The Quarrel of Barrels!

The Wrecking of the Virus

U.S. stocks are set to open higher Monday, as investors take comfort from tentative signs the spread of coronavirus is slowing. The coronavirus outbreak has already caused severe disruption across the globe and economies, and it is likely that the effect will not die down for a considerably significant time from now. Governments need to ensure effective and well-resourced public health measures to prevent infection and contagion, as the number of cases are on a constant high.

The British pound fell this morning as the UK Prime Minister was taken to hospital having been unable to shake of COVID-19 from isolation at home.

Oil too has endured a torrid early morning session, as quarrels amongst the OPEC+ members sees a virtual meeting postponed until Thursday. As the Friday U.S. Nonfarm Payrolls illustrated, COVID-19 is wrecking almost unimaginable havoc on the world’s economy.

The U.S. has reported over 337,000 confirmed infections from Covid-19, by far the highest tally in the world, and over 9,600 deaths. Besides the FOMC Meeting Minutes and OPEC Meeting, this week’s calendar also features U.S. data on JOLTs Job Openings, Initial Jobless Claims, Producer Price Index and the UK GDP.

The US:

The severe unemployment problems in the US:

- After Thursdays staggering initial jobless claims print showed that more than 6.65 million American’s had filed for unemployment benefits for the first time during the previous week (following the previous week’s shocking 3million+ initial claims report).

- Friday’s nonfarm payrolls release indicated that the U.S. economy had lost more than 700,000 jobs in March, lifting the country’s unemployment rate from all-time lows. And unemployment will continue to rise, given that 10 million Americans have already filed for unemployment benefits in the last two weeks.

The primary focus of the US:

- The primary focus in the U.S. will remain on containing the outbreak as it makes its way across the country.

- Much attention will also fall on the economic data that will start to show the impact of much of the country falling to a stop.

- Economists are trying to figure out how bad the economy will contract and how high the unemployment rate will skyrocket.

The Fed Minutes Release:

- On Wednesday, 8th April, 2020 the Fed will release their minutes to their second intra-policy March 15th meeting. The Fed threw the kitchen sink at this last meeting and the minutes will likely reiterate their aggressive stance on tackling the coronavirus crisis.

- The problem for the Fed is that the balance sheet is growing astronomically. The Fed can’t keep up this pace and will have to gradually slow down purchases before the economy is on a sound footing.

Crude oil swings:

- Crude Oil remained a primary focus, as wild price swings endured throughout the week. The commodity surged 32% on hopes of an agreement between Saudi Arabia and Russia to reduce production, boosting prices.

- WTI added 13% on Friday after catapulting nearly 25% on Thursday, a nearly 40% leap in just two days.

This week will centre on OPEC+ meeting scheduled for Thursday and the evolution of coronavirus ahead of Easter week.

The UK

- The UK is still seeing accelerating coronavirus and cases as the lockdown continues. The number of cases and deaths are continuing to accelerate, although only the latter is really important given the number of people not being tested.

- It’s going to be an awful couple of weeks, with many predicting that the lockdown measures continue for months to come.

Europe and the outbreak:

- Europe is also reporting terrible news on the virus front as both the UK and France have had some of their deadliest days with the outbreak.

- Italy may have some optimism that deaths and new cases are stabilizing and Spain may be showing signs that the death rate is declining.

- The paper tiger known as the European Union cannot even agree to the joint offering of an EU pandemic bond thanks to resistance from the usual suspects, Germany and the Netherlands.

Asia tightening their borders:

- Asia is once again tightening their borders as a new wave of infections may have been imported. Global economic activity will not return anytime as over 90% of the world’s GDP has some type of social distancing measure in place.

New Zealand cases continue increasing:

- COVID-19 cases continue to increase in New Zealand.

- There is potential for stronger measures from the Government, including the deployment of the military to enforce. Negative for NZD with the economy set for another leg lower.

No important data to focus on when it comes to NZD this week. The economy is currently battling the ever-increasing spread of the virus.

Australia Dollar remains low:

- Low Australian Dollar has seen bargain hunting in Australian shares this past week. The good times are unlikely to last as the AUD remains at record lows, a resource demand shock internationally, and a slowdown in domestic activity as the country is partially locked down.

- RBA rate decision Tuesday, expected to be unchanged. Financial stability outlook Thursday will be more closely watched. Expect RBA to announce further QE and possibly instruct Australian Banks and large corporate to suspend dividend payments.

Japanese data release can help in the momentum of Japanese stocks:

- Japan PMI data and IP data were less bad than expected this week. That said, markets are still awaiting Japan’s new stimulus package. Confidence eroding as government inaction persists and doubts continue over their COVID-19 response.

- Household spending Tuesday expected to shrink 4.0%. Machinery Orders expected to fall by 2.0% on Wednesday.

- Potential for upside surprises in data though following a decent performance this week from China, South Korea and Japan. If the government finally announces its package details next week, that could provide more upside momentum in the short term for Japanese stocks.

Gold consolidation continues:

- The disconnect in the market remains, with gold rallying around 1.5% Friday – more than 2% from its lows – alongside the dollar and the stock market.

- It’s slightly lower at the time of writing but is basically hovering around breakeven on the day but holding its position back above $1,600.

- Complicating the picture is the strong underlying demand for U.S. dollars globally, which is showing no signs of receding anytime soon.

- Friday’s closing price puts it dead centre of its recent $1600.00 to $1640.00 current range with Asia showing little interest today, as gold climbs meekly to $1620.00 an ounce.

- Positions above 1621.00 with a target TP of 1636.00 are suggested

USD remains complicated:

- The Fed’s unprecedented measures have ameliorated the funding of dollar liabilities and that has put a dent in the dollar’s rally.

- The dollar’s days are far from over since not all strains are alleviated in the funding markets and the sharp global recession will likely keep Treasuries in high demand.

Here are the key market moving factors for the week: Week Ahead: All times listed are EDT

- Oil Market Turmoil

- Wall Street Braces More Volatility

- U.S. Coronavirus Pandemic Worsens

- Fed Meeting Minutes

- U.S. Initial Jobless Claims

Monday

4:30: UK – Construction PMI: expected to fall to 44.0, considered contraction mode, from 52.6 in February.

Tuesday

00:30: Australia – RBA Interest Rate Decision and Statement: anticipated to remain flat at 0.25%.

10:00: U.S. – JOLTs Job Openings: forecast to fall to 6.476M from 6.963M.

10:00: Canada – Ivey PMI: printed at 54.1 in February.

Wednesday

8:15: Canada – Housing Starts: expected to fall to 165.0K in March, from 210.1 in the previous month.

10:30: U.S. – Crude Oil Inventories: weak demand led to an increase of 13.834 million barrels in U.S. stockpiles last week.

Thursday

2:00: UK – GDP: seen to have risen to 1.1% from 0.6% YoY.

2:00: UK – Manufacturing Production: probably remained flat at 0.2% MoM

7:30: Eurozone – ECB Publishes Account of Monetary Policy Meeting

8:30: U.S. – Initial Jobless Claims: expected to show an additional 5,000K new filings after last week’s whopping 6,486K claims.

8:30: U.S. – PPI: probably rose to -0.3% from -0.6%.

8:30: Canada – Employment Change: anticipated to have plunged to -350.0K from 30.3K

Friday

8:30: U.S. – Core CPI: forecast to decline to 0.1% from 0.2%; the headline number is expected to have dropped to -0.3% from 0.1%.

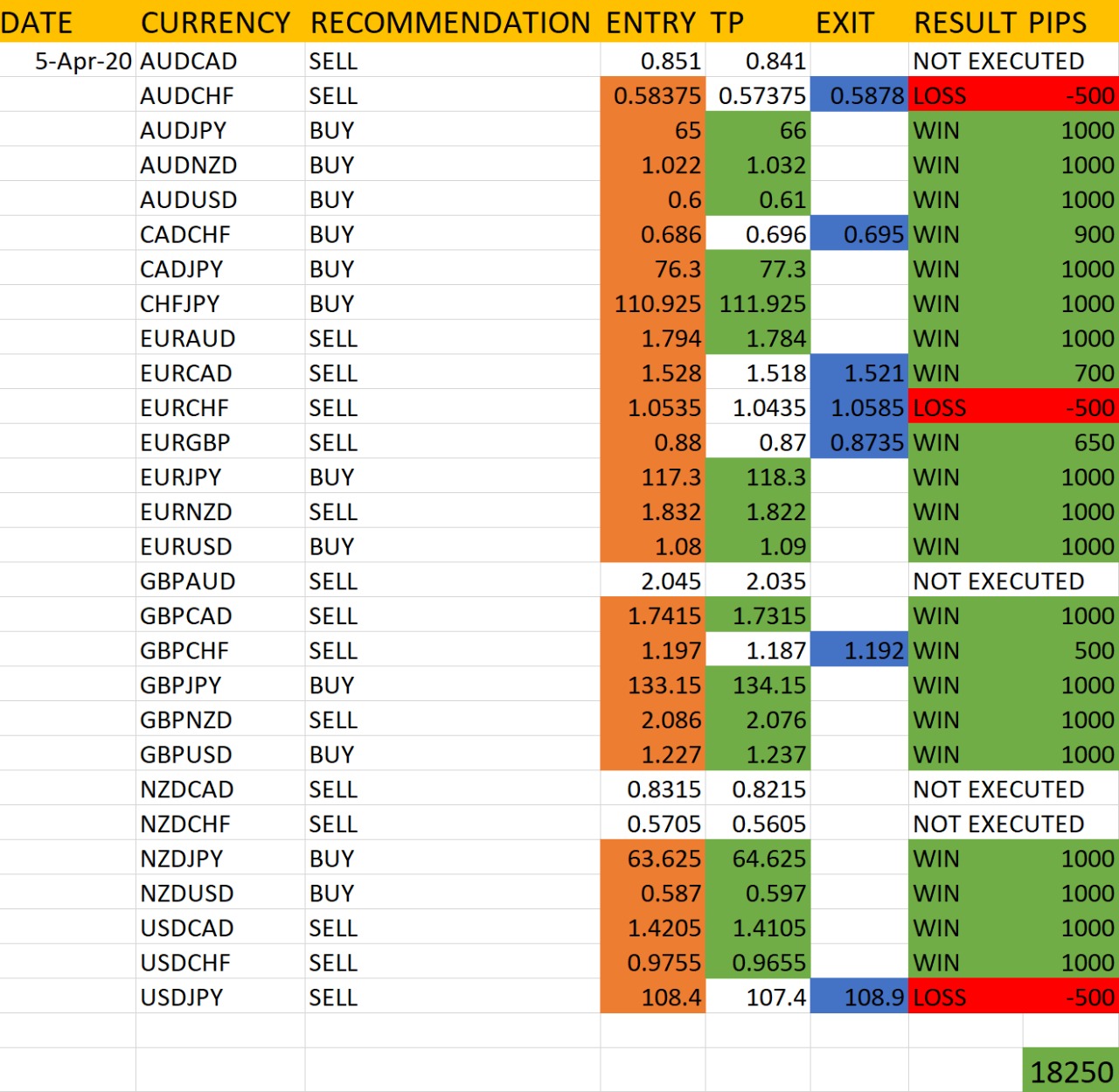

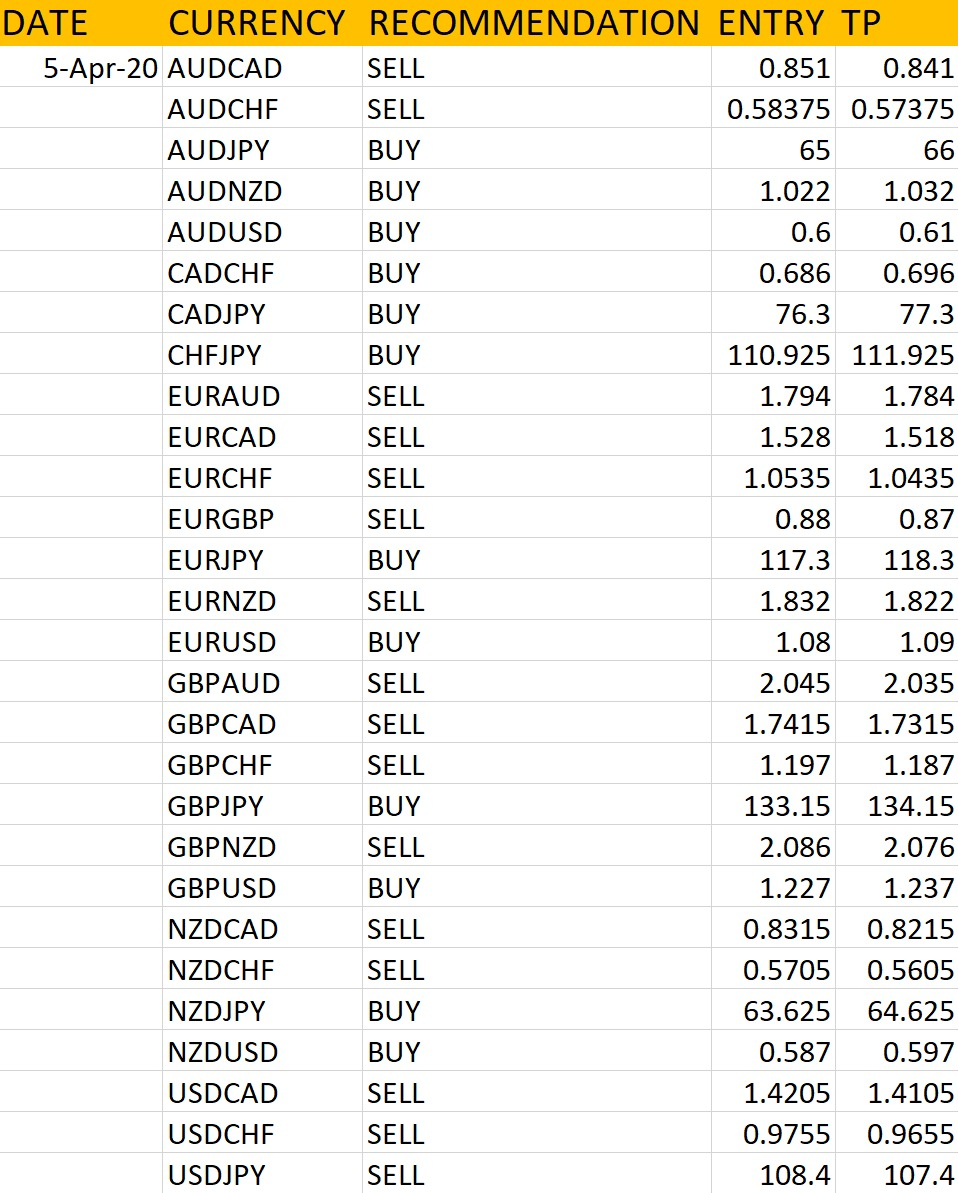

Based on the situation in the world and the global disruptive situation caused and fuelled by the pandemic, here’s the weekly analysis provided by the analyst at RvR Ventures, defining the entry and the exit points.

The analysis is solely based on market research, market indicators, the fundamental factors and the technical trends. Important market moving factors this week include the US PPI, US Initial Jobless Claims, which is expected to show additional 5,000k new filings and the UK GDP, amongst others.

The accuracy report of the above market analysis will be published on 10 April, 2020.

The accuracy report of the above market analysis will be published on 10 April, 2020.

Trade responsibly; invest only as much as you can lose. All the profits and losses due to the above analysis are your own personal responsibility. Kindlt practice money management & risk mitigation while trading.

- Chat with us to know more: https://wa.me/971581958582

- Register to open your account: http://bit.ly/OpenFxAccount

- Join Our Telegram Channel: https://t.me/ForexFundManagers

- Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc

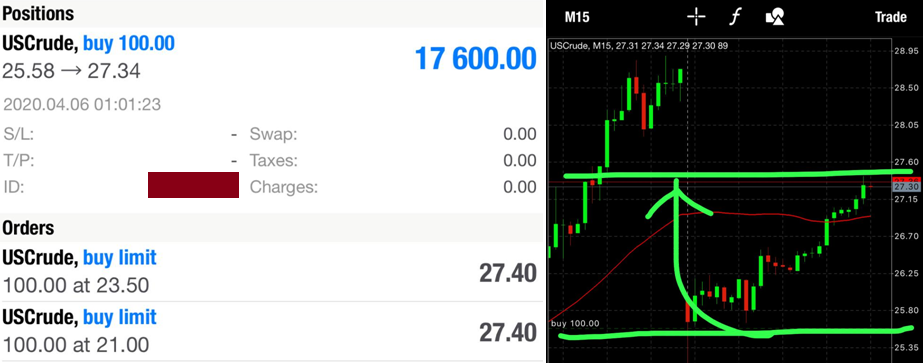

OIL TRIGGERS THE MARKET BUT WE CATCH THE TREND, IN ADVANCE!

Apart from the current pandemic situation, this week, the major focus remains on the OPEC meeting. In the last few weeks, analysts all over the world have reduced their oil forecasts by a staggering 25%. Never in history has the world experienced such a massive reduction in global oil consumption. The situation in the world oil industry is changing so rapidly; the market hasn’t entirely digested the incredible damage taking place.

The market opened with a crash at 25.10 however recovered back and consolidated at 27.0 – -27.60 range (crude oil), as forecasted by the analysts at RvR Ventures on 03 April, 2020. Anyone who believed in the analysis should have ideally taken a buy when the market reopened today. We did, and the results are in front of you.

Goes out to say, if you’d believed in the analysis and had opened a buy, you’d be floating in incredible profits just as the day even began. Trade carefully; invest only as much as you can lose. Practice strict money management.