COVID_19 v/s Bazookas

In an effort to get a handle on the economic and financial consequences of the Covid-19 pandemic, many have pointed to the 2008 global financial crisis as the most relevant example, especially in the aftermath of the extraordinary monetary policy actions announced by the US Federal Reserve on March 15. That would be an unfortunate mistake.

What worked 11 years ago won’t work today. The Covid-19 pandemic is the mirror image of the global financial crisis. The policy response needs to be crafted accordingly.

The global financial crisis was, first and foremost, a financial shock that took a severe toll on the real economy. Covid-19, by contrast, is a public health crisis. Draconian containment efforts – lockdowns, transport bans and restrictions on public assembly – are producing a shock to the real economy, with devastating consequences for businesses, their workers and the financial sector.

Unpredictability continues as we unearth Coronavirus data; Stocks and Metals plunge lower

This week’s data release on key market moving factors, including German Manufacturing PMI, U.S. Core Durable Goods Orders and Crude Oil Inventories, and UK Retail Sales, are expected to provide some haunting numbers, indicating just how severe the impact of the coronavirus pandemic will likely be on the global economy. To soften the blow, Trump announced his support plans for the economy. U.S. stocks are set to open lower Monday, as investors fret about the ability of policymakers to come up with stimulus policies to shore up economies against the coronavirus pandemic.

Covid 19 and the impact on the US:

It comes as no surprise that COVID-19 has hit the US economy severely.

- First, retail sales dropped 0.5 percent in February. That’s the biggest drop in a year.

- Second, the US consumer sentiment fell from 101 in February to 95.9 in March.

- Third, the Philadelphia Fed manufacturing index fell from 36.7 in February to -12.7 in March, the lowest reading since June 2012.

- Fourth, initial jobless claims surged from 211,00 last week to 281,000 yesterday, meaning that more Americans applied for unemployment benefits.

- Fifth, the New York Fed’s Empire State business conditions index fell record 34.4 points to -21.5, the lowest level since the global financial crisis.

The U.S. dollar has sold off a touch Monday, as U.S. politicians squabble about the details of the latest rescue package, but its underlying strength points to more gains going forward.

Trump To The Rescue

On Tuesday, U.S. President announced a plan to send money to Americans as soon as possible to ease the negative economic shock from the coronavirus crisis. Trump said some people should get $1,000 as help with their living expenses because they cannot work under quarantine and social distancing. On Wednesday, he wrote on Twitter:

For the people that are now out of work because of the important and necessary containment policies, for instance, the shutting down of hotels, bars and restaurants, the money will soon be coming to you.

Will Trump’s free cash help the economy and the gold market?

In addition to this, we are also waiting for the US response on the prospective bill.

Republicans and Democrats in the U.S. Senate on Saturday continued with efforts to reach a deal on a $1 trillion-plus bill aimed at mitigating the coronavirus pandemic’s economic fallout for workers and businesses.

White House economic adviser Larry Kudlow said he expects the final legislative package to be worth $1.3 trillion to $1.4 trillion. The prospective bill is said to have $2 trillion net impact on a U.S. economy, according to White House officials.

What does this mean for gold?

Gold is struggling to shine amid fresh risk-off in the markets with prices trapped in a descending triangle pattern on the 4-hour chart. So far, the top end of the triangle, currently at $1,508, has proved a tough nut to crack. A breakout would imply an end of the sell-off from recent highs above $1,700 and could yield a rally to $1,555.

Gold carved out a bullish engulfing candle on Friday, validating the oversold conditions signaled by the 14-day relative strength index and making Monday’s close pivotal.

A close above Friday’s high of $1,516 would confirm a bullish reversal candlestick pattern and open the doors for a notable recovery rally. Alternatively, a close under Friday’s low of $1,455.

According to the package stimulus, it means higher government expenditure, higher deficits and higher indebtedness. Soaring debt, combined with increasing money supply, very low real interest rates and global recession, is another fundamentally positive factor for the gold market. When the blood dries on the trading floor, investors will cease to sell gold in order to raise cash – and then we get the fundamental reason for the rally in gold to start. A similar dynamic occurred after the collapse of the Lehman Brothers – gold fell initially before rebounding sharply amid the loose monetary policy.

USD

The dollar has come back into favor and rapidly, despite a slew of measures from the Federal Reserve to support the economy and ensure the plumbing of the financial markets continues to function. The dollar has been soaring to trade at its highest level since the start of 2017.

UK:

The UK is not taking the coronavirus lightly, despite initial criticism against the government to the contrary. The number of cases now stands at 3,983 with 177 deaths, a significant acceleration on a day earlier. Bank of England have announced huge fiscal and monetary easing packages and made clear that they will continue to add to them as the situation develops.

After falling about 10% against the dollar over the last two weeks, The British pound is seen holding withing a consolidating over the past couple of trading sessions.

Eurozone:

The ECB disappointed the markets by not cutting interest rates at the meeting last week but responded with a massive surprise QE program on Wednesday that made up for it. The temporary bond purchases, until the end of the year, named Pandemic Emergency Purchase Program, took the pressure off the rising yields across Europe.

EUR/USD is charting a bullish reversal pattern on technical charts amid another brutal sell-off in the global equity markets. The common currency is drawing haven bids against currencies like the New Zealand dollar and the Australian dollar and the uptick in the crosses seems to be lifting EUR/USD. The currency pair found bids near 1.0635 in early Asia and is currently trading near 1.0717, representing a 0.20% gain on the day.

Australia:

The slowdown in the domestic economy as borders are shut. RBA cut rates and announced a massive QE program. The AUD was crushed, hitting multi-decade lows. There is massive stock market volatility.

There is a high possibility of heavy intervention by the RBA. The stock market may introduce trading curbs and/or shorten trading hours.

New Zealand:

Like AUD, NZD has been heavily sold and hit GFC low. The New Zealand dollar remains vulnerable to further resource price drops. RBNZ cut rates to 0.25% and is preparing other measures if needed. There is no sign of housing market stress or job losses. A spike in coronavirus cases will put pressure on NZ stocks.

NZD/USD remains vulnerable to falling below 0.5500 as economic recession approaches and USD maintains a safe-haven bid. During the Asian session on Monday, the RBNZ said that it will start purchasing $30 billion worth of government bonds across the yield curve for the next 12 months.

NZD/USD seems to recover losses, currently at 0.5677, after tanking down to 0.5670 as the Asian markets open for trading on Monday. The pair’s initial reaction could be traced to the RBNZ’s stimulus program while the following recovery could have taken clues from the Fed member’s downbeat comments.

Japan:

BoJ did not cut its interest rate, but increased QE. A fiscal stimulus package from the finance ministry is still imminent. There is no data of note, but high risk of the Olympics being cancelled–a major blow to the economy.

On Monday. the Bank of Japan (BOJ) bought yet another record JPY201.6 billion worth of Japanese stock exchange-traded funds (ETFs), Japan’s Finance Ministry official said that they will issue up to JPY300 billion of additional inflation-linked bonds to improve market functioning. The recovery in the USD/JPY pair from 109.67 lows gains further traction in the European session, now pushing the rates to regain the 110.50 barrier.

Oil

It’s been a wild ride for oil. Early gains were short-lived and heavy losses followed once again. It’s the perfect storm for oil which is facing a global recession and an oil price war. The latter can be avoided but no side is showing any indication that it’s going to blink first.

Here’s a list of all the important market moving factors:

Monday

20:30: Japan – Services PMI: came in at 46.8 in February.

Tuesday

4:30: Germany – Manufacturing PMI: anticipated to keep falling into contraction, to 40.0 from 48.0.

5:30: UK – Manufacturing PMI: expected to tick higher, to 51.8 from 51.7 in the previous month.

10:00: U.S. – New Home Sales: seen to fall to 750K from 764K.

Wednesday

5:00: Germany – Ifo Business Climate Index: likely fell to 87.5 from 96.0.

5:30: UK – CPI: forecast to slip to 1.6% from 1.8%.

8:30: U.S. – Core Durable Goods Orders: expected to plunge to -0.3% from 0.8%.

10:30: U.S. – Crude Oil Inventories: anticipated to rise to 3.086M from 1.954M last week.

Thursday

5:30: UK – Retail Sales: seen to have dropped to 0.2% from 0.9%.

8:30: U.S. – GDP: expected to remain flat at 2.1%.

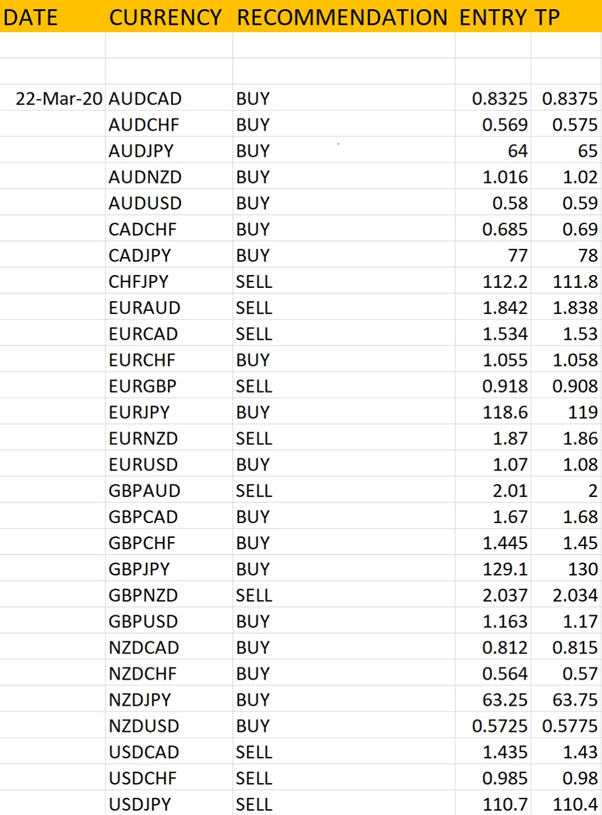

The below table is the analysis provided by the analyst at RvR Ventures. We shall measure the accuracy at the end of the week. Till then, invest as much as you can lose.

Looking ahead, there’s no evidence that a peak in COVID-19 has yet been reached, which means further downside for the currencies to fresh multi-year lows. The Trump administration, including President Donald Trump, is about to start a press conference and any surprises can move the markets.

Stay home, stay safe.

Trade Responsibly, risk only as much as you can lose. All the profit and losses due to the above analysis are your own personal responsibility.

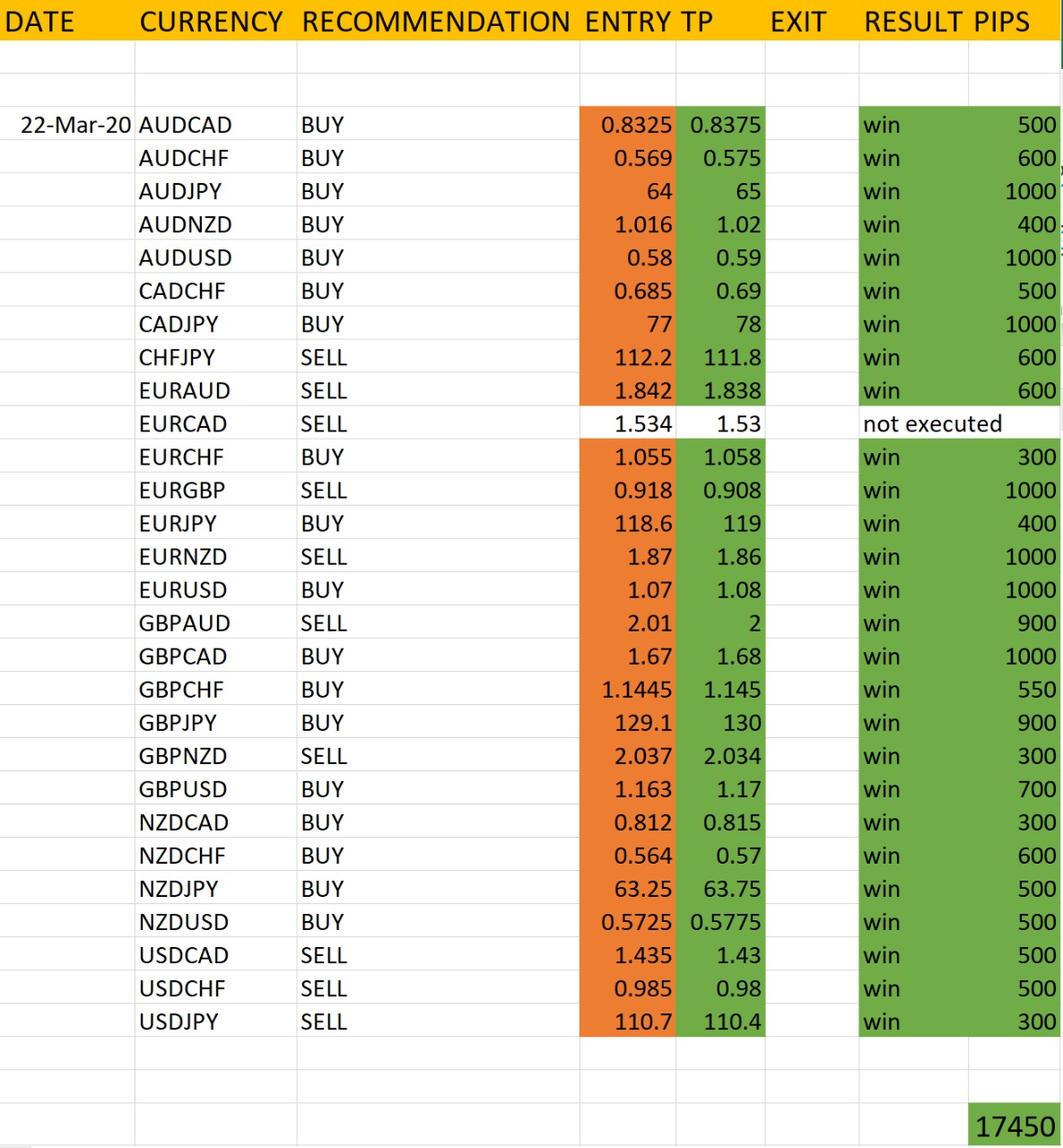

Report: Date: 27 March 2020 | Accuracy achieved: 100% TP Hit | 99% Trades Hit

At the start of every week, we provide you with the analysis on 28 currency pairs based on the technicals, fundamentals and the current market scenario. You may be wondering how accurate that analysis are, right?

To prove the precision of the market analyst at RvR Ventures, here’s the report from the trading week which defines the total number of trades executed and trades won, which in this particular case is 100%. The trader faced no loss this week, proving the accuracy to be 100% on the trades executed. Out of the 28 trades analysed and predicted, only 1 was not executed with EURCAD.

In this extremely volatile market during the time of a pandemic which has almost paralysed the global economies, the trader at RvR Ventures was able to analyse the situation correctly, making an amazing profit with a difference of 17,450 pips on 27 currency pairs.

The key market factors responsible were German Manufacturing PMI, Core Production Index, US Crude Oil Inventories, US GDP amongst others, on the basis of which the analyst was able to assess the market scenario, further identify the key buying and selling points, and also advising you on the profit points.

Watch LIVE #ForexTrading by Neural network based #Robots & Professional Traders at: https://youtu.be/QbE2i46JsfM

Chat with us to know more: https://wa.me/971581958582

Register to open your account: http://bit.ly/OpenFxAccount

Join Our Telegram Channel: https://t.me/ForexFundManagers

Subscribe Our You Tube Channel: https://youtu.be/AnTlQd-FQxc

CLICK to watch LIVE

CLICK to watch LIVE