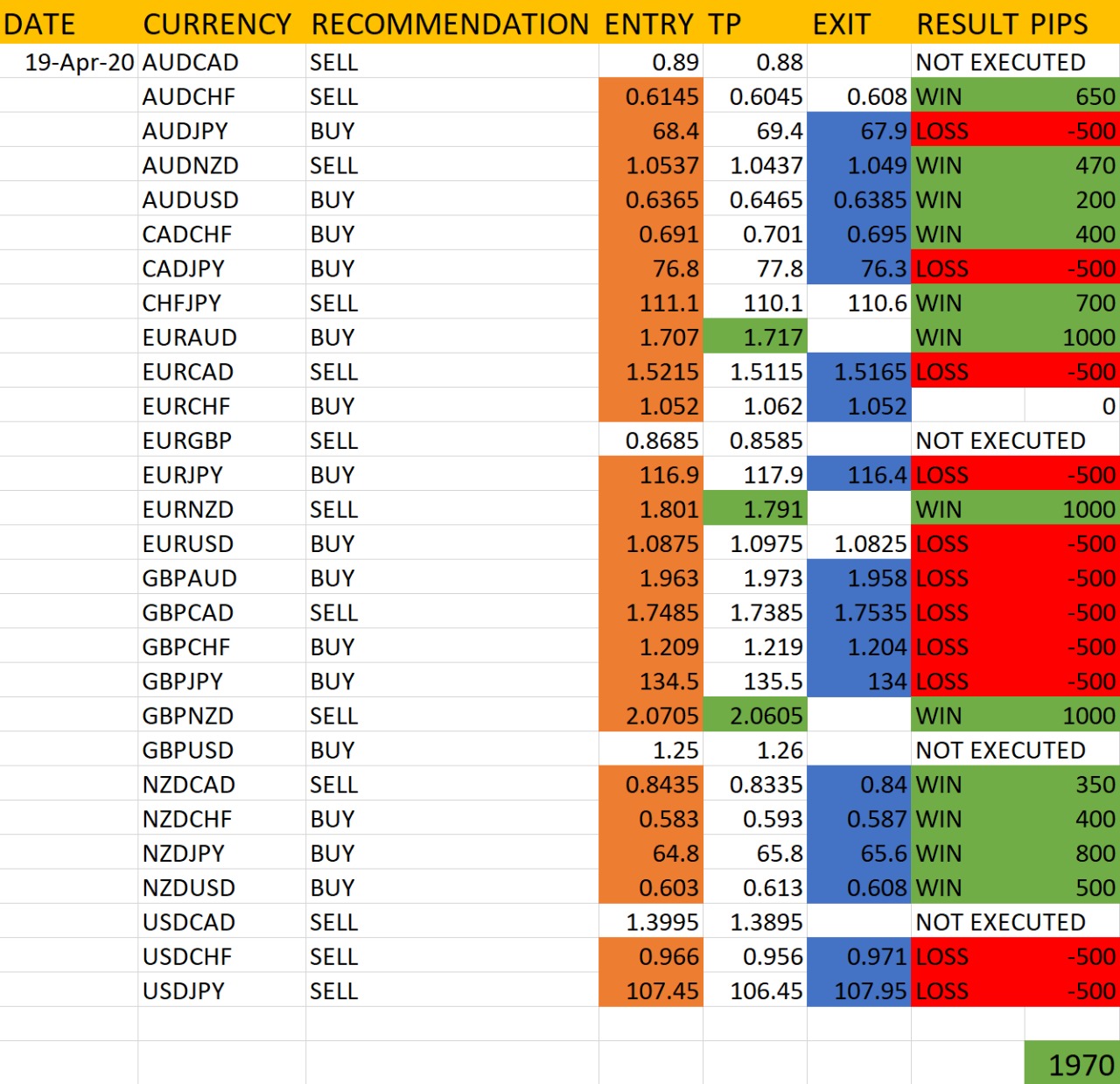

The accuracy report of the above market analysis will be published on 24th April, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindly practice money management & risk mitigation while trading.

- Chat with us to know more: https://wa.me/971581958582

- Register to open your account: http://bit.ly/OpenFxAccount

- Join Our Telegram Channel: https://t.me/ForexFundManagers

- Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc